Instructions For Requesting An Extension To File Texas Franchise Tax Reports Form 05-141 2011

ADVERTISEMENT

05- 141 ( Back)

( R ev. 2- 03/ 11)

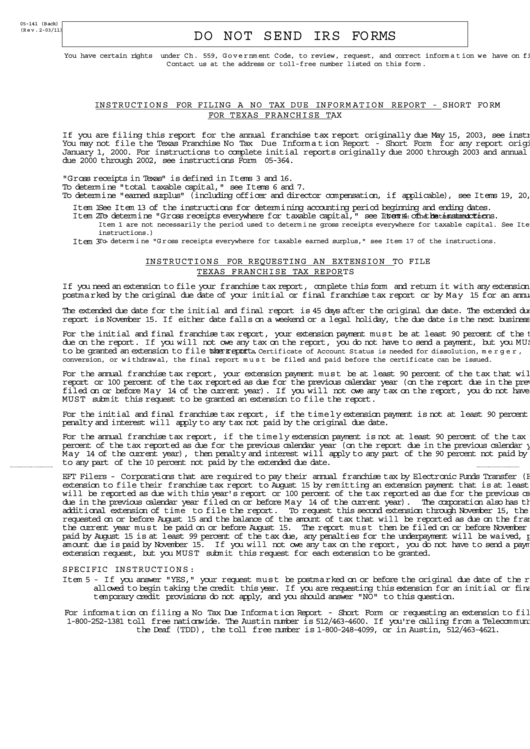

DO NO T SEND I RS FO RM S

You have cer t ai n r i ght s under Ch. 559, G over nm ent Code, t o r evi ew, r equest , and cor r ect i nf or m at i on we have on f i l e about you.

Cont act us at t he addr ess or t ol l - f r ee num ber l i st ed on t hi s f or m .

I N STR U C TI O N S FO R FI LI N G A N O TA X D U E I N FO R M A TI O N R EPO R T - SH O R T FO R M

FO R TEXA S FR A N C H I SE TA X

I f you ar e f i l i ng t hi s r epor t f or t he annual f r anchi se t ax r epor t or i gi nal l y due May 15, 2003, see i nst r uct i ons For m 05- 386.

You m ay not f i l e t he Texas Fr anchi se No Tax Due I nf or m at i on Repor t - Shor t For m f or any r epor t or i gi nal l y due pr i or t o

Januar y 1, 2000. For i nst r uct i ons t o com pl et e i ni t i al r epor t s or i gi nal l y due 2000 t hr ough 2003 and annual r epor t s or i gi nal l y

due 2000 t hr ough 2002, see i nst r uct i ons For m 05- 364.

" Gr oss r ecei pt s i n Texas" i s def i ned i n I t ems 3 and 16.

To det er mi ne " t ot al t axabl e capi t al , " see I t ems 6 and 7.

To det er mi ne " ear ned sur pl us" ( i ncl udi ng of f i cer and di r ect or compensat i on, i f appl i cabl e) , see I t ems 19, 20, and 21.

I t em 1 -

See I t em 13 of t he i nst r uct i ons f or det er mi ni ng account i ng per i od begi nni ng and endi ng dat es.

I t em 2 -

To det er mi ne " Gr oss r ecei pt s ever ywher e f or t axabl e capi t al , " see I t em 4 of t he i nst r uct i ons.

( NO TE: The dat es used f or

I t em 1 ar e not necessar i l y t he per i od used t o det er m i ne gr oss r ecei pt s ever ywher e f or t axabl e capi t al . See I t em 2 of t he

i nst r uct i ons. )

I t em 3 -

To det er m i ne " G r oss r ecei pt s ever ywher e f or t axabl e ear ned sur pl us, " see I t em 17 of t he i nst r uct i ons.

I N STR U C TI O N S FO R R EQ U ESTI N G A N EXTEN SI O N TO FI LE

TEXA S FR A N C H I SE TA X R EPO R TS

I f you need an ext ensi on t o f i l e your f r anchi se t ax r epor t , compl et e t hi s f or m and r et ur n i t wi t h any ext ensi on payment due,

post mar ked by t he or i gi nal due dat e of your i ni t i al or f i nal f r anchi se t ax r epor t or by May 15 f or an annual f r anchi se t ax r epor t .

The ext ended due dat e f or t he i ni t i al and f i nal r epor t i s 45 days af t er t he or i gi nal due dat e. The ext ended due dat e f or an annual

r epor t i s November 15. I f ei t her dat e f al l s on a weekend or a l egal hol i day, t he due dat e i s t he next busi ness day.

