Instructions For Form Et-133 - New York Department Of Taxation And Finance

ADVERTISEMENT

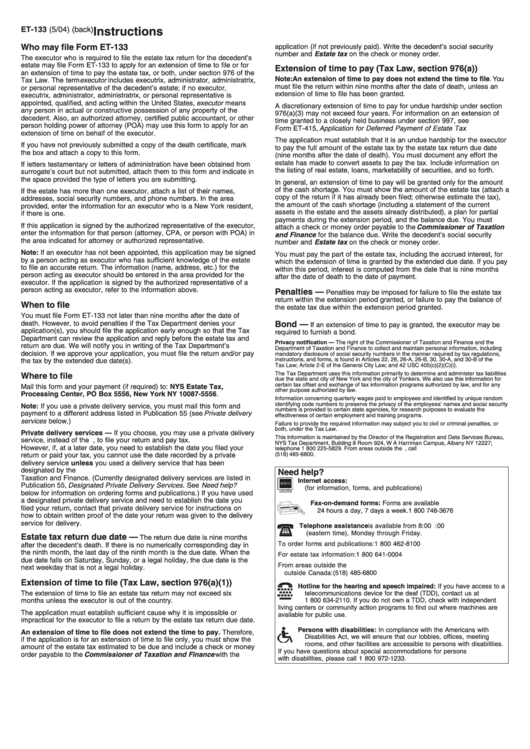

ET-133 (5/04) (back)

Instructions

Who may file Form ET-133

application (if not previously paid). Write the decedent’s social security

number and Estate tax on the check or money order.

The executor who is required to file the estate tax return for the decedent’s

estate may file Form ET-133 to apply for an extension of time to file or for

Extension of time to pay (Tax Law, section 976(a))

an extension of time to pay the estate tax, or both, under section 976 of the

Note: An extension of time to pay does not extend the time to file. You

Tax Law. The term executor includes executrix, administrator, administratrix,

must file the return within nine months after the date of death, unless an

or personal representative of the decedent’s estate; if no executor,

extension of time to file has been granted.

executrix, administrator, administratrix, or personal representative is

appointed, qualified, and acting within the United States, executor means

A discretionary extension of time to pay for undue hardship under section

any person in actual or constructive possession of any property of the

976(a)(3) may not exceed four years. For information on an extension of

decedent. Also, an authorized attorney, certified public accountant, or other

time granted to a closely held business under section 997, see

person holding power of attorney (POA) may use this form to apply for an

Form ET-415, Application for Deferred Payment of Estate Tax .

extension of time on behalf of the executor.

The application must establish that it is an undue hardship for the executor

If you have not previously submitted a copy of the death certificate, mark

to pay the full amount of the estate tax by the estate tax return due date

the box and attach a copy to this form.

(nine months after the date of death). You must document any effort the

estate has made to convert assets to pay the tax. Include information on

If letters testamentary or letters of administration have been obtained from

the listing of real estate, loans, marketability of securities, and so forth.

surrogate’s court but not submitted, attach them to this form and indicate in

the space provided the type of letters you are submitting.

In general, an extension of time to pay will be granted only for the amount

of the cash shortage. You must show the amount of the estate tax (attach a

If the estate has more than one executor, attach a list of their names,

copy of the return if it has already been filed; otherwise estimate the tax),

addresses, social security numbers, and phone numbers. In the area

the amount of the cash shortage (including a statement of the current

provided, enter the information for an executor who is a New York resident,

assets in the estate and the assets already distributed), a plan for partial

if there is one.

payments during the extension period, and the balance due. You must

If this application is signed by the authorized representative of the executor,

attach a check or money order payable to the Commissioner of Taxation

enter the information for that person (attorney, CPA, or person with POA) in

and Finance for the balance due. Write the decedent’s social security

the area indicated for attorney or authorized representative.

number and Estate tax on the check or money order.

Note: If an executor has not been appointed, this application may be signed

You must pay the part of the estate tax, including the accrued interest, for

by a person acting as executor who has sufficient knowledge of the estate

which the extension of time is granted by the extended due date. If you pay

to file an accurate return. The information (name, address, etc.) for the

within this period, interest is computed from the date that is nine months

person acting as executor should be entered in the area provided for the

after the date of death to the date of payment.

executor. If the application is signed by the authorized representative of a

person acting as executor, refer to the information above.

