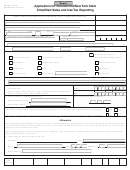

Form Dtf-820 - Certificate Of Nonresidency Of New York State And/or Local Taxing Jurisdiction - 2001 Page 2

ADVERTISEMENT

DTF-820 (3/01) (back)

Instructions

B.

The purchaser checks the exemption in box 1 and the seller

To the purchaser

does a courtesy registration for the purchaser at a New York

This form is to be used:

State DMV or County Clerk’s Office.

(1) by a non-resident to claim an exemption from both the state

C. The purchaser checks the exemption in box 2 and the seller

and local sales tax applicable to the purchase of motor vehicles,

has knowledge that the purchaser maintains a residence or a

trailers, and, on or after March 1, 2001, vessels provided that

place of abode in the local taxing jurisdiction where the sale

the conditions set forth in box 1 are satisfied, and the purchaser

occurs.

supplies the vendor with a properly completed copy of this

certificate prior to taking delivery; or

Invalid exemption certificates - Sales transactions which are not

supported by valid exemption certificates are deemed to be taxable

(2) by a resident to claim an exemption from the local sales tax

retail sales. The burden of proof that the tax was not required to be

imposed in the taxing jurisdiction where the sale takes place

collected is upon the seller.

applicable to the purchase of motor vehicles, trailers, and, on or

Retention of exemption certificates - You must keep this

after March 1, 2001, vessels provided that the conditions set

certificate for at least three years after the due date of the return

forth in box 2 are satisfied, and the purchaser supplies the

to which it relates, or the date the return was filed, if later. You must

vendor with a properly completed copy of this certificate prior to

also maintain a method of associating an invoice (or other source

taking deliver. (The seller must, however, collect sales tax at the

document) for an exempt sale made to a customer with the

combined state and local rate in effect in the taxing jurisdiction

exemption certificate you have on file from that customer.

where the purchaser is resident.)

Misuse of this certificate

Notice

Any person who issues a false or fraudulent exemption certificate

The above exemptions apply to purchases of motor vehicles

may be liable for penalties and interest in addition to the tax initially

and trailers. Effective March 1, 2001, these exemptions also

due. Some penalties that apply are:

apply to the purchase of vessels purchased on or after that

•

100% of the tax due

date. For the definition of vessel , and for more information on

this exemption, see TSB-M-01(4)S.

•

$50 for each fraudulent exemption certificate issued

a misdemeanor penalty (consisting of fines not to exceed

By checking box 1 the purchaser is claiming an exemption from

$10,000 for an individual or $20,000 for a corporation)

both the state and local sales taxes. If the purchaser is purchasing

•

revocation of your certificate of authority, if you are required to

a trailer or vessel, the seller must note Exempt: out-of-state

be registered as a vendor

purchaser on the bill of sale. If the purchaser is purchasing a

motor vehicle, the seller must provide the purchaser with a MV-50.

Need help?

The seller must write the phrase Exempt: out-of-state purchaser

on the MV-50, as explained in TSB- M-95(2)S.

Telephone assistance is available from 8:30 a.m. to 4:25 p.m. (eastern

time), Monday through Friday.

By checking box 2 the purchaser is claiming an exemption from the

Tax information: 1 800 972-1233

local tax imposed by the taxing jurisdiction where the sale takes

Forms and publications: 1 800 462-8100

place. In this case, the seller must collect sales tax based on the

From outside the U.S. and outside Canada: (518) 485-6800

Fax-on-demand forms: 1 800 748-3676

combined state and local tax rate in effect where the purchaser is

Internet access:

resident. If the purchaser is an individual, this means that the

Hearing and speech impaired (telecommunications device for the

applicable rate is the combined state and local rate in effect in the

deaf (TDD) callers only): 1 800 634-2110 (8:30 a.m. to 4:25 p.m.,

taxing jurisdiction where the purchaser has a residence or

eastern time)

permanent place of abode; if the purchaser is a business, this

means that the applicable rate is the combined state and local rate

Persons with disabilities: In compliance with the Americans with

in effect in the taxing jurisdiction where the property will be

Disabilities Act, we will ensure that our lobbies, offices, meeting rooms,

principally used or garaged.

and other facilities are accessible to persons with disabilities. If you have

questions about special accommodations for persons with disabilities,

To the seller

please call 1 800 225-5829.

If you are a registered New York State vendor and you accept this

If you need to write, address your letter to: NYS Tax Department,

exemption certificate in good faith from the purchaser prior to the

Taxpayer Assistance Bureau, W A Harriman Campus, Albany NY 12227.

purchaser taking delivery of the property, you will be protected from

sales tax liability for the transaction if the certificate is complete (all

Privacy notification

required entries are made). A certificate is accepted in good faith

The Commissioner of Taxation and Finance may collect and maintain personal

when a seller, exercising reasonable and ordinary due care, has no

information pursuant to the New York State Tax Law, including but not limited to,

knowledge that the exemption certificate is false or is fraudulently

sections 171, 171-a, 287, 308, 429, 475, 505, 697, 1096, 1142, and 1415 of that

presented.

Law; and may require disclosure of social security numbers pursuant to

42 USC 405(c)(2)(C)(i).

On audit, the Tax Department will accept this form as proof that the

This information will be used to determine and administer tax liabilities and, when

transaction was not subject to the tax(es) in question, as long as

authorized by law, for certain tax offset and exchange of tax information

the information that is entered on the form by the purchaser is not

programs as well as for any other lawful purpose.

contradicted by the preprinted statements already contained on the

Information concerning quarterly wages paid to employees is provided to certain

form, and as long as the seller has no actual knowledge that the

state agencies for purposes of fraud prevention, support enforcement, evaluation

information supplied or statements attested to by the purchaser are

of the effectiveness of certain employment and training programs and other

false or fraudulent.

purposes authorized by law.

Failure to provide the required information may subject you to civil or criminal

This certificate will not be deemed to be accepted in good faith

penalties, or both, under the Tax Law.

where, for example:

This information is maintained by the Director of the Registration and Data

A.

The purchaser checks the exemption in box 1 and then gives a

Services Bureau, NYS Tax Department, Building 8, Room 338, W A Harriman

New York State address in any of the address boxes

Campus, Albany NY 12227; telephone 1 800 225-5829. From areas outside the

United States and Canada, call (518) 485-6800.

appearing on the form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2