For t he i ni t i al and f i nal f r anchi se t ax r epor t , your ext ensi on payment must be at l east 90 per cent of t he t ax t hat wi l l be r epor t ed as

due on t he r epor t . I f you wi l l not owe any t ax on t he r epor t , you do not have t o send a payment , but you MUST submi t t hi s r equest

t o be gr ant ed an ext ensi on t o f i l e t he r epor t .

NO TE: I f a Cer t i f i cat e of Account St at us i s needed f or di ssol ut i on, m er ger ,

conver si on, or w i t hdr aw al , t he f i nal r epor t m ust be f i l ed and pai d bef or e t he cer t i f i cat e can be i ssued.

For t he annual f r anchi se t ax r epor t , your ext ensi on payment must be at l east 90 per cent of t he t ax t hat wi l l be due wi t h t hi s year ' s

r epor t or 100 per cent of t he t ax r epor t ed as due f or t he pr evi ous cal endar year ( on t he r epor t due i n t he pr evi ous cal endar year

f i l ed on or bef or e May 14 of t he cur r ent year ) . I f you wi l l not owe any t ax on t he r epor t , you do not have t o send a payment , but you

MUST submi t t hi s r equest t o be gr ant ed an ext ensi on t o f i l e t he r epor t .

For t he i ni t i al and f i nal f r anchi se t ax r epor t , i f t he t i mel y ext ensi on payment i s not at l east 90 per cent of t he t ax t hat wi l l be due, t hen

penal t y and i nt er est wi l l appl y t o any t ax not pai d by t he or i gi nal due dat e.

For t he annual f r anchi se t ax r epor t , i f t he t i mel y ext ensi on payment i s not at l east 90 per cent of t he t ax t hat wi l l be due or 100

per cent of t he t ax r epor t ed as due f or t he pr evi ous cal endar year ( on t he r epor t due i n t he pr evi ous cal endar year f i l ed on or bef or e

May 14 of t he cur r ent year ) , t hen penal t y and i nt er est wi l l appl y t o any par t of t he 90 per cent not pai d by t he or i gi nal due dat e and

t o any par t of t he 10 per cent not pai d by t he ext ended due dat e.

EFT Fi l er s - Cor por at i ons t hat ar e r equi r ed t o pay t hei r annual f r anchi se t ax by El ect r oni c Funds Tr ansf er ( EFT) may r equest an

ext ensi on t o f i l e t hei r f r anchi se t ax r epor t t o August 15 by r emi t t i ng an ext ensi on payment t hat i s at l east 90 per cent of t he t ax t hat

wi l l be r epor t ed as due wi t h t hi s year ' s r epor t or 100 per cent of t he t ax r epor t ed as due f or t he pr evi ous cal endar year ( on t he r epor t

due i n t he pr evi ous cal endar year f i l ed on or bef or e May 14 of t he cur r ent year ) . The cor por at i on al so has t he opt i on t o r equest an

addi t i onal ext ensi on of t i me t o f i l e t he r epor t . To r equest t hi s second ext ensi on t hr ough November 15, t he ext ensi on must be

r equest ed on or bef or e August 15 and t he bal ance of t he amount of t ax t hat wi l l be r epor t ed as due on t he f r anchi se t ax r epor t f or

t he cur r ent year must be pai d on or bef or e August 15. The r epor t must t hen be f i l ed on or bef or e November 15. I f t he t ot al amount

pai d by August 15 i s at l east 99 per cent of t he t ax due, any penal t i es f or t he under payment wi l l be wai ved, pr ovi ded t he t ot al

amount due i s pai d by November 15. I f you wi l l not owe any t ax on t he r epor t , you do not have t o send a payment wi t h ei t her

ext ensi on r equest , but you MUST submi t t hi s r equest f or each ext ensi on t o be gr ant ed.

SPEC I FI C I N STR U C TI O N S:

I t em 5 - I f you answer " YES, " your r equest must be post mar ked on or bef or e t he or i gi nal due dat e of t he r epor t , or you wi l l not be

al l owed t o begi n t aki ng t he cr edi t t hi s year . I f you ar e r equest i ng t hi s ext ensi on f or an i ni t i al or f i nal r epor t per i od,

t empor ar y cr edi t pr ovi si ons do not appl y, and you shoul d answer " NO" t o t hi s quest i on.

For i nf or mat i on on f i l i ng a No Tax Due I nf or mat i on Repor t - Shor t For m or r equest i ng an ext ensi on t o f i l e a f r anchi se t ax r epor t , cal l

1- 800- 252- 1381 t ol l f r ee nat i onwi de. The Aust i n number i s 512/ 463- 4600. I f you' r e cal l i ng f r om a Tel ecommuni cat i ons Devi ce f or

t he Deaf ( TDD) , t he t ol l f r ee number i s 1- 800- 248- 4099, or i n Aust i n, 512/ 463- 4621.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1