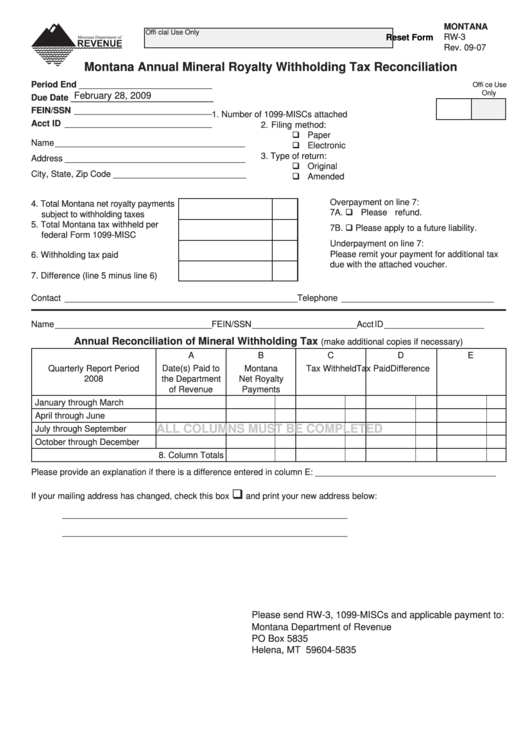

MONTANA

Offi cial Use Only

RW-3

Reset Form

Rev. 09-07

Montana Annual Mineral Royalty Withholding Tax Reconciliation

Period End ____________________________

Offi ce Use

Only

February 28, 2009

Due Date ______________________________

FEIN/SSN _____________________________

1. Number of 1099-MISCs attached ..............

Acct ID _______________________________

2. Filing method:

Paper

Name ________________________________________

Electronic

3. Type of return:

Address ______________________________________

Original

City, State, Zip Code ____________________________

Amended

Overpayment on line 7:

4. Total Montana net royalty payments

7A. Please refund.

subject to withholding taxes .............

5. Total Montana tax withheld per

7B. Please apply to a future liability.

federal Form 1099-MISC .................

Underpayment on line 7:

Please remit your payment for additional tax

6. Withholding tax paid ........................

due with the attached voucher.

7. Difference (line 5 minus line 6) ........

Contact _________________________________________________ Telephone ________________________________

Name _________________________________ FEIN/SSN ______________________Acct ID _____________________

Annual Reconciliation of Mineral Withholding Tax

(make additional copies if necessary)

A

B

C

D

E

Quarterly Report Period

Date(s) Paid to

Montana

Tax Withheld

Tax Paid

Difference

2008

the Department

Net Royalty

of Revenue

Payments

January through March

April through June

ALL COLUMNS MUST BE COMPLETED

July through September

October through December

8. Column Totals

Please provide an explanation if there is a difference entered in column E: ______________________________________

If your mailing address has changed, check this box

and print your new address below:

____________________________________________________________

____________________________________________________________

Please send RW-3, 1099-MISCs and applicable payment to:

Montana Department of Revenue

PO Box 5835

Helena, MT 59604-5835

1

1 2

2