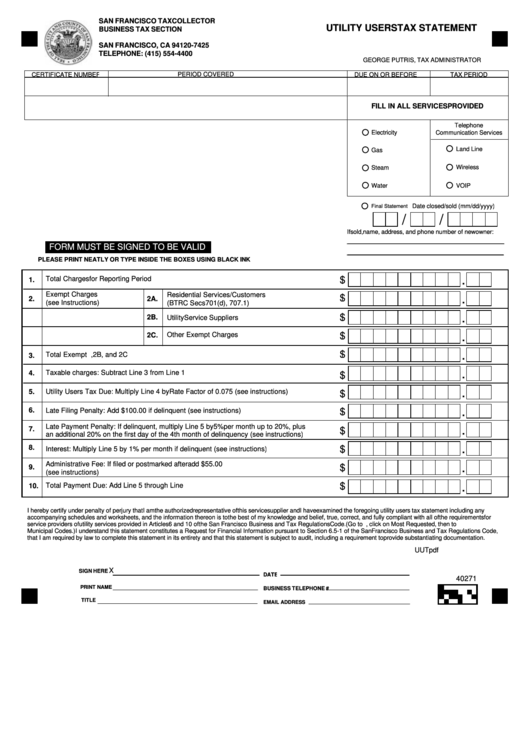

SAN FRANCISCO TAX COLLECTOR

UTILITY USERS TAX STATEMENT

BUSINESS TAX SECTION

P.O. BOX 7425

SAN FRANCISCO, CA 94120-7425

TELEPHONE: (415) 554-4400

GEORGE PUTRIS, TAX ADMINISTRATOR

CERTIFICATE NUMBER

PERIOD COVERED

DUE ON OR BEFORE

TAX PERIOD

FILL IN ALL SERVICES PROVIDED

Telephone

Electricity

Communication Services

Land Line

Gas

Wireless

Steam

Water

VOIP

Date closed/sold (mm/dd/yyyy)

Final Statement

/

/

If sold, name, address, and phone number of new owner:

____________________________________

FORM MUST BE SIGNED TO BE VALID

___________________________

PLEASE PRINT NEATLY OR TYPE INSIDE THE BOXES USING BLACK INK

.

Total Charges for Reporting Period

$

1.

Exempt Charges

Residential Services/Customers

.

$

2.

2A.

(see Instructions)

(BTRC Secs 701(d), 707.1)

.

$

2B.

Utility Service Suppliers

.

2C.

Other Exempt Charges

$

.

$

Total Exempt Charges. Add Lines 2A, 2B, and 2C

3.

.

4.

Taxable charges: Subtract Line 3 from Line 1

$

.

Utility Users Tax Due: Multiply Line 4 by Rate Factor of 0.075 (see instructions)

5.

$

.

6.

Late Filing Penalty: Add $100.00 if delinquent (see instructions)

$

Late Payment Penalty: If delinquent, multiply Line 5 by 5% per month up to 20%, plus

.

7.

$

an additional 20% on the first day of the 4th month of delinquency (see instructions)

.

8.

$

Interest: Multiply Line 5 by 1% per month if delinquent (see instructions)

Administrative Fee: If filed or postmarked after

add $55.00

.

$

9.

(see instructions)

.

$

Total Payment Due: Add Line 5 through Line 9. Make check payable to the SF Tax Collector

10.

I hereby certify under penalty of perjury that I am the authorized representative of this service supplier and I have examined the foregoing utility users tax statement including any

accompanying schedules and worksheets, and the information thereon is to the best of my knowledge and belief, true, correct, and fully compliant with all of the requirements for

service providers of utility services provided in Articles 6 and 10 of the San Francisco Business and Tax Regulations Code. (Go to , click on Most Requested, then to

Municipal Codes.) I understand this statement constitutes a Request for Financial Information pursuant to Section 6.5-1 of the San Francisco Business and Tax Regulations Code,

that I am required by law to complete this statement in its entirety and that this statement is subject to audit, including a requirement to provide substantiating documentation.

UUTpdf

X

SIGN HERE

DATE

40271

PRINT NAME

BUSINESS TELEPHONE #

TITLE

EMAIL ADDRESS

1

1 2

2