Form G-65 - Specific Line Instructions - State Of Hawaii

ADVERTISEMENT

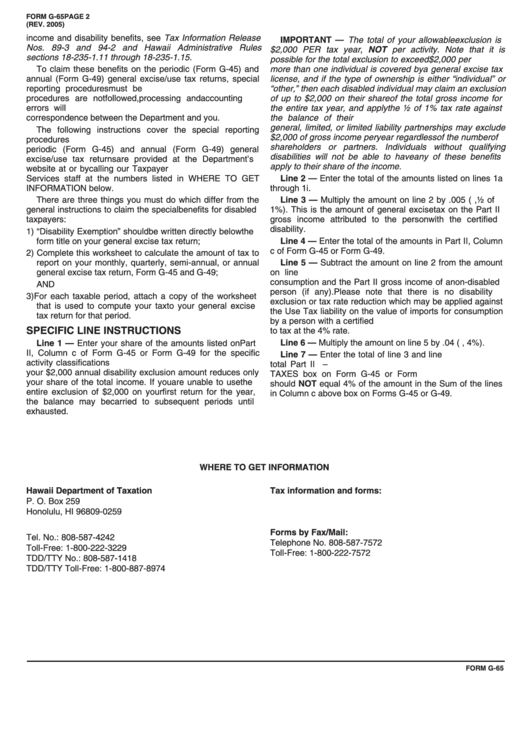

FORM G-65

PAGE 2

(REV. 2005)

income and disability benefits, see Tax Information Release

IMPORTANT — The total of your allowable exclusion is

Nos. 89-3 and 94-2 and Hawaii Administrative Rules

$2,000 PER tax year, NOT per activity. Note that it is

sections 18-235-1.11 through 18-235-1.15.

possible for the total exclusion to exceed $2,000 per year. If

To claim these benefits on the periodic (Form G-45) and

more than one individual is covered by a general excise tax

annual (Form G-49) general excise/use tax returns, special

license, and if the type of ownership is either “individual” or

reporting procedures must be followed.

If the reporting

“other,” then each disabled individual may claim an exclusion

procedures are not followed, processing and accounting

of up to $2,000 on their share of the total gross income for

the entire tax year, and apply the ½ of 1% tax rate against

errors will occur.

These errors will result in delays and

correspondence between the Department and you.

the balance of their share.

Qualifying corporations and

general, limited, or limited liability partnerships may exclude

The following instructions cover the special reporting

$2,000 of gross income per year regardless of the number of

procedures only.

Basic instructions for completing the

shareholders or partners. Individuals without qualifying

periodic (Form G-45) and annual (Form G-49) general

disabilities will not be able to have any of these benefits

excise/use tax returns are provided at the Department’s

apply to their share of the income.

website at or by calling our Taxpayer

Services staff at the numbers listed in WHERE TO GET

Line 2 — Enter the total of the amounts listed on lines 1a

INFORMATION below.

through 1i.

There are three things you must do which differ from the

Line 3 — Multiply the amount on line 2 by .005 (i.e.,½ of

general instructions to claim the special benefits for disabled

1%). This is the amount of general excise tax on the Part II

taxpayers:

gross income attributed to the person with the certified

disability.

1) “Disability Exemption” should be written directly below the

form title on your general excise tax return;

Line 4 — Enter the total of the amounts in Part II, Column

c of Form G-45 or Form G-49.

2) Complete this worksheet to calculate the amount of tax to

report on your monthly, quarterly, semi-annual, or annual

Line 5 — Subtract the amount on line 2 from the amount

general excise tax return, Form G-45 and G-49;

on line 4.

This is the sum of the value of imports for

consumption and the Part II gross income of a non-disabled

AND

person (if any).

Please note that there is no disability

3) For each taxable period, attach a copy of the worksheet

exclusion or tax rate reduction which may be applied against

that is used to compute your tax to your general excise

the Use Tax liability on the value of imports for consumption

tax return for that period.

by a person with a certified disability. This amount is subject

SPECIFIC LINE INSTRUCTIONS

to tax at the 4% rate.

Line 6 — Multiply the amount on line 5 by .04 (i.e., 4%).

Line 1 — Enter your share of the amounts listed on Part

II, Column c of Form G-45 or Form G-49 for the specific

Line 7 — Enter the total of line 3 and line 6. This is your

activity classifications listed. Be sure that any deduction for

total Part II taxes. Also enter this amount in the Part II –

your $2,000 annual disability exclusion amount reduces only

TAXES box on Form G-45 or Form G-49.

This amount

your share of the total income. If you are unable to use the

should NOT equal 4% of the amount in the Sum of the lines

entire exclusion of $2,000 on your first return for the year,

in Column c above box on Forms G-45 or G-49.

the balance may be carried to subsequent periods until

exhausted.

WHERE TO GET INFORMATION

Hawaii Department of Taxation

Tax information and forms:

P. O. Box 259

Honolulu, HI 96809-0259

Forms by Fax/Mail:

Tel. No.: 808-587-4242

Telephone No. 808-587-7572

Toll-Free: 1-800-222-3229

Toll-Free: 1-800-222-7572

TDD/TTY No.: 808-587-1418

TDD/TTY Toll-Free: 1-800-887-8974

FORM G-65

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1