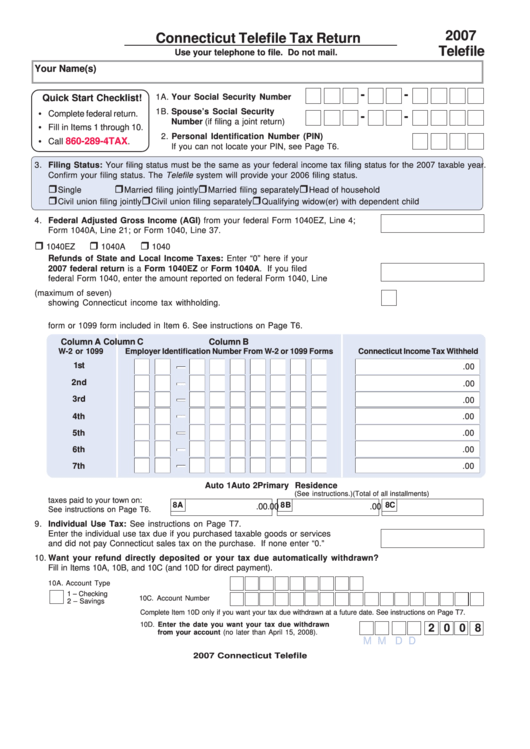

Connecticut Telefile Tax Return Form - 2007

ADVERTISEMENT

2007

Connecticut Telefile Tax Return

Telefile

Use your telephone to file. Do not mail.

Your Name(s)

-

-

1A. Your Social Security Number

Quick Start Checklist!

1B. Spouse’s Social Security

• Complete federal return.

-

-

Number (if filing a joint return)

• Fill in Items 1 through 10.

2. Personal Identification Number (PIN)

860-289-4TAX

• Call

.

If you can not locate your PIN, see Page T6.

3. Filing Status: Your filing status must be the same as your federal income tax filing status for the 2007 taxable year.

Confirm your filing status. The Telefile system will provide your 2006 filing status.

Single

Married filing jointly

Married filing separately

Head of household

Civil union filing jointly

Civil union filing separately

Qualifying widow(er) with dependent child

4. Federal Adjusted Gross Income (AGI) from your federal Form 1040EZ, Line 4;

Form 1040A, Line 21; or Form 1040, Line 37. ................................................................ 4.

.00

5. Check the box to indicate the form used to file your 2007 federal return.

1040EZ

1040A

1040

R efunds of State and Local Income Taxes: Enter “0” here if your

2007 federal return is a Form 1040EZ or Form 1040A. If you filed

federal Form 1040, enter the amount reported on federal Form 1040, Line 10. ............ 5.

.00

6. Enter the total number of W-2 forms and any 1099 forms (maximum of seven)

showing Connecticut income tax withholding. ................................................................ 6.

7. Enter the Federal Employer Identification Number and Connecticut income tax withheld for each W-2

form or 1099 form included in Item 6. See instructions on Page T6.

Column A

Column B

Column C

Employer Identification Number From W-2 or 1099 Forms

Connecticut Income Tax Withheld

W-2 or 1099

1st

.00

2nd

.00

3rd

.00

4th

.00

5th

.00

6th

.00

7th

.00

Auto 1

Auto 2

Primary Residence

8. Enter total amount of property

(See instructions.)

(Total of all installments)

taxes paid to your town on:

8A

8B

8C

.00

.00

.00

See instructions on Page T6.

9. Individual Use Tax: See instructions on Page T7.

Enter the individual use tax due if you purchased taxable goods or services

and did not pay Connecticut sales tax on the purchase. If none enter “0.” ................... 9.

.00

10. Want your refund directly deposited or your tax due automatically withdrawn?

Fill in Items 10A, 10B, and 10C (and 10D for direct payment).

10B. Routing Number

10A. Account Type

1 – Checking

10C. Account Number

2 – Savings

Complete Item 10D only if you want your tax due withdrawn at a future date. See instructions on Page T7.

10D. Enter the date you want your tax due withdrawn

2 0 0 8

from your account (no later than April 15, 2008).

M M D D

2007 Connecticut Telefile

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2