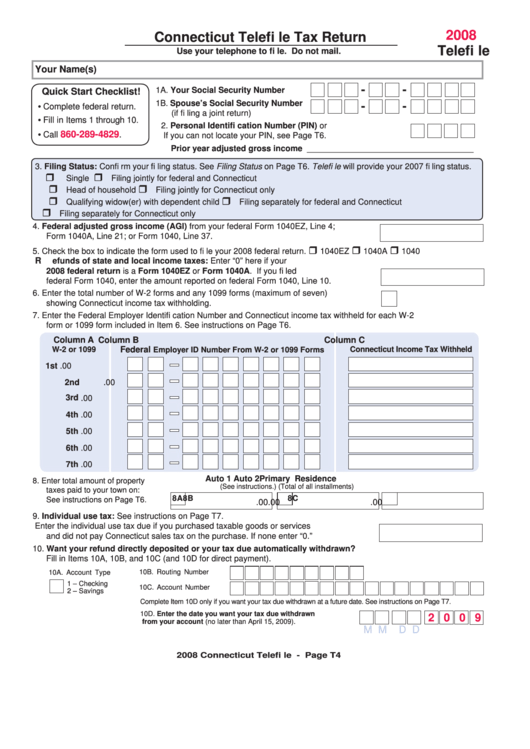

Connecticut Telefile Tax Return - 2008

ADVERTISEMENT

2008

Connecticut Telefi le Tax Return

Telefi le

Use your telephone to fi le. Do not mail.

Your Name(s)

-

-

1A. Your Social Security Number

Quick Start Checklist!

1B. Spouse’s Social Security Number

-

-

• Complete federal return.

(if fi ling a joint return)

• Fill in Items 1 through 10.

2. Personal Identifi cation Number (PIN) or

860-289-4829

• Call

.

If you can not locate your PIN, see Page T6.

Prior year adjusted gross income ____________________________________

3. Filing Status: Confi rm your fi ling status. See Filing Status on Page T6. Telefi le will provide your 2007 fi ling status.

Single

Filing jointly for federal and Connecticut

Head of household

Filing jointly for Connecticut only

Qualifying widow(er) with dependent child

Filing separately for federal and Connecticut

Filing separately for Connecticut only

4. Federal adjusted gross income (AGI) from your federal Form 1040EZ, Line 4;

Form 1040A, Line 21; or Form 1040, Line 37. .................................................................... 4.

.00

5. Check the box to indicate the form used to fi le your 2008 federal return.

1040EZ

1040A

1040

R efunds of state and local income taxes: Enter “0” here if your

2008 federal return is a Form 1040EZ or Form 1040A. If you fi led

federal Form 1040, enter the amount reported on federal Form 1040, Line 10. ................ 5.

.00

6. Enter the total number of W-2 forms and any 1099 forms (maximum of seven)

showing Connecticut income tax withholding. .................................................................. 6.

7. Enter the Federal Employer Identifi cation Number and Connecticut income tax withheld for each W-2

form or 1099 form included in Item 6. See instructions on Page T6.

Column A

Column B

Column C

Federal

W-2 or 1099

Connecticut Income Tax Withheld

Employer ID Number From W-2 or 1099 Forms

1st

.00

2nd

.00

3rd

.00

4th

.00

5th

.00

6th

.00

7th

.00

Auto 1

Auto 2

Primary Residence

8. Enter total amount of property

(See instructions.)

(Total of all installments)

taxes paid to your town on:

8A

8B

8C

See instructions on Page T6.

.00

.00

.00

9. Individual use tax: See instructions on Page T7.

Enter the individual use tax due if you purchased taxable goods or services

and did not pay Connecticut sales tax on the purchase. If none enter “0.” ........................ 9.

.00

10. Want your refund directly deposited or your tax due automatically withdrawn?

Fill in Items 10A, 10B, and 10C (and 10D for direct payment).

10B. Routing Number

10A. Account Type

1 – Checking

10C. Account Number

2 – Savings

Complete Item 10D only if you want your tax due withdrawn at a future date. See instructions on Page T7.

10D. Enter the date you want your tax due withdrawn

2 0 0 9

from your account (no later than April 15, 2009).

M M D D

2008 Connecticut Telefi le - Page T4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2