Form Dtf-804 - Claim For Credit Of Sales Tax Paid To Another State - New York State Department Of Taxation And Finance

ADVERTISEMENT

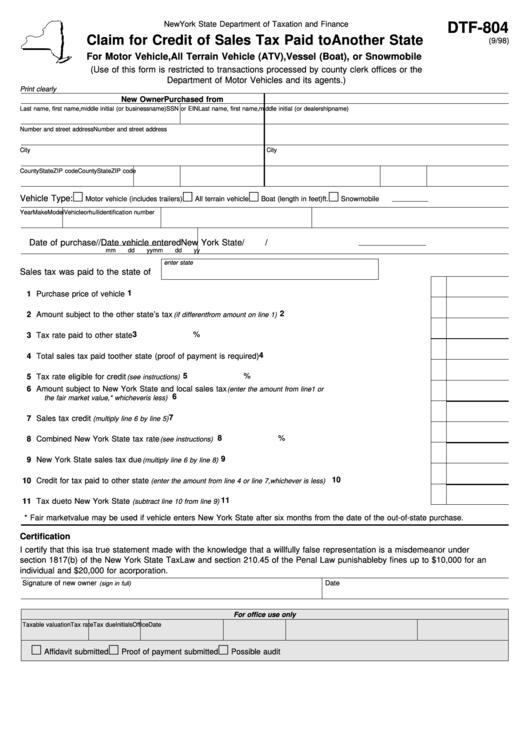

New York State Department of Taxation and Finance

DTF-804

Claim for Credit of Sales Tax Paid to Another State

(9/98)

For Motor Vehicle, All Terrain Vehicle (ATV), Vessel (Boat), or Snowmobile

(Use of this form is restricted to transactions processed by county clerk offices or the

Department of Motor Vehicles and its agents.)

Print clearly

New Owner

Purchased from

Last name, first name, middle initial (or business name)

SSN or EIN

Last name, first name, middle initial (or dealership name)

Number and street address

Number and street address

City

City

County

State

ZIP code

County

State

ZIP code

□

□

□

□

Vehicle Type:

Motor vehicle (includes trailers)

All terrain vehicle

Boat (length in feet)

ft.

Snowmobile

Year

Make

Model

Vehicle or hull identification number

Date of purchase

/

/

Date vehicle entered New York State

/

/

mm

dd

yy

mm

dd

yy

enter state

Sales tax was paid to the state of

1

1 Purchase price of vehicle . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2 Amount subject to the other state’s tax

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(if different from amount on line 1)

3

%

3 Tax rate paid to other state . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4 Total sales tax paid to other state (proof of payment is required) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

%

5 Tax rate eligible for credit

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(see instructions)

6 Amount subject to New York State and local sales tax

(enter the amount from line 1 or

6

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

the fair market value,* whichever is less)

7

7 Sales tax credit

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(multiply line 6 by line 5)

8

%

8 Combined New York State tax rate

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(see instructions)

9

9 New York State sales tax due

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(multiply line 6 by line 8)

10

10 Credit for tax paid to other state

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

(enter the amount from line 4 or line 7, whichever is less)

11

11 Tax due to New York State

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(subtract line 10 from line 9)

* Fair market value may be used if vehicle enters New York State after six months from the date of the out-of-state purchase.

Certification

I certify that this is a true statement made with the knowledge that a willfully false representation is a misdemeanor under

section 1817(b) of the New York State Tax Law and section 210.45 of the Penal Law punishable by fines up to $10,000 for an

individual and $20,000 for a corporation.

Signature of new owner

Date

(sign in full)

For office use only

Taxable valuation

Tax rate

Tax due

Initials

Office

Date

□

□

□

Affidavit submitted

Proof of payment submitted

Possible audit

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1