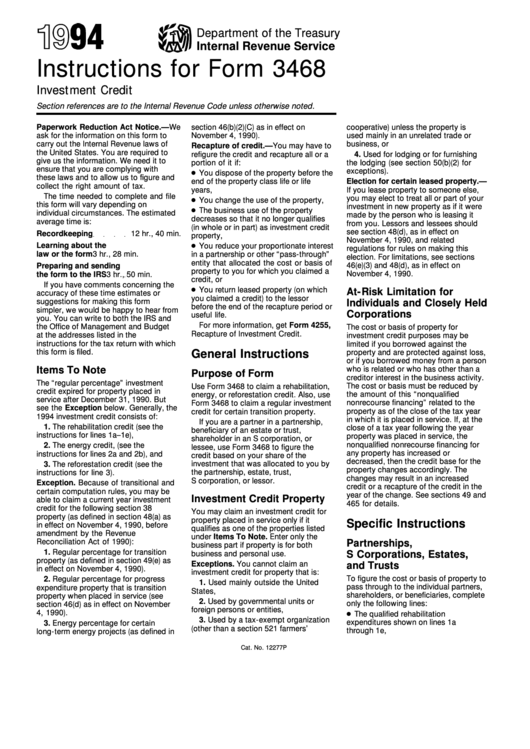

Instructions For Form 3468 - Investment Credit - 1994

ADVERTISEMENT

Department of the Treasury

Internal Revenue Service

Instructions for Form 3468

Investment Credit

Section references are to the Inter nal Revenue Code unless otherwise noted.

Paperwork Reduction Act Notice.—We

section 46(b)(2)(C) as in effect on

cooperative) unless the property is

ask for the information on this form to

November 4, 1990).

used mainly in an unrelated trade or

carry out the Internal Revenue laws of

business, or

Recapture of credit.—You may have to

the United States. You are required to

refigure the credit and recapture all or a

4. Used for lodging or for furnishing

give us the information. We need it to

portion of it if:

the lodging (see section 50(b)(2) for

ensure that you are complying with

exceptions).

You dispose of the property before the

these laws and to allow us to figure and

end of the property class life or life

Election for certain leased property.—

collect the right amount of tax.

years,

If you lease property to someone else,

The time needed to complete and file

you may elect to treat all or part of your

You change the use of the property,

this form will vary depending on

investment in new property as if it were

The business use of the property

individual circumstances. The estimated

made by the person who is leasing it

decreases so that it no longer qualifies

average time is:

from you. Lessors and lessees should

(in whole or in part) as investment credit

see section 48(d), as in effect on

Recordkeeping

12 hr., 40 min.

property,

November 4, 1990, and related

Learning about the

You reduce your proportionate interest

regulations for rules on making this

law or the form

3 hr., 28 min.

in a partnership or other “pass-through”

election. For limitations, see sections

entity that allocated the cost or basis of

46(e)(3) and 48(d), as in effect on

Preparing and sending

property to you for which you claimed a

November 4, 1990.

the form to the IRS

3 hr., 50 min.

credit, or

If you have comments concerning the

You return leased property (on which

At-Risk Limitation for

accuracy of these time estimates or

you claimed a credit) to the lessor

suggestions for making this form

Individuals and Closely Held

before the end of the recapture period or

simpler, we would be happy to hear from

Corporations

useful life.

you. You can write to both the IRS and

For more information, get Form 4255,

the Office of Management and Budget

The cost or basis of property for

Recapture of Investment Credit.

at the addresses listed in the

investment credit purposes may be

instructions for the tax return with which

limited if you borrowed against the

this form is filed.

General Instructions

property and are protected against loss,

or if you borrowed money from a person

Items To Note

who is related or who has other than a

Purpose of Form

creditor interest in the business activity.

The “regular percentage” investment

The cost or basis must be reduced by

Use Form 3468 to claim a rehabilitation,

credit expired for property placed in

the amount of this “nonqualified

energy, or reforestation credit. Also, use

service after December 31, 1990. But

Form 3468 to claim a regular investment

nonrecourse financing” related to the

see the Exception below. Generally, the

property as of the close of the tax year

credit for certain transition property.

1994 investment credit consists of:

in which it is placed in service. If, at the

If you are a partner in a partnership,

1. The rehabilitation credit (see the

close of a tax year following the year

beneficiary of an estate or trust,

instructions for lines 1a–1e),

property was placed in service, the

shareholder in an S corporation, or

nonqualified nonrecourse financing for

2. The energy credit, (see the

lessee, use Form 3468 to figure the

any property has increased or

instructions for lines 2a and 2b), and

credit based on your share of the

decreased, then the credit base for the

investment that was allocated to you by

3. The reforestation credit (see the

property changes accordingly. The

the partnership, estate, trust,

instructions for line 3).

changes may result in an increased

S corporation, or lessor.

Exception. Because of transitional and

credit or a recapture of the credit in the

certain computation rules, you may be

year of the change. See sections 49 and

Investment Credit Property

able to claim a current year investment

465 for details.

credit for the following section 38

You may claim an investment credit for

property (as defined in section 48(a) as

property placed in service only if it

Specific Instructions

in effect on November 4, 1990, before

qualifies as one of the properties listed

amendment by the Revenue

under Items To Note. Enter only the

Reconciliation Act of 1990):

Partnerships,

business part if property is for both

1. Regular percentage for transition

S Corporations, Estates,

business and personal use.

property (as defined in section 49(e) as

Exceptions. You cannot claim an

and Trusts

in effect on November 4, 1990).

investment credit for property that is:

To figure the cost or basis of property to

2. Regular percentage for progress

1. Used mainly outside the United

pass through to the individual partners,

expenditure property that is transition

States,

shareholders, or beneficiaries, complete

property when placed in service (see

2. Used by governmental units or

only the following lines:

section 46(d) as in effect on November

foreign persons or entities,

4, 1990).

The qualified rehabilitation

3. Used by a tax-exempt organization

expenditures shown on lines 1a

3. Energy percentage for certain

(other than a section 521 farmers’

through 1e,

long-term energy projects (as defined in

Cat. No. 12277P

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3