Instructions For Form 8609 - Low-Income Housing Credit Allocation And Certification - 2011

ADVERTISEMENT

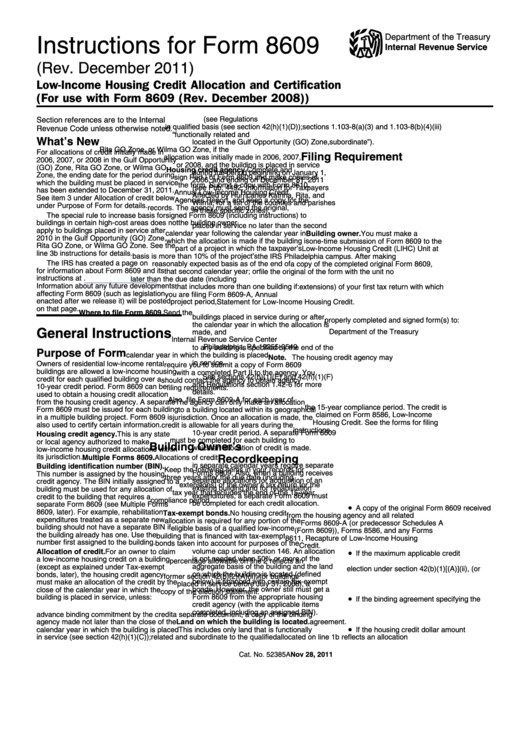

Instructions for Form 8609

Department of the Treasury

Internal Revenue Service

(Rev. December 2011)

Low-Income Housing Credit Allocation and Certification

(For use with Form 8609 (Rev. December 2008))

2. The allocation relates to an increase

low-income building (see Regulations

Section references are to the Internal

in qualified basis (see section 42(h)(1)(D));

sections 1.103-8(a)(3) and 1.103-8(b)(4)(iii)

Revenue Code unless otherwise noted.

3. The allocation is made to a building

for the meaning of “functionally related and

What’s New

located in the Gulf Opportunity (GO) Zone,

subordinate”).

Rita GO Zone, or Wilma GO Zone, if the

For allocations of credit initially made in

Filing Requirement

allocation was initially made in 2006, 2007,

2006, 2007, or 2008 in the Gulf Opportunity

or 2008, and the building is placed in service

(GO) Zone, Rita GO Zone, or Wilma GO

Housing credit agency. Complete and

during the period beginning on January 1,

Zone, the ending date for the period during

sign Part I of Form 8609 and make copies of

2006, and ending on December 31, 2011

which the building must be placed in service

the form. Submit a copy with Form 8610,

(see Pub. 4492, Information for Taxpayers

has been extended to December 31, 2011.

Annual Low-Income Housing Credit

Affected by Hurricanes Katrina, Rita, and

See item 3 under Allocation of credit below

Agencies Report, and keep a copy for the

Wilma, for a list of the counties and parishes

under Purpose of Form for details.

records. The agency must send the original,

in these specific zones);

The special rule to increase basis for

signed Form 8609 (including instructions) to

4. The allocation is made for a building

buildings in certain high-cost areas does not

the building owner.

placed in service no later than the second

apply to buildings placed in service after

calendar year following the calendar year in

Building owner. You must make a

2010 in the Gulf Opportunity (GO) Zone,

which the allocation is made if the building is

one-time submission of Form 8609 to the

Rita GO Zone, or Wilma GO Zone. See the

part of a project in which the taxpayer’s

Low-Income Housing Credit (LIHC) Unit at

line 3b instructions for details.

basis is more than 10% of the project’s

the IRS Philadelphia campus. After making

The IRS has created a page on IRS.gov

reasonably expected basis as of the end of

a copy of the completed original Form 8609,

for information about Form 8609 and its

that second calendar year; or

file the original of the form with the unit no

instructions at

5. The allocation is made for a project

later than the due date (including

Information about any future developments

that includes more than one building if:

extensions) of your first tax return with which

affecting Form 8609 (such as legislation

a. The allocation is made during the

you are filing Form 8609-A, Annual

enacted after we release it) will be posted

project period,

Statement for Low-Income Housing Credit.

on that page.

b. The allocation applies only to

Where to file Form 8609. Send the

buildings placed in service during or after

properly completed and signed form(s) to:

the calendar year in which the allocation is

General Instructions

Department of the Treasury

made, and

Internal Revenue Service Center

c. The part of the allocation that applies

Philadelphia, PA 19255-0549

to any building is specified by the end of the

Purpose of Form

calendar year in which the building is placed

Note. The housing credit agency may

in service.

