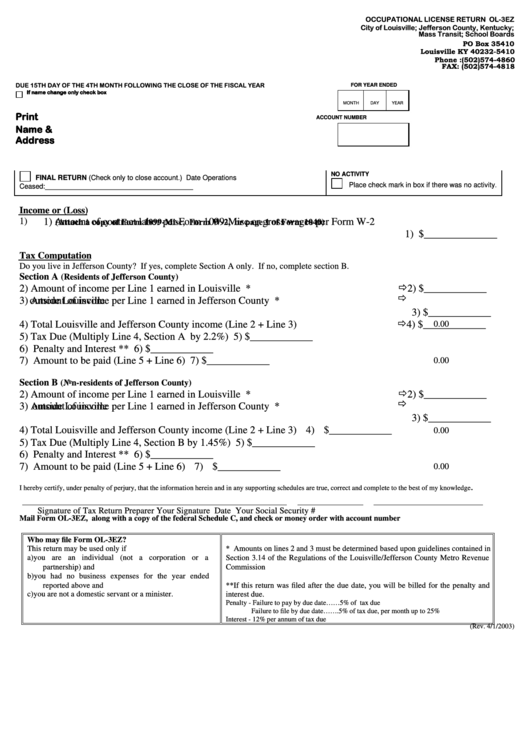

OCCUPATIONAL LICENSE RETURN OL-3EZ

City of Louisville; Jefferson County, Kentucky;

Mass Transit; School Boards

PO Box 35410

Louisville KY 40232-5410

Phone :(502)574-4860

FAX: (502)574-4818

DUE 15TH DAY OF THE 4TH MONTH FOLLOWING THE CLOSE OF THE FISCAL YEAR

FOR YEAR ENDED

If name change only check box

MONTH

DAY

YEAR

Print

ACCOUNT NUMBER

Name &

Address

NO ACTIVITY

FINAL RETURN (Check only to close account.) Date Operations

Place check mark in box if there was no activity

.

Ceased:______________________________________

Income or (Loss)

1)

1) Amount of contract labor per Form 1099-Misc or gross wages per Form W-2

(Attach a copy of Form 1099-Misc, Form W-2, or page 1 of Form 1040)

1) $______________

Tax Computation

Do you live in Jefferson County? If yes, complete Section A only. If no, complete section B.

Section A

(Residents of Jefferson County)

2) Amount of income per Line 1 earned in Louisville *

2) $____________

3) Amount of income per Line 1 earned in Jefferson County *

outside Louisville

3) $____________

4) Total Louisville and Jefferson County income (Line 2 + Line 3)

4) $____________

0.00

5) Tax Due (Multiply Line 4, Section A by 2.2%)

5) $____________

6) Penalty and Interest **

6) $____________

7) Amount to be paid (Line 5 + Line 6)

7) $____________

0.00

Section B

(Non-residents of Jefferson County)

2) Amount of income per Line 1 earned in Louisville *

2) $____________

3) Amount of income per Line 1 earned in Jefferson County *

outside Louisville

3) $____________

4) Total Louisville and Jefferson County income (Line 2 + Line 3)

4) $____________

0.00

5) Tax Due (Multiply Line 4, Section B by 1.45%)

5) $____________

6) Penalty and Interest **

6) $____________

7) Amount to be paid (Line 5 + Line 6)

7) $____________

0.00

.

I hereby certify, under penalty of perjury, that the information herein and in any supporting schedules are true, correct and complete to the best of my knowledge

Signature of Tax Return Preparer

Your Signature

Date

Your Social Security #

Mail Form OL-3EZ, along with a copy of the federal Schedule C, and check or money order with account number

Who may file Form OL-3EZ?

This return may be used only if

* Amounts on lines 2 and 3 must be determined based upon guidelines contained in

a)

you are an individual (not a corporation or a

Section 3.14 of the Regulations of the Louisville/Jefferson County Metro Revenue

partnership) and

Commission

b)

you had no business expenses for the year ended

reported above and

**If this return was filed after the due date, you will be billed for the penalty and

c)

you are not a domestic servant or a minister.

interest due.

Penalty - Failure to pay by due date……5% of tax due

Failure to file by due date…….5% of tax due, per month up to 25%

Interest - 12% per annum of tax due

(Rev. 4/1/2003)

1

1