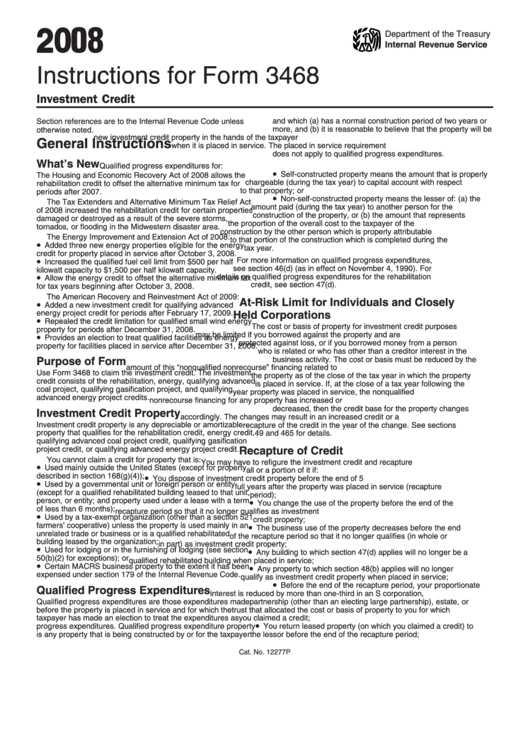

Instructions For Form 3468 - Investment Credit - 2008

ADVERTISEMENT

2 0 08

Department of the Treasury

Internal Revenue Service

Instructions for Form 3468

Investment Credit

and which (a) has a normal construction period of two years or

Section references are to the Internal Revenue Code unless

more, and (b) it is reasonable to believe that the property will be

otherwise noted.

new investment credit property in the hands of the taxpayer

General Instructions

when it is placed in service. The placed in service requirement

does not apply to qualified progress expenditures.

What’s New

Qualified progress expenditures for:

•

Self-constructed property means the amount that is properly

The Housing and Economic Recovery Act of 2008 allows the

chargeable (during the tax year) to capital account with respect

rehabilitation credit to offset the alternative minimum tax for

to that property; or

periods after 2007.

•

Non-self-constructed property means the lesser of: (a) the

The Tax Extenders and Alternative Minimum Tax Relief Act

amount paid (during the tax year) to another person for the

of 2008 increased the rehabilitation credit for certain properties

construction of the property, or (b) the amount that represents

damaged or destroyed as a result of the severe storms,

the proportion of the overall cost to the taxpayer of the

tornados, or flooding in the Midwestern disaster area.

construction by the other person which is properly attributable

The Energy Improvement and Extension Act of 2008:

to that portion of the construction which is completed during the

•

Added three new energy properties eligible for the energy

tax year.

credit for property placed in service after October 3, 2008.

•

For more information on qualified progress expenditures,

Increased the qualified fuel cell limit from $500 per half

see section 46(d) (as in effect on November 4, 1990). For

kilowatt capacity to $1,500 per half kilowatt capacity.

•

details on qualified progress expenditures for the rehabilitation

Allow the energy credit to offset the alternative minimum tax

credit, see section 47(d).

for tax years beginning after October 3, 2008.

The American Recovery and Reinvestment Act of 2009:

At-Risk Limit for Individuals and Closely

•

Added a new investment credit for qualifying advanced

energy project credit for periods after February 17, 2009.

Held Corporations

•

Repealed the credit limitation for qualified small wind energy

The cost or basis of property for investment credit purposes

property for periods after December 31, 2008.

•

may be limited if you borrowed against the property and are

Provides an election to treat qualified facilities as energy

protected against loss, or if you borrowed money from a person

property for facilities placed in service after December 31, 2008.

who is related or who has other than a creditor interest in the

business activity. The cost or basis must be reduced by the

Purpose of Form

amount of this “nonqualified nonrecourse” financing related to

Use Form 3468 to claim the investment credit. The investment

the property as of the close of the tax year in which the property

credit consists of the rehabilitation, energy, qualifying advanced

is placed in service. If, at the close of a tax year following the

coal project, qualifying gasification project, and qualifying

year property was placed in service, the nonqualified

advanced energy project credits.

nonrecourse financing for any property has increased or

decreased, then the credit base for the property changes

Investment Credit Property

accordingly. The changes may result in an increased credit or a

Investment credit property is any depreciable or amortizable

recapture of the credit in the year of the change. See sections

property that qualifies for the rehabilitation credit, energy credit,

49 and 465 for details.

qualifying advanced coal project credit, qualifying gasification

project credit, or qualifying advanced energy project credit.

Recapture of Credit

You cannot claim a credit for property that is:

You may have to refigure the investment credit and recapture

•

Used mainly outside the United States (except for property

all or a portion of it if:

•

described in section 168(g)(4));

You dispose of investment credit property before the end of 5

•

Used by a governmental unit or foreign person or entity

full years after the property was placed in service (recapture

(except for a qualified rehabilitated building leased to that unit,

period);

•

person, or entity; and property used under a lease with a term

You change the use of the property before the end of the

of less than 6 months);

recapture period so that it no longer qualifies as investment

•

Used by a tax-exempt organization (other than a section 521

credit property;

•

farmers’ cooperative) unless the property is used mainly in an

The business use of the property decreases before the end

unrelated trade or business or is a qualified rehabilitated

of the recapture period so that it no longer qualifies (in whole or

building leased by the organization;

in part) as investment credit property;

•

•

Used for lodging or in the furnishing of lodging (see section

Any building to which section 47(d) applies will no longer be a

50(b)(2) for exceptions); or

qualified rehabilitated building when placed in service;

•

•

Certain MACRS business property to the extent it has been

Any property to which section 48(b) applies will no longer

expensed under section 179 of the Internal Revenue Code.

qualify as investment credit property when placed in service;

•

Before the end of the recapture period, your proportionate

Qualified Progress Expenditures

interest is reduced by more than one-third in an S corporation,

Qualified progress expenditures are those expenditures made

partnership (other than an electing large partnership), estate, or

before the property is placed in service and for which the

trust that allocated the cost or basis of property to you for which

taxpayer has made an election to treat the expenditures as

you claimed a credit;

•

progress expenditures. Qualified progress expenditure property

You return leased property (on which you claimed a credit) to

is any property that is being constructed by or for the taxpayer

the lessor before the end of the recapture period;

Cat. No. 12277P

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6