Form 720-V - Electronic Filing Payment Voucher - 2016

ADVERTISEMENT

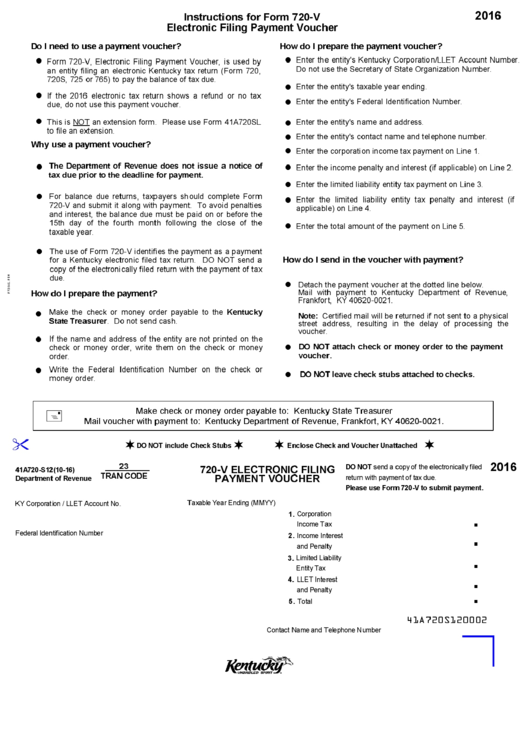

Instructions for Form 720-V

2016

Electronic Filing Payment Voucher

Do I need to use a payment voucher?

How do I prepare the payment voucher?

l

l

Enter the entity's Kentucky Corporation/LLET Account Number.

Form 720-V, Electronic Filing Payment Voucher, is used by

Do not use the Secretary of State Organization Number.

an entity filing an electronic Kentucky tax return (Form 720,

720S, 725 or 765) to pay the balance of tax due.

l

Enter the entity's taxable year ending.

l

If the 2016 electronic tax return shows a refund or no tax

l

Enter the entity's Federal Identification Number.

due, do not use this payment voucher.

l

This is NOT an extension form. Please use Form 41A720SL

Enter the entity's name and address.

l

to file an extension.

l

Enter the entity's contact name and telephone number.

Why use a payment voucher?

l

Enter the corporation income tax payment on Line 1.

l

The Department of Revenue does not issue a notice of

l

Enter the income penalty and interest (if applicable) on Line 2.

tax due prior to the deadline for payment.

l

Enter the limited liability entity tax payment on Line 3.

l

For balance due returns, taxpayers should complete Form

l

Enter the limited liability entity tax penalty and interest (if

720-V and submit it along with payment. To avoid penalties

applicable) on Line 4.

and interest, the balance due must be paid on or before the

15th day of the fourth month following the close of the

l

Enter the total amount of the payment on Line 5.

taxable year.

l

The use of Form 720-V identifies the payment as a payment

How do I send in the voucher with payment?

for a Kentucky electronic filed tax return. DO NOT send a

copy of the electronically filed return with the payment of tax

due.

l

Detach the payment voucher at the dotted line below.

Mail with payment to Kentucky Department of Revenue,

How do I prepare the payment?

Frankfort, KY 40620-0021.

Make the check or money order payable to the Kentucky

l

Note: Certified mail will be returned if not sent to a physical

State Treasurer . Do not send cash.

street address, resulting in the delay of processing the

voucher.

l

If the name and address of the entity are not printed on the

l

DO NOT attach check or money order to the payment

check or money order, write them on the check or money

voucher.

order.

Write the Federal Identification Number on the check or

l

l

DO NOT leave check stubs attached to checks.

money order.

+

Make check or money order payable to: Kentucky State Treasurer

Mail voucher with payment to: Kentucky Department of Revenue, Frankfort, KY 40620-0021.

"

¬

¬

¬

¬

DO NOT include Check Stubs

Enclose Check and Voucher Unattached

23

2016

720-V ELECTRONIC FILING

DO NOT

send a copy of the electronically filed

41A720-S12(10-16)

TRAN CODE

PAYMENT VOUCHER

Department of Revenue

return with payment of tax due.

Please use Form 720-V to submit payment.

Taxable Year Ending (MMYY)

KY Corporation / LLET Account No.

1.

Corporation

.

Income Tax

Federal Identification Number

2.

Income Interest

.

and Penalty

3.

Limited Liability

.

Entity Tax

4.

LLET Interest

.

and Penalty

.

5.

Total

41A720S120002

Contact Name and Telephone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1