Report Of Hotel Occupancy Tax - City Of Dripping Springs, Texas

ADVERTISEMENT

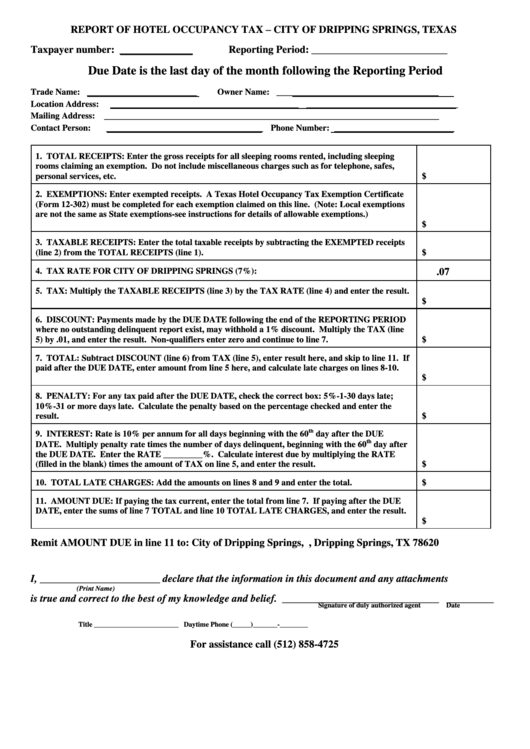

REPORT OF HOTEL OCCUPANCY TAX – CITY OF DRIPPING SPRINGS, TEXAS

Taxpayer number: ______________

Reporting Period: __________________________

Due Date is the last day of the month following the Reporting Period

_____________________

_______________________________

Trade Name:

Owner Name:

____________________________________ _____________________________

Location Address:

________________________________________________________________

Mailing Address:

______________________________

_______________________

Contact Person:

Phone Number:

1. TOTAL RECEIPTS: Enter the gross receipts for all sleeping rooms rented, including sleeping

rooms claiming an exemption. Do not include miscellaneous charges such as for telephone, safes,

personal services, etc.

$

2. EXEMPTIONS: Enter exempted receipts. A Texas Hotel Occupancy Tax Exemption Certificate

(Form 12-302) must be completed for each exemption claimed on this line. (Note: Local exemptions

are not the same as State exemptions-see instructions for details of allowable exemptions.)

$

3. TAXABLE RECEIPTS: Enter the total taxable receipts by subtracting the EXEMPTED receipts

(line 2) from the TOTAL RECEIPTS (line 1).

$

4. TAX RATE FOR CITY OF DRIPPING SPRINGS (7%):

.07

5. TAX: Multiply the TAXABLE RECEIPTS (line 3) by the TAX RATE (line 4) and enter the result.

$

6. DISCOUNT: Payments made by the DUE DATE following the end of the REPORTING PERIOD

where no outstanding delinquent report exist, may withhold a 1% discount. Multiply the TAX (line

5) by .01, and enter the result. Non-qualifiers enter zero and continue to line 7.

$

7. TOTAL: Subtract DISCOUNT (line 6) from TAX (line 5), enter result here, and skip to line 11. If

paid after the DUE DATE, enter amount from line 5 here, and calculate late charges on lines 8-10.

$

8. PENALTY: For any tax paid after the DUE DATE, check the correct box: 5%-1-30 days late;

10%-31 or more days late. Calculate the penalty based on the percentage checked and enter the

result.

$

th

9. INTEREST: Rate is 10% per annum for all days beginning with the 60

day after the DUE

th

DATE. Multiply penalty rate times the number of days delinquent, beginning with the 60

day after

the DUE DATE. Enter the RATE _________%. Calculate interest due by multiplying the RATE

(filled in the blank) times the amount of TAX on line 5, and enter the result.

$

10. TOTAL LATE CHARGES: Add the amounts on lines 8 and 9 and enter the total.

$

11. AMOUNT DUE: If paying the tax current, enter the total from line 7. If paying after the DUE

DATE, enter the sums of line 7 TOTAL and line 10 TOTAL LATE CHARGES, and enter the result.

$

Remit AMOUNT DUE in line 11 to: City of Dripping Springs, P.O. Box 384, Dripping Springs, TX 78620

I, _______________________ declare that the information in this document and any attachments

(Print Name)

is true and correct to the best of my knowledge and belief. ______________________________ _________

Signature of duly authorized agent

Date

Title ________________________ Daytime Phone (_____)_______-________

For assistance call (512) 858-4725

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1