2006 Instructions For The Wisconsin Fiduciary Return Form 2 And Schedules Cc, Wd, And 2k-1

ADVERTISEMENT

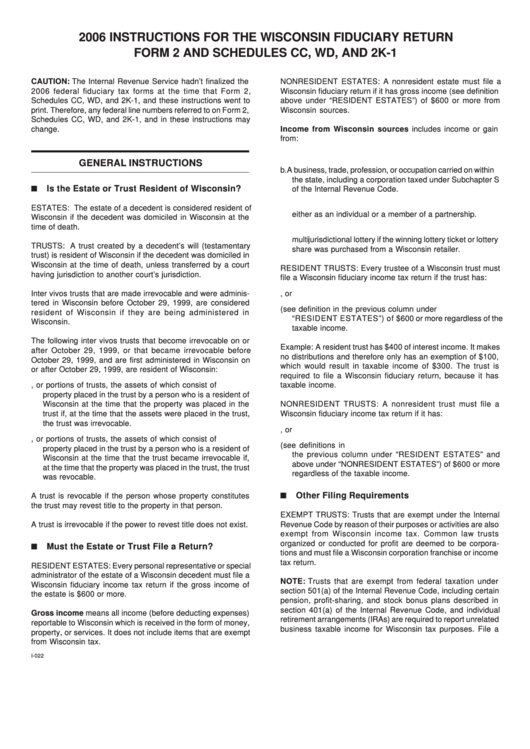

2006 INSTRUCTIONS FOR THE WISCONSIN FIDUCIARY RETURN

FORM 2 AND SCHEDULES CC, WD, AND 2K-1

CAUTION: The Internal Revenue Service hadn’t finalized the

NONRESIDENT ESTATES: A nonresident estate must file a

2006 federal fiduciary tax forms at the time that Form 2,

Wisconsin fiduciary return if it has gross income (see definition

Schedules CC, WD, and 2K-1, and these instructions went to

above under “RESIDENT ESTATES”) of $600 or more from

print. Therefore, any federal line numbers referred to on Form 2,

Wisconsin sources.

Schedules CC, WD, and 2K-1, and in these instructions may

change.

Income from Wisconsin sources includes income or gain

from:

a. Real or tangible personal property located within the state.

GENERAL INSTRUCTIONS

b. A business, trade, profession, or occupation carried on within

the state, including a corporation taxed under Subchapter S

Is the Estate or Trust Resident of Wisconsin?

of the Internal Revenue Code.

c. Personal or professional services performed within the state

ESTATES: The estate of a decedent is considered resident of

either as an individual or a member of a partnership.

Wisconsin if the decedent was domiciled in Wisconsin at the

time of death.

d. Income received from the Wisconsin state lottery or a

multijurisdictional lottery if the winning lottery ticket or lottery

TRUSTS: A trust created by a decedent’s will (testamentary

share was purchased from a Wisconsin retailer.

trust) is resident of Wisconsin if the decedent was domiciled in

Wisconsin at the time of death, unless transferred by a court

RESIDENT TRUSTS: Every trustee of a Wisconsin trust must

having jurisdiction to another court’s jurisdiction.

file a Wisconsin fiduciary income tax return if the trust has:

Inter vivos trusts that are made irrevocable and were adminis-

1. any taxable income for the tax year, or

tered in Wisconsin before October 29, 1999, are considered

2. gross income (see definition in the previous column under

resident of Wisconsin if they are being administered in

“RESIDENT ESTATES”) of $600 or more regardless of the

Wisconsin.

taxable income.

The following inter vivos trusts that become irrevocable on or

Example: A resident trust has $400 of interest income. It makes

after October 29, 1999, or that became irrevocable before

no distributions and therefore only has an exemption of $100,

October 29, 1999, and are first administered in Wisconsin on

which would result in taxable income of $300. The trust is

or after October 29, 1999, are resident of Wisconsin:

required to file a Wisconsin fiduciary return, because it has

1. Trusts, or portions of trusts, the assets of which consist of

taxable income.

property placed in the trust by a person who is a resident of

Wisconsin at the time that the property was placed in the

NONRESIDENT TRUSTS: A nonresident trust must file a

trust if, at the time that the assets were placed in the trust,

Wisconsin fiduciary income tax return if it has:

the trust was irrevocable.

1. any Wisconsin taxable income for the year, or

2. Trusts, or portions of trusts, the assets of which consist of

2. gross income from Wisconsin sources (see definitions in

property placed in the trust by a person who is a resident of

the previous column under “RESIDENT ESTATES” and

Wisconsin at the time that the trust became irrevocable if,

above under “NONRESIDENT ESTATES”) of $600 or more

at the time that the property was placed in the trust, the trust

regardless of the taxable income.

was revocable.

Other Filing Requirements

A trust is revocable if the person whose property constitutes

the trust may revest title to the property in that person.

EXEMPT TRUSTS: Trusts that are exempt under the Internal

A trust is irrevocable if the power to revest title does not exist.

Revenue Code by reason of their purposes or activities are also

exempt from Wisconsin income tax. Common law trusts

organized or conducted for profit are deemed to be corpora-

Must the Estate or Trust File a Return?

tions and must file a Wisconsin corporation franchise or income

tax return.

RESIDENT ESTATES: Every personal representative or special

administrator of the estate of a Wisconsin decedent must file a

NOTE: Trusts that are exempt from federal taxation under

Wisconsin fiduciary income tax return if the gross income of

section 501(a) of the Internal Revenue Code, including certain

the estate is $600 or more.

pension, profit-sharing, and stock bonus plans described in

section 401(a) of the Internal Revenue Code, and individual

Gross income means all income (before deducting expenses)

retirement arrangements (IRAs) are required to report unrelated

reportable to Wisconsin which is received in the form of money,

business taxable income for Wisconsin tax purposes. File a

property, or services. It does not include items that are exempt

from Wisconsin tax.

I-022

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18