Owners of residential low-income rental

require you to submit a copy of Form 8609

buildings are allowed a low-income housing

with a completed Part II to the agency. You

See sections 42(h)(1)(E) and 42(h)(1)(F)

credit for each qualified building over a

should contact the agency to obtain agency

and Regulations section 1.42-6 for more

10-year credit period. Form 8609 can be

filing requirements.

details.

used to obtain a housing credit allocation

Also, file Form 8609-A for each year of

from the housing credit agency. A separate

The agency can only make an allocation

the 15-year compliance period. The credit is

Form 8609 must be issued for each building

to a building located within its geographical

claimed on Form 8586, Low-Income

in a multiple building project. Form 8609 is

jurisdiction. Once an allocation is made, the

Housing Credit. See the forms for filing

also used to certify certain information.

credit is allowable for all years during the

instructions.

10-year credit period. A separate Form 8609

Housing credit agency. This is any state

must be completed for each building to

or local agency authorized to make

Building Owner’s

which an allocation of credit is made.

low-income housing credit allocations within

Recordkeeping

its jurisdiction.

Multiple Forms 8609. Allocations of credit

in separate calendar years require separate

Building identification number (BIN).

Keep the following items in your records for

Forms 8609. Also, when a building receives

This number is assigned by the housing

three years after the due date (including

separate allocations for acquisition of an

credit agency. The BIN initially assigned to a

extensions) of the owner’s tax return for the

existing building and for rehabilitation

building must be used for any allocation of

tax year that includes the end of the 15-year

expenditures, a separate Form 8609 must

credit to the building that requires a

compliance period.

be completed for each credit allocation.

separate Form 8609 (see Multiple Forms

•

A copy of the original Form 8609 received

8609, later). For example, rehabilitation

Tax-exempt bonds. No housing credit

from the housing agency and all related

expenditures treated as a separate new

allocation is required for any portion of the

Forms 8609-A (or predecessor Schedules A

building should not have a separate BIN if

eligible basis of a qualified low-income

(Form 8609)), Forms 8586, and any Forms

the building already has one. Use the

building that is financed with tax-exempt

8611, Recapture of Low-Income Housing

number first assigned to the building.

bonds taken into account for purposes of the

Credit.

Allocation of credit. For an owner to claim

volume cap under section 146. An allocation

•

If the maximum applicable credit

is not needed when 50% or more of the

a low-income housing credit on a building

percentage allowable on line 2 reflects an

(except as explained under Tax-exempt

aggregate basis of the building and the land

election under section 42(b)(1)[(A)](ii), (or

on which the building is located (defined

bonds, later), the housing credit agency

former section 42(b)(2)(A)(ii), for buildings

below) is financed with certain tax-exempt

must make an allocation of the credit by the

placed in service before July 31, 2008), a

bonds. However, the owner still must get a

close of the calendar year in which the

copy of the election statement.

Form 8609 from the appropriate housing

•

building is placed in service, unless:

If the binding agreement specifying the

credit agency (with the applicable items

1. The allocation is the result of an

housing credit dollar amount is contained in

completed, including an assigned BIN).

advance binding commitment by the credit

a separate document, a copy of the binding

Land on which the building is located.

agency made not later than the close of the

agreement.

•

calendar year in which the building is placed

This includes only land that is functionally

If the housing credit dollar amount

in service (see section 42(h)(1)(C));

related and subordinate to the qualified

allocated on line 1b reflects an allocation

Nov 28, 2011

Cat. No. 52385A

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4