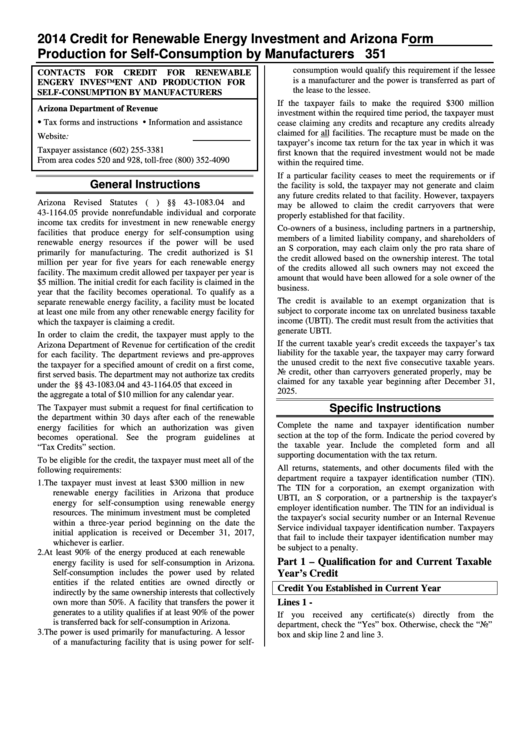

Instructions For Form 351 - Arizona Credit For Renewable Energy Investment And Production For Self-Consumption By Manufacturers - 2014

ADVERTISEMENT

2014 Credit for Renewable Energy Investment and

Arizona Form

Production for Self-Consumption by Manufacturers

351

consumption would qualify this requirement if the lessee

CONTACTS

FOR

CREDIT

FOR

RENEWABLE

is a manufacturer and the power is transferred as part of

ENGERY INVESTMENT AND PRODUCTION FOR

the lease to the lessee.

SELF-CONSUMPTION BY MANUFACTURERS

If the taxpayer fails to make the required $300 million

Arizona Department of Revenue

investment within the required time period, the taxpayer must

Tax forms and instructions Information and assistance

cease claiming any credits and recapture any credits already

claimed for all facilities. The recapture must be made on the

Website:

taxpayer’s income tax return for the tax year in which it was

Taxpayer assistance

(602) 255-3381

first known that the required investment would not be made

From area codes 520 and 928, toll-free

(800) 352-4090

within the required time.

If a particular facility ceases to meet the requirements or if

General Instructions

the facility is sold, the taxpayer may not generate and claim

any future credits related to that facility. However, taxpayers

Arizona Revised Statutes (A.R.S.) §§ 43-1083.04 and

may be allowed to claim the credit carryovers that were

43-1164.05 provide nonrefundable individual and corporate

properly established for that facility.

income tax credits for investment in new renewable energy

Co-owners of a business, including partners in a partnership,

facilities that produce energy for self-consumption using

members of a limited liability company, and shareholders of

renewable energy resources if the power will be used

an S corporation, may each claim only the pro rata share of

primarily for manufacturing. The credit authorized is $1

the credit allowed based on the ownership interest. The total

million per year for five years for each renewable energy

of the credits allowed all such owners may not exceed the

facility. The maximum credit allowed per taxpayer per year is

amount that would have been allowed for a sole owner of the

$5 million. The initial credit for each facility is claimed in the

business.

year that the facility becomes operational. To qualify as a

The credit is available to an exempt organization that is

separate renewable energy facility, a facility must be located

subject to corporate income tax on unrelated business taxable

at least one mile from any other renewable energy facility for

income (UBTI). The credit must result from the activities that

which the taxpayer is claiming a credit.

generate UBTI.

In order to claim the credit, the taxpayer must apply to the

If the current taxable year's credit exceeds the taxpayer’s tax

Arizona Department of Revenue for certification of the credit

liability for the taxable year, the taxpayer may carry forward

for each facility. The department reviews and pre-approves

the unused credit to the next five consecutive taxable years.

the taxpayer for a specified amount of credit on a first come,

No credit, other than carryovers generated properly, may be

first served basis. The department may not authorize tax credits

claimed for any taxable year beginning after December 31,

under the A.R.S. §§ 43-1083.04 and 43-1164.05 that exceed in

2025.

the aggregate a total of $10 million for any calendar year.

Specific Instructions

The Taxpayer must submit a request for final certification to

the department within 30 days after each of the renewable

Complete the name and taxpayer identification number

energy facilities for which an authorization was given

section at the top of the form. Indicate the period covered by

becomes operational. See the program guidelines at

the taxable year. Include the completed form and all

under the “Tax Credits” section.

supporting documentation with the tax return.

To be eligible for the credit, the taxpayer must meet all of the

All returns, statements, and other documents filed with the

following requirements:

department require a taxpayer identification number (TIN).

1. The taxpayer must invest at least $300 million in new

The TIN for a corporation, an exempt organization with

renewable energy facilities in Arizona that produce

UBTI, an S corporation, or a partnership is the taxpayer's

energy for self-consumption using renewable energy

employer identification number. The TIN for an individual is

resources. The minimum investment must be completed

the taxpayer's social security number or an Internal Revenue

within a three-year period beginning on the date the

Service individual taxpayer identification number. Taxpayers

initial application is received or December 31, 2017,

that fail to include their taxpayer identification number may

whichever is earlier.

be subject to a penalty.

2.

At least 90% of the energy produced at each renewable

Part 1 – Qualification for and Current Taxable

energy facility is used for self-consumption in Arizona.

Self-consumption includes the power used by related

Year’s Credit

entities if the related entities are owned directly or

Credit You Established in Current Year

indirectly by the same ownership interests that collectively

Lines 1 -

own more than 50%. A facility that transfers the power it

generates to a utility qualifies if at least 90% of the power

If you received any certificate(s) directly from the

is transferred back for self-consumption in Arizona.

department, check the “Yes” box. Otherwise, check the “No”

3. The power is used primarily for manufacturing. A lessor

box and skip line 2 and line 3.

of a manufacturing facility that is using power for self-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3