Instructions For Form 8453-K - Kentucky

ADVERTISEMENT

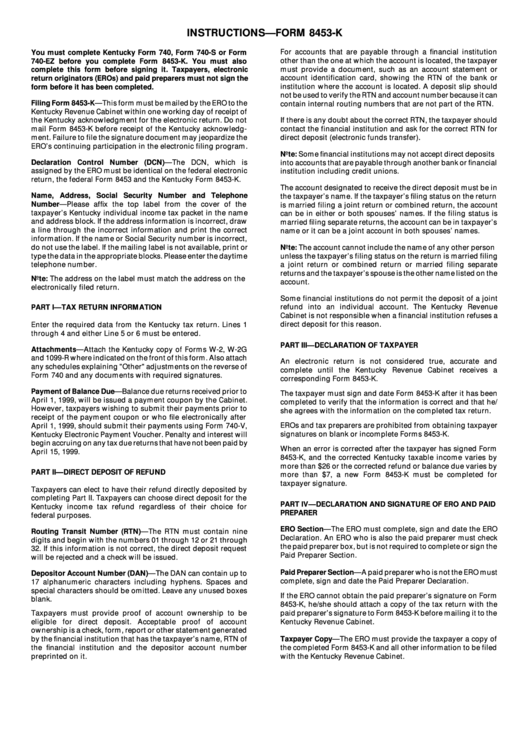

INSTRUCTIONS—FORM 8453-K

For accounts that are payable through a financial institution

You must complete Kentucky Form 740, Form 740-S or Form

other than the one at which the account is located, the taxpayer

740-EZ before you complete Form 8453-K. You must also

must provide a document, such as an account statement or

complete this form before signing it. Taxpayers, electronic

account identification card, showing the RTN of the bank or

return originators (EROs) and paid preparers must not sign the

institution where the account is located. A deposit slip should

form before it has been completed.

not be used to verify the RTN and account number because it can

Filing Form 8453-K—This form must be mailed by the ERO to the

contain internal routing numbers that are not part of the RTN.

Kentucky Revenue Cabinet within one working day of receipt of

the Kentucky acknowledgment for the electronic return. Do not

If there is any doubt about the correct RTN, the taxpayer should

mail Form 8453-K before receipt of the Kentucky acknowledg-

contact the financial institution and ask for the correct RTN for

ment. Failure to file the signature document may jeopardize the

direct deposit (electronic funds transfer).

ERO’s continuing participation in the electronic filing program.

Note: Some financial institutions may not accept direct deposits

Declaration Control Number (DCN)—The DCN, which is

into accounts that are payable through another bank or financial

assigned by the ERO must be identical on the federal electronic

institution including credit unions.

return, the federal Form 8453 and the Kentucky Form 8453-K.

The account designated to receive the direct deposit must be in

Name, Address, Social Security Number and Telephone

the taxpayer’s name. If the taxpayer’s filing status on the return

Number—Please affix the top label from the cover of the

is married filing a joint return or combined return, the account

taxpayer’s Kentucky individual income tax packet in the name

can be in either or both spouses’ names. If the filing status is

and address block. If the address information is incorrect, draw

married filing separate returns, the account can be in taxpayer’s

a line through the incorrect information and print the correct

name or it can be a joint account in both spouses’ names.

information. If the name or Social Security number is incorrect,

do not use the label. If the mailing label is not available, print or

Note: The account cannot include the name of any other person

type the data in the appropriate blocks. Please enter the daytime

unless the taxpayer’s filing status on the return is married filing

telephone number.

a joint return or combined return or married filing separate

returns and the taxpayer’s spouse is the other name listed on the

Note: The address on the label must match the address on the

account.

electronically filed return.

Some financial institutions do not permit the deposit of a joint

refund into an individual account. The Kentucky Revenue

PART I—TAX RETURN INFORMATION

Cabinet is not responsible when a financial institution refuses a

direct deposit for this reason.

Enter the required data from the Kentucky tax return. Lines 1

through 4 and either Line 5 or 6 must be entered.

PART III—DECLARATION OF TAXPAYER

Attachments—Attach the Kentucky copy of Forms W-2, W-2G

and 1099-R where indicated on the front of this form. Also attach

An electronic return is not considered true, accurate and

any schedules explaining "Other" adjustments on the reverse of

complete until the Kentucky Revenue Cabinet receives a

Form 740 and any documents with required signatures.

corresponding Form 8453-K.

Payment of Balance Due—Balance due returns received prior to

The taxpayer must sign and date Form 8453-K after it has been

April 1, 1999, will be issued a payment coupon by the Cabinet.

completed to verify that the information is correct and that he/

However, taxpayers wishing to submit their payments prior to

she agrees with the information on the completed tax return.

receipt of the payment coupon or who file electronically after

EROs and tax preparers are prohibited from obtaining taxpayer

April 1, 1999, should submit their payments using Form 740-V,

signatures on blank or incomplete Forms 8453-K.

Kentucky Electronic Payment Voucher. Penalty and interest will

begin accruing on any tax due returns that have not been paid by

When an error is corrected after the taxpayer has signed Form

April 15, 1999.

8453-K, and the corrected Kentucky taxable income varies by

more than $26 or the corrected refund or balance due varies by

PART II—DIRECT DEPOSIT OF REFUND

more than $7, a new Form 8453-K must be completed for

taxpayer signature.

Taxpayers can elect to have their refund directly deposited by

completing Part II. Taxpayers can choose direct deposit for the

PART IV—DECLARATION AND SIGNATURE OF ERO AND PAID

Kentucky income tax refund regardless of their choice for

PREPARER

federal purposes.

ERO Section—The ERO must complete, sign and date the ERO

Routing Transit Number (RTN)—The RTN must contain nine

Declaration. An ERO who is also the paid preparer must check

digits and begin with the numbers 01 through 12 or 21 through

the paid preparer box, but is not required to complete or sign the

32. If this information is not correct, the direct deposit request

Paid Preparer Section.

will be rejected and a check will be issued.

Paid Preparer Section—A paid preparer who is not the ERO must

Depositor Account Number (DAN)—The DAN can contain up to

complete, sign and date the Paid Preparer Declaration.

17 alphanumeric characters including hyphens. Spaces and

special characters should be omitted. Leave any unused boxes

If the ERO cannot obtain the paid preparer’s signature on Form

blank.

8453-K, he/she should attach a copy of the tax return with the

Taxpayers must provide proof of account ownership to be

paid preparer’s signature to Form 8453-K before mailing it to the

eligible for direct deposit. Acceptable proof of account

Kentucky Revenue Cabinet.

ownership is a check, form, report or other statement generated

by the financial institution that has the taxpayer’s name, RTN of

Taxpayer Copy—The ERO must provide the taxpayer a copy of

the financial institution and the depositor account number

the completed Form 8453-K and all other information to be filed

preprinted on it.

with the Kentucky Revenue Cabinet.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1