Application For Extension Of Time To File Muskegon Income Tax Return

ADVERTISEMENT

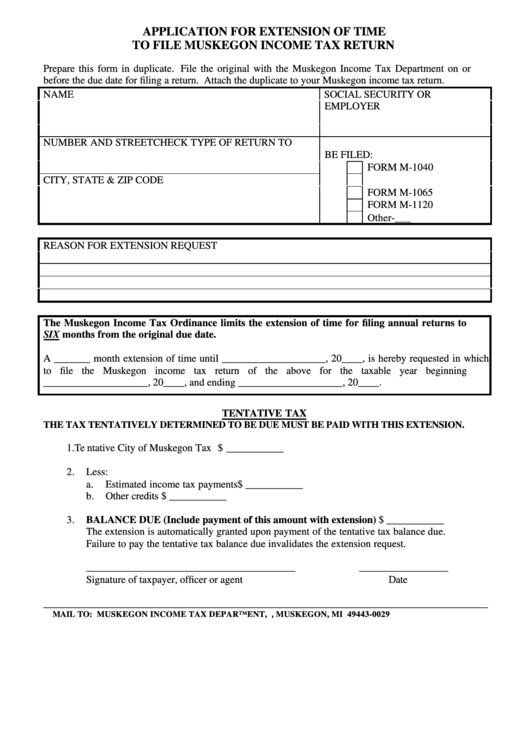

APPLICATION FOR EXTENSION OF TIME

TO FILE MUSKEGON INCOME TAX RETURN

Prepare this form in duplicate. File the original with the Muskegon Income Tax Department on or

before the due date for filing a return. Attach the duplicate to your Muskegon income tax return.

NAME

SOCIAL SECURITY OR

EMPLOYER I.D. NUMBER

NUMBER AND STREET

CHECK TYPE OF RETURN TO

BE FILED:

FORM M-1040

CITY, STATE & ZIP CODE

FORM M-1040EZ

FORM M-1065

FORM M-1120

Other-___

REASON FOR EXTENSION REQUEST

The Muskegon Income Tax Ordinance limits the extension of time for filing annual returns to

SIX months from the original due date.

A _______ month extension of time until ____________________, 20____, is hereby requested in which

to file the Muskegon income tax return of the above for the taxable year beginning

____________________, 20____, and ending ____________________, 20____.

TENTATIVE TAX

THE TAX TENTATIVELY DETERMINED TO BE DUE MUST BE PAID WITH THIS EXTENSION.

1.

Te ntative City of Muskegon Tax .......................................................... $ ___________

2.

Less:

a.

Estimated income tax payments ..................................................... $ ___________

b.

Other credits .................................................................................. $ ___________

3.

BALANCE DUE (Include payment of this amount with extension) $ ___________

The extension is automatically granted upon payment of the tentative tax balance due.

Failure to pay the tentative tax balance due invalidates the extension request.

________________________________________

_________________

Signature of taxpayer, officer or agent

Date

_____________________________________________________________________________________

MAIL TO : MUSKEGON INCOME TAX DEPARTMENT, P.O. BOX 29, MUSKEGON, MI 49443-0029

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1