Instructions For Form 709 - 2008

ADVERTISEMENT

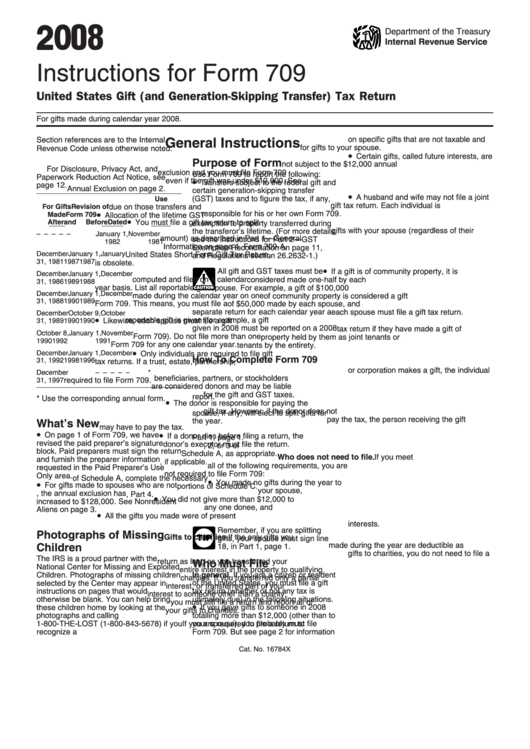

2 0 08

Department of the Treasury

Internal Revenue Service

Instructions for Form 709

United States Gift (and Generation-Skipping Transfer) Tax Return

For gifts made during calendar year 2008.

on specific gifts that are not taxable and

Section references are to the Internal

General Instructions

for gifts to your spouse.

Revenue Code unless otherwise noted.

•

Certain gifts, called future interests, are

Purpose of Form

not subject to the $12,000 annual

For Disclosure, Privacy Act, and

exclusion and you must file Form 709

Use Form 709 to report the following:

Paperwork Reduction Act Notice, see

•

even if the gift was under $12,000. See

Transfers subject to the federal gift and

page 12.

Annual Exclusion on page 2.

certain generation-skipping transfer

•

A husband and wife may not file a joint

(GST) taxes and to figure the tax, if any,

Use

gift tax return. Each individual is

For Gifts

Revision of

due on those transfers and

•

responsible for his or her own Form 709.

Made

Form 709

Allocation of the lifetime GST

•

After

and

Before

Dated

You must file a gift tax return to split

exemption to property transferred during

gifts with your spouse (regardless of their

the transferor’s lifetime. (For more details,

– – – – –

January 1,

November

amount) as described in Part 1 — General

see the instructions for Part 2 — GST

1982

1981

Information on page 4. Form 709-A,

Exemption Reconciliation on page 11,

December

January 1,

January

United States Short Form Gift Tax Return,

and Regulations section 26.2632-1.)

31, 1981

1987

1987

is obsolete.

•

All gift and GST taxes must be

If a gift is of community property, it is

December

January 1,

December

!

computed and filed on a calendar

considered made one-half by each

31, 1986

1989

1988

year basis. List all reportable gifts

spouse. For example, a gift of $100,000

CAUTION

December

January 1,

December

made during the calendar year on one

of community property is considered a gift

31, 1988

1990

1989

Form 709. This means, you must file a

of $50,000 made by each spouse, and

separate return for each calendar year a

each spouse must file a gift tax return.

December

October 9,

October

•

reportable gift is given (for example, a gift

Likewise, each spouse must file a gift

31, 1989

1990

1990

given in 2008 must be reported on a 2008

tax return if they have made a gift of

October 8,

January 1,

November

Form 709). Do not file more than one

property held by them as joint tenants or

1990

1992

1991

Form 709 for any one calendar year.

tenants by the entirety.

•

December

January 1,

December

Only individuals are required to file gift

How To Complete Form 709

31, 1992

1998

1996

tax returns. If a trust, estate, partnership,

or corporation makes a gift, the individual

1. Determine whether you are

December

– – – – –

*

beneficiaries, partners, or stockholders

required to file Form 709.

31, 1997

are considered donors and may be liable

2. Determine what gifts you must

for the gift and GST taxes.

report.

* Use the corresponding annual form.

•

The donor is responsible for paying the

3. Decide whether you and your

gift tax. However, if the donor does not

spouse, if any, will elect to split gifts for

pay the tax, the person receiving the gift

the year.

What’s New

may have to pay the tax.

4. Complete lines 1 through 18 of

•

•

On page 1 of Form 709, we have

If a donor dies before filing a return, the

Part 1, page 1.

revised the paid preparer’s signature

donor’s executor must file the return.

5. List each gift on Part 1, 2, or 3 of

block. Paid preparers must sign the return

Schedule A, as appropriate.

Who does not need to file. If you meet

and furnish the preparer information

6. Complete Schedule B, if applicable.

all of the following requirements, you are

requested in the Paid Preparer’s Use

7. If the gift was listed on Part 2 or 3

not required to file Form 709:

Only area.

of Schedule A, complete the necessary

•

•

You made no gifts during the year to

For gifts made to spouses who are not

portions of Schedule C.

your spouse,

U.S. citizens, the annual exclusion has

8. Complete Schedule A, Part 4.

•

You did not give more than $12,000 to

increased to $128,000. See Nonresident

9. Complete Part 2 on page 1.

any one donee, and

Aliens on page 3.

10. Sign and date the return.

•

All the gifts you made were of present

interests.

Remember, if you are splitting

Photographs of Missing

Gifts to charities. If the only gifts you

TIP

gifts, your spouse must sign line

made during the year are deductible as

Children

18, in Part 1, page 1.

gifts to charities, you do not need to file a

The IRS is a proud partner with the

return as long as you transferred your

Who Must File

National Center for Missing and Exploited

entire interest in the property to qualifying

Children. Photographs of missing children

In general. If you are a citizen or resident

charities. If you transferred only a partial

selected by the Center may appear in

of the United States, you must file a gift

interest, or transferred part of your

tax return (whether or not any tax is

instructions on pages that would

interest to someone other than a charity,

ultimately due) in the following situations.

otherwise be blank. You can help bring

you must still file a return and report all of

•

these children home by looking at the

If you gave gifts to someone in 2008

your gifts to charities.

photographs and calling

totalling more than $12,000 (other than to

1-800-THE-LOST (1-800-843-5678) if you

your spouse), you probably must file

If you are required to file a return to

recognize a child.

Form 709. But see page 2 for information

report noncharitable gifts and you made

Cat. No. 16784X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12