rd

601 Tremont Street (23

) - Galveston, TX 77550 - (409) 797-5132

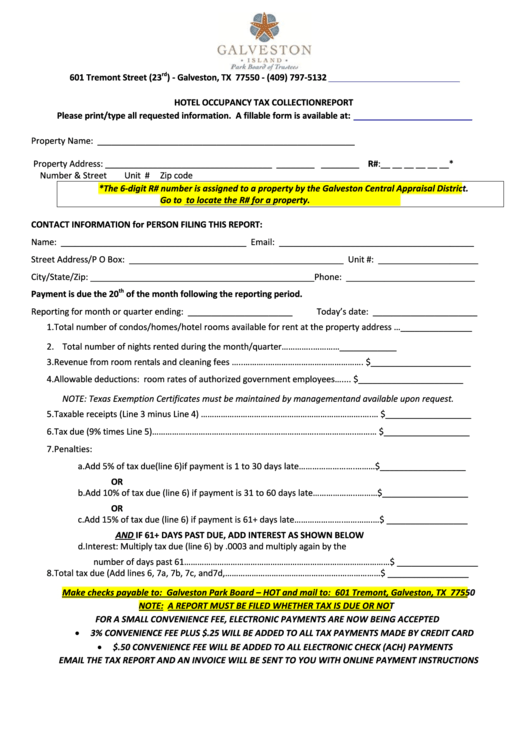

HOTEL OCCUPANCY TAX COLLECTION REPORT

Please print/type all requested information. A fillable form is available at:

Property Name: ______________________________________________________

Property Address: ___________________________________ ________ ________ R#:__ __ __ __ __ __*

Number & Street

Unit #

Zip code

*The 6-digit R# number is assigned to a property by the Galveston Central Appraisal District.

Go to

to locate the R# for a property.

CONTACT INFORMATION for PERSON FILING THIS REPORT:

Name: _______________________________________ Email: _________________________________________

Street Address/P O Box: _____________________________________________ Unit #: _____________________

City/State/Zip: _______________________________________________ Phone: ___________________________

th

Payment is due the 20

of the month following the reporting period.

Reporting for month or quarter ending: ______________________

Today’s date: ______________________

1. Total number of condos/homes/hotel rooms available for rent at the property address …_______________

2. Total number of nights rented during the month/quarter…………..…………..........................._______________

3. Revenue from room rentals and cleaning fees …..………..……………………………………. $_____________________

4. Allowable deductions: room rates of authorized government employees…........ $______________________

NOTE: Texas Exemption Certificates must be maintained by management and available upon request.

5. Taxable receipts (Line 3 minus Line 4) ……………………………………………………………….….… $__________________

6. Tax due (9% times Line 5)…………………………………….…………………………..……………..……… $__________________

7. Penalties:

a. Add 5% of tax due (line 6) if payment is 1 to 30 days late…………………….………$__________________

OR

b. Add 10% of tax due (line 6) if payment is 31 to 60 days late………………..………$__________________

OR

c. Add 15% of tax due (line 6) if payment is 61+ days late………………….………….…$ _________________

AND IF 61+ DAYS PAST DUE, ADD INTEREST AS SHOWN BELOW

d. Interest: Multiply tax due (line 6) by .0003 and multiply again by the

number of days past 61…………………………………………………………………………………$ _________________

8. Total tax due (Add lines 6, 7a, 7b, 7c, and 7d,…………………………………………….………………$ _________________

Make checks payable to: Galveston Park Board – HOT and mail to: 601 Tremont, Galveston, TX 77550

NOTE: A REPORT MUST BE FILED WHETHER TAX IS DUE OR NOT

FOR A SMALL CONVENIENCE FEE, ELECTRONIC PAYMENTS ARE NOW BEING ACCEPTED

•

3% CONVENIENCE FEE PLUS $.25 WILL BE ADDED TO ALL TAX PAYMENTS MADE BY CREDIT CARD

•

$.50 CONVENIENCE FEE WILL BE ADDED TO ALL ELECTRONIC CHECK (ACH) PAYMENTS

EMAIL THE TAX REPORT AND AN INVOICE WILL BE SENT TO YOU WITH ONLINE PAYMENT INSTRUCTIONS

1

1