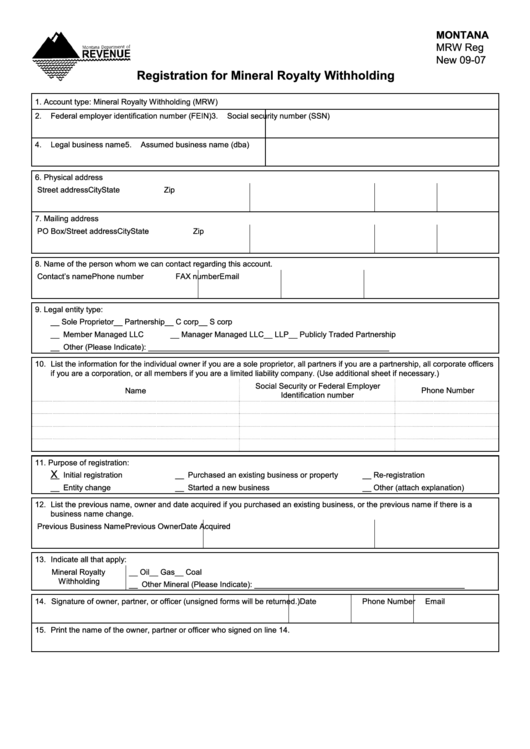

Form Mrw Reg - Registration For Mineral Royalty Withholding

ADVERTISEMENT

MONTANA

MRW Reg

New 09-07

Registration for Mineral Royalty Withholding

1.

Account type: Mineral Royalty Withholding (MRW)

2. Federal employer identification number (FEIN)

3. Social security number (SSN)

4. Legal business name

5. Assumed business name (dba)

6.

Physical address

Street address

City

State

Zip

7.

Mailing address

PO Box/Street address

City

State

Zip

8.

Name of the person whom we can contact regarding this account.

Contact’s name

Phone number

FAX number

Email

9.

Legal entity type:

__ Sole Proprietor

__ Partnership

__ C corp

__ S corp

__ Member Managed LLC

__ Manager Managed LLC

__ LLP

__ Publicly Traded Partnership

__ Other (Please Indicate): _______________________________________________________

10. List the information for the individual owner if you are a sole proprietor, all partners if you are a partnership, all corporate officers

if you are a corporation, or all members if you are a limited liability company. (Use additional sheet if necessary.)

Social Security or Federal Employer

Name

Phone Number

Identification number

11. Purpose of registration:

X

__ Initial registration

__ Purchased an existing business or property

__ Re-registration

__ Entity change

__ Started a new business

__ Other (attach explanation)

12. List the previous name, owner and date acquired if you purchased an existing business, or the previous name if there is a

business name change.

Previous Business Name

Previous Owner

Date Acquired

13. Indicate all that apply:

Mineral Royalty

__ Oil

__ Gas

__ Coal

Withholding

__ Other Mineral (Please Indicate): ________________________________________________

14. Signature of owner, partner, or officer (unsigned forms will be returned.) Date

Phone Number

Email

15. Print the name of the owner, partner or officer who signed on line 14.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1