Penalties —

Penalties may be imposed for failure to file the estate tax

return within the extension period granted, or failure to pay the balance of

When to file

the estate tax due within the extension period granted.

You must file Form ET-133 not later than nine months after the date of

death. However, to avoid penalties if the Tax Department denies your

Bond —

If an extension of time to pay is granted, the executor may be

application(s), you should file the application early enough so that the Tax

required to furnish a bond.

Department can review the application and reply before the estate tax and

Privacy notification — The right of the Commissioner of Taxation and Finance and the

return are due. We will notify you in writing of the Tax Department’s

Department of Taxation and Finance to collect and maintain personal information, including

decision. If we approve your application, you must file the return and/or pay

mandatory disclosure of social security numbers in the manner required by tax regulations,

instructions, and forms, is found in Articles 22, 26, 26-A, 26-B, 30, 30-A, and 30-B of the

the tax by the extended due date(s).

Tax Law; Article 2-E of the General City Law; and 42 USC 405(c)(2)(C)(i).

The Tax Department uses this information primarily to determine and administer tax liabilities

Where to file

due the state and city of New York and the city of Yonkers. We also use this information for

certain tax offset and exchange of tax information programs authorized by law, and for any

Mail this form and your payment (if required) to: NYS Estate Tax,

other purpose authorized by law.

Processing Center, PO Box 5556, New York NY 10087-5556.

Information concerning quarterly wages paid to employees and identified by unique random

identifying code numbers to preserve the privacy of the employees’ names and social security

Note: If you use a private delivery service, you must mail this form and

numbers is provided to certain state agencies, for research purposes to evaluate the

payment to a different address listed in Publication 55 (see Private delivery

effectiveness of certain employment and training programs.

services below.)

Failure to provide the required information may subject you to civil or criminal penalties, or

both, under the Tax Law.

Private delivery services — If you choose, you may use a private delivery

This information is maintained by the Director of the Registration and Data Services Bureau,

service, instead of the U.S. Postal Service, to file your return and pay tax.

NYS Tax Department, Building 8 Room 924, W A Harriman Campus, Albany NY 12227;

However, if, at a later date, you need to establish the date you filed your

telephone 1 800 225-5829. From areas outside the U.S. and outside Canada, call

(518) 485-6800.

return or paid your tax, you cannot use the date recorded by a private

delivery service unless you used a delivery service that has been

designated by the U.S. Secretary of the Treasury or the Commissioner of

Need help?

Taxation and Finance. (Currently designated delivery services are listed in

Internet access:

Publication 55, Designated Private Delivery Services. See Need help?

(for information, forms, and publications)

below for information on ordering forms and publications.) If you have used

a designated private delivery service and need to establish the date you

Fax-on-demand forms: Forms are available

filed your return, contact that private delivery service for instructions on

24 hours a day, 7 days a week.

1 800 748-3676

how to obtain written proof of the date your return was given to the delivery

service for delivery.

Telephone assistance is available from 8:00 A.M. to 5:00 P.M.

(eastern time), Monday through Friday.

Estate tax return due date —

The return due date is nine months

To order forms and publications:

1 800 462-8100

after the decedent’s death. If there is no numerically corresponding day in

the ninth month, the last day of the ninth month is the due date. When the

For estate tax information:

1 800 641-0004

due date falls on Saturday, Sunday, or a legal holiday, the due date is the

From areas outside the U.S. and

next weekday that is not a legal holiday.

outside Canada:

(518) 485-6800

Extension of time to file (Tax Law, section 976(a)(1))

Hotline for the hearing and speech impaired: If you have access to a

The extension of time to file an estate tax return may not exceed six

telecommunications device for the deaf (TDD), contact us at

months unless the executor is out of the country.

1 800 634-2110. If you do not own a TDD, check with independent

living centers or community action programs to find out where machines are

The application must establish sufficient cause why it is impossible or

available for public use.

impractical for the executor to file a return by the estate tax return due date.

Persons with disabilities: In compliance with the Americans with

An extension of time to file does not extend the time to pay. Therefore,

Disabilities Act, we will ensure that our lobbies, offices, meeting

if the application is for an extension of time to file only, you must show the

rooms, and other facilities are accessible to persons with disabilities.

amount of the estate tax estimated to be due and include a check or money

If you have questions about special accommodations for persons

order payable to the Commissioner of Taxation and Finance with the

with disabilities, please call 1 800 972-1233.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1