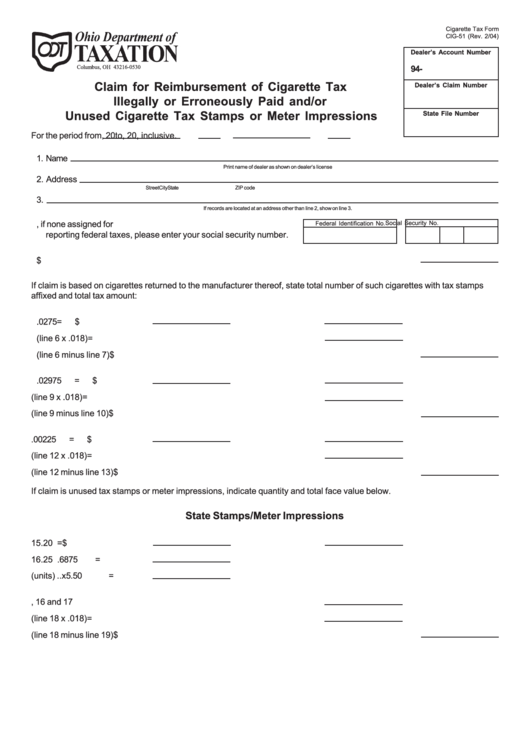

Form Cig-51 - Claim For Reimbursement Of Cigarette Tax Illegally Or Erroneously Paid And/or Unused Cigarette Tax Stamps Or Meter Impressions

ADVERTISEMENT

Cigarette Tax Form

CIG-51 (Rev. 2/04)

Dealer’s Account Number

94-

P.O. Box 530

Columbus, OH 43216-0530

Claim for Reimbursement of Cigarette Tax

Dealer’s Claim Number

Illegally or Erroneously Paid and/or

Unused Cigarette Tax Stamps or Meter Impressions

State File Number

For the period from

, 20

to

, 20

, inclusive.

1. Name

Print name of dealer as shown on dealer’s license

2. Address

Street

City

State

ZIP code

3.

If records are located at an address other than line 2, show on line 3.

4. Federal employer identification number or, if none assigned for

Federal Identification No.

Social Security No.

reporting federal taxes, please enter your social security number.

5. By an illegal or erroneous payment or assessment ........................................................................ $

If claim is based on cigarettes returned to the manufacturer thereof, state total number of such cigarettes with tax stamps

affixed and total tax amount:

6. State only stamped ...........

x

.0275

=

$

7. Less dealers discount (line 6 x .018)

=

8. Net amount (line 6 minus line 7)

$

9. Combined stamped ...........

x

.02975

=

$

10. Less dealers discount (line 9 x .018)

=

11. Net amount (line 9 minus line 10)

$

12. County only stamped ........

x

.00225

=

$

13. Less dealers discount (line 12 x .018)

=

14. Net amount (line 12 minus line 13)

$

If claim is unused tax stamps or meter impressions, indicate quantity and total face value below.

State Stamps/Meter Impressions

15. 20 stamps .........................

x

.55

=

$

16. 25 stamps .........................

x

.6875

=

17. Meter impressions (units) ..

x

5.50

=

18. Total of lines 15, 16 and 17

19. Less dealers discount (line 18 x .018)

=

20. Net amount (line 18 minus line 19)

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2