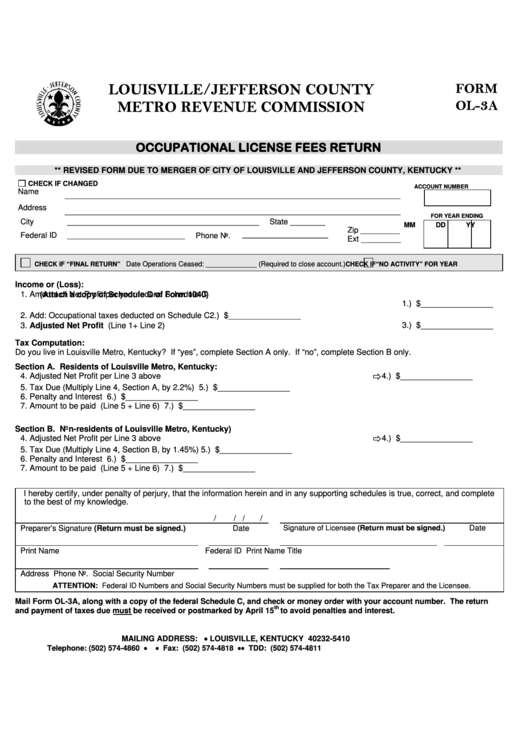

FORM

LOUISVILLE/JEFFERSON COUNTY

3

OL-

A

METRO REVENUE COMMISSION

OCCUPATIONAL LICENSE FEES RETURN

** REVISED FORM DUE TO MERGER OF CITY OF LOUISVILLE AND JEFFERSON COUNTY, KENTUCKY **

CHECK IF CHANGED

ACCOUNT NUMBER

Name

_____________________________________________________________________________

Address

_____________________________________________________________________________

FOR YEAR ENDING

MM

DD

YY

City

____________________________________________

Zip _________

State ________

Federal ID

___________________________

Phone No.

Ext __

______________________

________

Date Operations Ceased: _____________ (Required to close account.)

CHECK IF “FINAL RETURN”

CHECK IF “NO ACTIVITY” FOR YEAR

Income or (Loss):

1.

Amount of Net Profit per your federal Schedule C

(Attach a copy of Schedule C of Form 1040)

1.) $________________

2.

Add: Occupational taxes deducted on Schedule C

2.) $________________

3.

3.) $________________

Adjusted Net Profit (Line 1+ Line 2)

Tax Computation:

Do you live in Louisville Metro, Kentucky? If “yes”, complete Section A only. If “no”, complete Section B only.

Section A. Residents of Louisville Metro, Kentucky:

4.

Adjusted Net Profit per Line 3 above

4.) $________________

5.

Tax Due (Multiply Line 4, Section A, by 2.2%)

5.) $________________

6.

Penalty and Interest

6.) $________________

7.

Amount to be paid (Line 5 + Line 6)

7.) $________________

Section B. Non-residents of Louisville Metro, Kentucky)

4.

Adjusted Net Profit per Line 3 above

4.) $________________

5.

Tax Due (Multiply Line 4, Section B, by 1.45%)

5.) $________________

6.

Penalty and Interest

6.) $________________

7.

Amount to be paid (Line 5 + Line 6)

7.) $________________

I hereby certify, under penalty of perjury, that the information herein and in any supporting schedules is true, correct, and complete

to the best of my knowledge.

/

/

/

/

Date

Date

Preparer’s Signature (Return must be signed.)

Signature of Licensee (Return must be signed.)

Print Name

Federal ID

Print Name

Title

Address

Phone No.

Social Security Number

ATTENTION: Federal ID Numbers and Social Security Numbers must be supplied for both the Tax Preparer and the Licensee.

Mail Form OL-3A, along with a copy of the federal Schedule C, and check or money order with your account number. The return

th

and payment of taxes due must be received or postmarked by April 15

to avoid penalties and interest.

MAILING ADDRESS: P.O. BOX 35410 • LOUISVILLE, KENTUCKY 40232-5410

Telephone: (502) 574-4860 •

• Fax: (502) 574-4818 • • TDD: (502) 574-4811

1

1