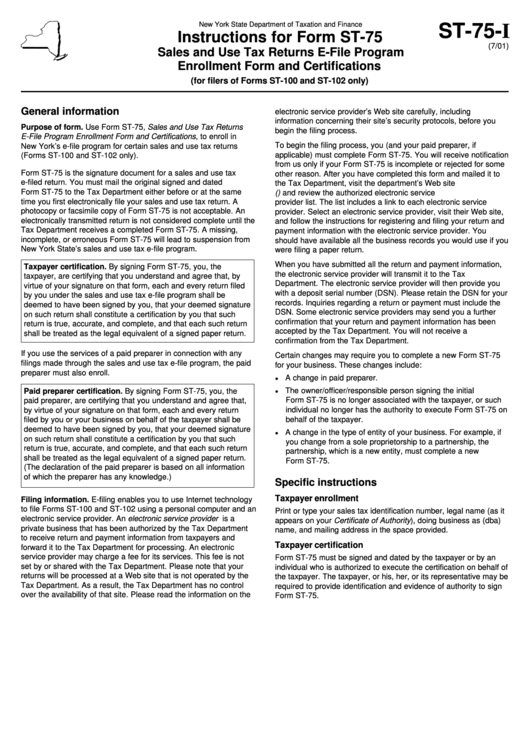

Instructions For Form St-75 Sales And Use Tax Returns E-File Program Enrollment Form And Certifications - Department Of Taxation And Finance

ADVERTISEMENT

New York State Department of Taxation and Finance

ST-75-I

Instructions for Form ST-75

(7/01)

Sales and Use Tax Returns E-File Program

Enrollment Form and Certifications

(for filers of Forms ST-100 and ST-102 only)

General information

electronic service provider’s Web site carefully, including

information concerning their site’s security protocols, before you

Purpose of form. Use Form ST-75, Sales and Use Tax Returns

begin the filing process.

E-File Program Enrollment Form and Certifications, to enroll in

To begin the filing process, you (and your paid preparer, if

New York’s e-file program for certain sales and use tax returns

applicable) must complete Form ST-75. You will receive notification

(Forms ST-100 and ST-102 only).

from us only if your Form ST-75 is incomplete or rejected for some

Form ST-75 is the signature document for a sales and use tax

other reason. After you have completed this form and mailed it to

e-filed return. You must mail the original signed and dated

the Tax Department, visit the department’s Web site

Form ST-75 to the Tax Department either before or at the same

( ) and review the authorized electronic service

time you first electronically file your sales and use tax return. A

provider list. The list includes a link to each electronic service

photocopy or facsimile copy of Form ST-75 is not acceptable. An

provider. Select an electronic service provider, visit their Web site,

electronically transmitted return is not considered complete until the

and follow the instructions for registering and filing your return and

Tax Department receives a completed Form ST-75. A missing,

payment information with the electronic service provider. You

incomplete, or erroneous Form ST-75 will lead to suspension from

should have available all the business records you would use if you

New York State’s sales and use tax e-file program.

were filing a paper return.

When you have submitted all the return and payment information,

Taxpayer certification. By signing Form ST-75, you, the

the electronic service provider will transmit it to the Tax

taxpayer, are certifying that you understand and agree that, by

Department. The electronic service provider will then provide you

virtue of your signature on that form, each and every return filed

with a deposit serial number (DSN). Please retain the DSN for your

by you under the sales and use tax e-file program shall be

records. Inquiries regarding a return or payment must include the

deemed to have been signed by you, that your deemed signature

DSN. Some electronic service providers may send you a further

on such return shall constitute a certification by you that such

confirmation that your return and payment information has been

return is true, accurate, and complete, and that each such return

accepted by the Tax Department. You will not receive a

shall be treated as the legal equivalent of a signed paper return.

confirmation from the Tax Department.

If you use the services of a paid preparer in connection with any

Certain changes may require you to complete a new Form ST-75

filings made through the sales and use tax e-file program, the paid

for your business. These changes include:

preparer must also enroll.

A change in paid preparer.

•

The owner/officer/responsible person signing the initial

Paid preparer certification. By signing Form ST-75, you, the

•

Form ST-75 is no longer associated with the taxpayer, or such

paid preparer, are certifying that you understand and agree that,

by virtue of your signature on that form, each and every return

individual no longer has the authority to execute Form ST-75 on

behalf of the taxpayer.

filed by you or your business on behalf of the taxpayer shall be

deemed to have been signed by you, that your deemed signature

•

A change in the type of entity of your business. For example, if

on such return shall constitute a certification by you that such

you change from a sole proprietorship to a partnership, the

return is true, accurate, and complete, and that each such return

partnership, which is a new entity, must complete a new

shall be treated as the legal equivalent of a signed paper return.

Form ST-75.

(The declaration of the paid preparer is based on all information

of which the preparer has any knowledge.)

Specific instructions

Taxpayer enrollment

Filing information. E-filing enables you to use Internet technology

to file Forms ST-100 and ST-102 using a personal computer and an

Print or type your sales tax identification number, legal name (as it

electronic service provider. An electronic service provider is a

appears on your Certificate of Authority), doing business as (dba)

private business that has been authorized by the Tax Department

name, and mailing address in the space provided.

to receive return and payment information from taxpayers and

Taxpayer certification

forward it to the Tax Department for processing. An electronic

service provider may charge a fee for its services. This fee is not

Form ST-75 must be signed and dated by the taxpayer or by an

set by or shared with the Tax Department. Please note that your

individual who is authorized to execute the certification on behalf of

returns will be processed at a Web site that is not operated by the

the taxpayer. The taxpayer, or his, her, or its representative may be

Tax Department. As a result, the Tax Department has no control

required to provide identification and evidence of authority to sign

over the availability of that site. Please read the information on the

Form ST-75.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2