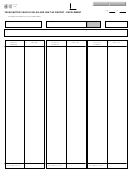

TEXAS FRANCHISE TAX REPORT - Page 2

05-158-B

(Rev. 4-09/3)

Tcode

13251 Annual

Taxpayer number

Report year

Due date

Taxpayer name

MARGIN

(Whole dollars only)

0 0

,

,

,

,

.

19. Revenue

19.

(Item 10 X 70%)

0 0

,

,

,

,

.

20. Revenue

20.

(Item 10 minus Item 14 COGS)

0 0

,

,

,

,

.

21. Revenue

21.

(Item 10 minus Item 18 Compensation)

0 0

,

,

,

,

.

22. MARGIN

22.

(Enter the lowest amount from Items 19, 20 or 21)

APPORTIONMENT FACTOR

0 0

,

,

,

,

.

23. Gross receipts in Texas

23.

(Whole dollars only)

0 0

,

,

,

,

.

24. Gross receipts everywhere

24.

(Whole dollars only)

.

25. APPORTIONMENT FACTOR

25.

(Divide Item 23 by Item 24) (Round to 4 decimal places)

TAXABLE MARGIN

(Whole dollars only)

0 0

,

,

,

,

.

26. Apportioned margin

26.

(Multiply Item 22 by Item 25)

0 0

,

,

,

,

.

27. Allowable deductions

27.

0 0

,

,

,

,

.

28. TAXABLE MARGIN

28.

(Item 26 minus Item 27)

TAX DUE

.

29. Tax rate

29.

(See instructions for determining the appropriate tax rate)

,

,

,

,

.

30. Tax due

30.

(Multiply Item 28 by the tax rate in Item 29) (Dollars and cents)

TAX ADJUSTMENTS

(Dollars and cents) (Do not include prior payments)

,

,

,

,

.

31. Tax credits

31.

(Item 23 from Form 05-160)

,

,

,

,

.

32. Tax due before discount

32.

(Item 30 minus Item 31)

,

,

,

,

.

33. Discount

33.

(See instructions)

TOTAL TAX DUE

(Dollars and cents)

,

,

,

,

.

34. TOTAL TAX DUE

34.

(Item 32 minus Item 33)

Do not include payment if this amount is less than $1,000 or if annualized total revenue is $300,000 or less.

If the entity is a tiered partnership, ANY amount in Item 34 is due. Complete form 05-170 if making a payment.

Print or type name

Area code and phone number

(

)

-

Mail original to:

I declare that the information in this document and any attachments is true and correct to the best of my knowledge and belief.

COMPTROLLER OF PUBLIC ACCOUNTS

Date

P.O. Box 149348

Austin, TX 78714-9348

If you have any questions regarding franchise tax, you may contact the Texas State Comptroller's field office in your area or call (800) 252-1381, toll free nationwide.

The Austin number is (512) 463-4600. For instructions on completing the franchise tax report forms, see Form 05-392 (2008) or Form 05-393 (2009).

Texas Comptroller Official Use Only

RETURN TO PAGE 1

VE/DE

PM Date

Page 2 of 2

1

1 2

2 3

3 4

4 5

5 6

6