Utility Users Tax Refund Claim Form - City Of San Jose

ADVERTISEMENT

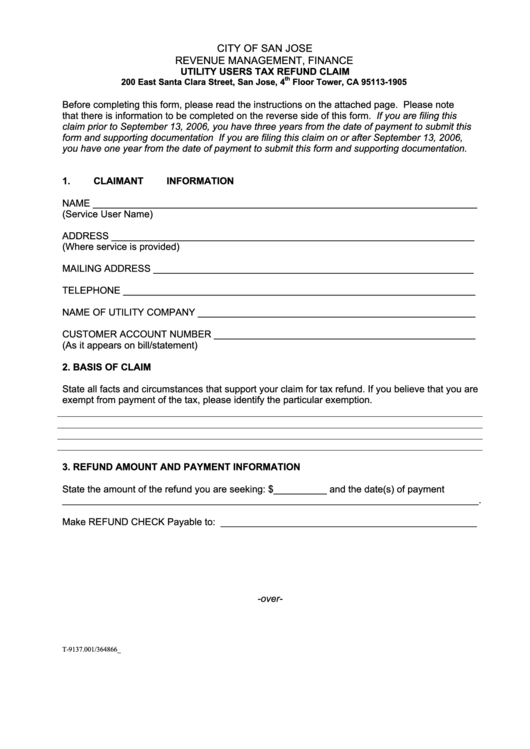

CITY OF SAN JOSE

REVENUE MANAGEMENT, FINANCE

UTILITY USERS TAX REFUND CLAIM

th

200 East Santa Clara Street, San Jose, 4

Floor Tower, CA 95113-1905

Before completing this form, please read the instructions on the attached page. Please note

that there is information to be completed on the reverse side of this form. If you are filing this

claim prior to September 13, 2006, you have three years from the date of payment to submit this

form and supporting documentation If you are filing this claim on or after September 13, 2006,

you have one year from the date of payment to submit this form and supporting documentation.

1.

CLAIMANT INFORMATION

NAME ________________________________________________________________________

(Service User Name)

ADDRESS ____________________________________________________________________

(Where service is provided)

MAILING ADDRESS ____________________________________________________________

TELEPHONE __________________________________________________________________

NAME OF UTILITY COMPANY ____________________________________________________

CUSTOMER ACCOUNT NUMBER _________________________________________________

(As it appears on bill/statement)

2.

BASIS OF CLAIM

State all facts and circumstances that support your claim for tax refund. If you believe that you are

exempt from payment of the tax, please identify the particular exemption.

3.

REFUND AMOUNT AND PAYMENT INFORMATION

State the amount of the refund you are seeking: $__________ and the date(s) of payment

______________________________________________________________________________.

Make REFUND CHECK Payable to: ________________________________________________

-over-

T-9137.001/364866_2.doc

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3