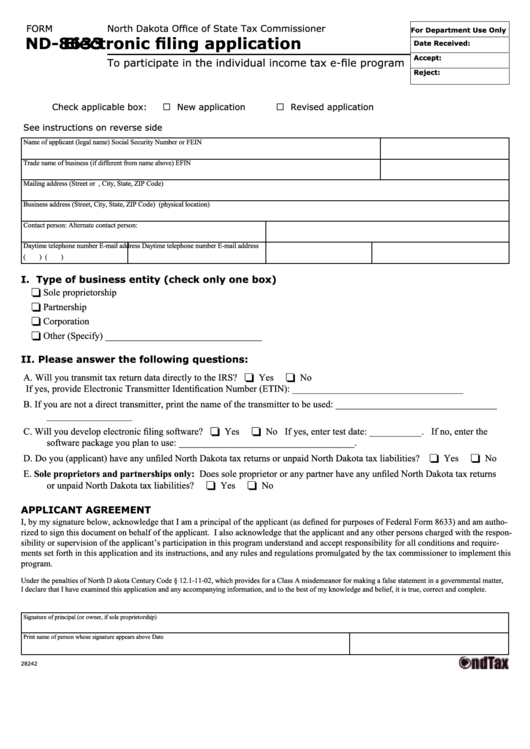

FORM

North Dakota Office of State Tax Commissioner

For Department Use Only

ND-8633

Electronic filing application

Date Received:

Accept:

To participate in the individual income tax e-file program

Reject:

Check applicable box:

New application

Revised application

See instructions on reverse side

Name of applicant (legal name)

Social Security Number or FEIN

Trade name of business (if different from name above)

EFIN

Mailing address (Street or P.O. Box, City, State, ZIP Code)

Business address (Street, City, State, ZIP Code) (physical location)

Contact person:

Alternate contact person:

Daytime telephone number

E-mail address

Daytime telephone number

E-mail address

(

)

(

)

I. Type of business entity (check only one box)

Sole proprietorship

Partnership

Corporation

Other (Specify) _________________________________

II. Please answer the following questions:

A. Will you transmit tax return data directly to the IRS? Yes

No

If yes, provide Electronic Transmitter Identification Number (ETIN): ____________________________________

B. If you are not a direct transmitter, print the name of the transmitter to be used: __________________________________

__________________

C. Will you develop electronic filing software? Yes

No If yes, enter test date: ___________. If no, enter the

software package you plan to use: _____________________________________.

D. Do you (applicant) have any unfiled North Dakota tax returns or unpaid North Dakota tax liabilities? Yes

No

E. Sole proprietors and partnerships only: Does sole proprietor or any partner have any unfiled North Dakota tax returns

or unpaid North Dakota tax liabilities?

Yes

No

APPLICANT AGREEMENT

I, by my signature below, acknowledge that I am a principal of the applicant (as defined for purposes of Federal Form 8633) and am autho-

rized to sign this document on behalf of the applicant. I also acknowledge that the applicant and any other persons charged with the respon-

sibility or supervision of the applicant’s participation in this program understand and accept responsibility for all conditions and require-

ments set forth in this application and its instructions, and any rules and regulations promulgated by the tax commissioner to implement this

program.

Under the penalties of North D akota Century Code § 12.1-11-02, which provides for a Class A misdemeanor for making a false statement in a governmental matter,

I declare that I have examined this application and any accompanying information, and to the best of my knowledge and belief, it is true, correct and complete.

Signature of principal (or owner, if sole proprietorship)

Print name of person whose signature appears above

Date

28242

1

1