Instructions For Form Pv-Pp-1a - Kansas Personal Property Assessment - 2006

ADVERTISEMENT

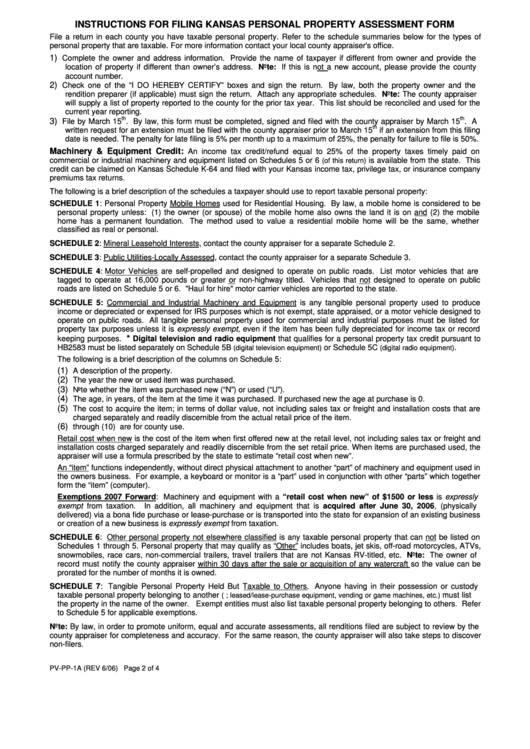

INSTRUCTIONS FOR FILING KANSAS PERSONAL PROPERTY ASSESSMENT FORM

File a return in each county you have taxable personal property. Refer to the schedule summaries below for the types of

personal property that are taxable. For more information contact your local county appraiser's office.

1)

Complete the owner and address information. Provide the name of taxpayer if different from owner and provide the

location of property if different than owner’s address. Note: If this is not a new account, please provide the county

account number.

2)

Check one of the “I DO HEREBY CERTIFY” boxes and sign the return. By law, both the property owner and the

rendition preparer (if applicable) must sign the return. Attach any appropriate schedules. Note: The county appraiser

will supply a list of property reported to the county for the prior tax year. This list should be reconciled and used for the

current year reporting.

th

th

3)

File by March 15

. By law, this form must be completed, signed and filed with the county appraiser by March 15

. A

th

written request for an extension must be filed with the county appraiser prior to March 15

if an extension from this filing

date is needed. The penalty for late filing is 5% per month up to a maximum of 25%, the penalty for failure to file is 50%.

Machinery & Equipment Credit:

An income tax credit/refund equal to 25% of the property taxes timely paid on

commercial or industrial machinery and equipment listed on Schedules 5 or 6

is available from the state. This

(of this return)

credit can be claimed on Kansas Schedule K-64 and filed with your Kansas income tax, privilege tax, or insurance company

premiums tax returns.

The following is a brief description of the schedules a taxpayer should use to report taxable personal property:

SCHEDULE 1: Personal Property Mobile Homes used for Residential Housing. By law, a mobile home is considered to be

personal property unless: (1) the owner (or spouse) of the mobile home also owns the land it is on and (2) the mobile

home has a permanent foundation. The method used to value a residential mobile home will be the same, whether

classified as real or personal.

SCHEDULE 2: Mineral Leasehold Interests, contact the county appraiser for a separate Schedule 2.

SCHEDULE 3: Public Utilities-Locally Assessed, contact the county appraiser for a separate Schedule 3.

SCHEDULE 4: Motor Vehicles are self-propelled and designed to operate on public roads. List motor vehicles that are

tagged to operate at 16,000 pounds or greater or non-highway titled. Vehicles that not designed to operate on public

roads are listed on Schedule 5 or 6. "Haul for hire" motor carrier vehicles are reported to the state.

SCHEDULE 5: Commercial and Industrial Machinery and Equipment is any tangible personal property used to produce

income or depreciated or expensed for IRS purposes which is not exempt, state appraised, or a motor vehicle designed to

operate on public roads. All tangible personal property used for commercial and industrial purposes must be listed for

property tax purposes unless it is expressly exempt, even if the item has been fully depreciated for income tax or record

*

keeping purposes.

Digital television and radio equipment that qualifies for a personal property tax credit pursuant to

HB2583 must be listed separately on Schedule 5B

or Schedule 5C

.

(digital television equipment)

(digital radio equipment)

The following is a brief description of the columns on Schedule 5:

(1)

A description of the property.

(2)

The year the new or used item was purchased.

(3)

Note whether the item was purchased new (“N”) or used (“U”).

(4)

The age, in years, of the item at the time it was purchased. If purchased new the age at purchase is 0.

(5)

The cost to acquire the item; in terms of dollar value, not including sales tax or freight and installation costs that are

charged separately and readily discernible from the actual retail price of the item.

(6)

through (10) are for county use.

Retail cost when new is the cost of the item when first offered new at the retail level, not including sales tax or freight and

installation costs charged separately and readily discernible from the set retail price. When items are purchased used, the

appraiser will use a formula prescribed by the state to estimate “retail cost when new”.

An “item” functions independently, without direct physical attachment to another “part” of machinery and equipment used in

the owners business. For example, a keyboard or monitor is a “part” used in conjunction with other “parts” which together

form the “item” (computer).

Exemptions 2007 Forward: Machinery and equipment with a “retail cost when new” of $1500 or less is expressly

exempt from taxation.

In addition, all machinery and equipment that is acquired after June 30, 2006, (physically

delivered) via a bona fide purchase or lease-purchase or is transported into the state for expansion of an existing business

or creation of a new business is expressly exempt from taxation.

SCHEDULE 6: Other personal property not elsewhere classified is any taxable personal property that can not be listed on

Schedules 1 through 5. Personal property that may qualify as “Other” includes boats, jet skis, off-road motorcycles, ATVs,

snowmobiles, race cars, non-commercial trailers, travel trailers that are not Kansas RV-titled, etc. Note: The owner of

record must notify the county appraiser within 30 days after the sale or acquisition of any watercraft so the value can be

prorated for the number of months it is owned.

SCHEDULE 7: Tangible Personal Property Held But Taxable to Others. Anyone having in their possession or custody

taxable personal property belonging to another

must list

(e.g.; leased/lease-purchase equipment, vending or game machines, etc.)

the property in the name of the owner. Exempt entities must also list taxable personal property belonging to others. Refer

to Schedule 5 for applicable exemptions.

Note: By law, in order to promote uniform, equal and accurate assessments, all renditions filed are subject to review by the

county appraiser for completeness and accuracy. For the same reason, the county appraiser will also take steps to discover

non-filers.

PV-PP-1A (REV 6/06)

Page 2 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1