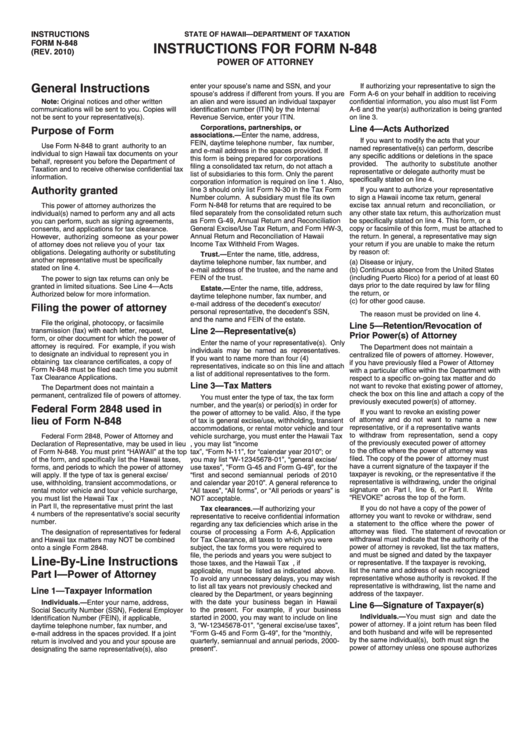

Instructions For Form N-848 - Department Of Taxation State Of Hawaii

ADVERTISEMENT

INSTRUCTIONS

STATE OF HAWAII—DEPARTMENT OF TAXATION

FORM N-848

INSTRUCTIONS FOR FORM N-848

(REV. 2010)

POWER OF ATTORNEY

General Instructions

enter your spouse’s name and SSN, and your

If authorizing your representative to sign the

spouse’s address if different from yours. If you are

Form A-6 on your behalf in addition to receiving

Note: Original notices and other written

an alien and were issued an individual taxpayer

confidential information, you also must list Form

identification number (ITIN) by the Internal

A-6 and the year(s) authorization is being granted

communications will be sent to you. Copies will

not be sent to your representative(s).

Revenue Service, enter your ITIN.

on line 3.

Corporations,

partnerships,

or

Line 4—Acts Authorized

Purpose of Form

associations.—Enter

the

name,

address,

If you want to modify the acts that your

FEIN, daytime telephone number, fax number,

Use Form N-848 to grant authority to an

named representative(s) can perform, describe

and e-mail address in the spaces provided. If

individual to sign Hawaii tax documents on your

any specific additions or deletions in the space

this form is being prepared for corporations

behalf, represent you before the Department of

provided. The authority to substitute another

filing a consolidated tax return, do not attach a

Taxation and to receive otherwise confidential tax

representative or delegate authority must be

list of subsidiaries to this form. Only the parent

information.

specifically stated on line 4.

corporation information is required on line 1. Also,

Authority granted

line 3 should only list Form N-30 in the Tax Form

If you want to authorize your representative

Number column. A subsidiary must file its own

to sign a Hawaii income tax return, general

Form N-848 for returns that are required to be

excise tax annual return and reconciliation, or

This power of attorney authorizes the

filed separately from the consolidated return such

any other state tax return, this authorization must

individual(s) named to perform any and all acts

as Form G-49, Annual Return and Reconciliation

be specifically stated on line 4. This form, or a

you can perform, such as signing agreements,

General Excise/Use Tax Return, and Form HW-3,

copy or facsimile of this form, must be attached to

consents, and applications for tax clearance.

Annual Return and Reconciliation of Hawaii

the return. In general, a representative may sign

However, authorizing someone as your power

Income Tax Withheld From Wages.

your return if you are unable to make the return

of attorney does not relieve you of your tax

by reason of:

obligations. Delegating authority or substituting

Trust.—Enter the name, title, address,

another representative must be specifically

daytime telephone number, fax number, and

(a) Disease or injury,

stated on line 4.

e-mail address of the trustee, and the name and

(b) Continuous absence from the United States

FEIN of the trust.

(including Puerto Rico) for a period of at least 60

The power to sign tax returns can only be

days prior to the date required by law for filing

granted in limited situations. See Line 4—Acts

Estate.—Enter the name, title, address,

the return, or

Authorized below for more information.

daytime telephone number, fax number, and

(c) for other good cause.

Filing the power of attorney

e-mail address of the decedent’s executor/

personal representative, the decedent’s SSN,

The reason must be provided on line 4.

and the name and FEIN of the estate.

File the original, photocopy, or facsimile

Line 5—Retention/Revocation of

Line 2—Representative(s)

transmission (fax) with each letter, request,

Prior Power(s) of Attorney

form, or other document for which the power of

Enter the name of your representative(s). Only

attorney is required. For example, if you wish

The Department does not maintain a

individuals may be named as representatives.

to designate an individual to represent you in

centralized file of powers of attorney. However,

If you want to name more than four (4)

obtaining tax clearance certificates, a copy of

if you have previously filed a Power of Attorney

representatives, indicate so on this line and attach

Form N-848 must be filed each time you submit

with a particular office within the Department with

a list of additional representatives to the form.

Tax Clearance Applications.

respect to a specific on-going tax matter and do

Line 3—Tax Matters

not want to revoke that existing power of attorney,

The Department does not maintain a

check the box on this line and attach a copy of the

permanent, centralized file of powers of attorney.

You must enter the type of tax, the tax form

previously executed power(s) of attorney.

number, and the year(s) or period(s) in order for

Federal Form 2848 used in

If you want to revoke an existing power

the power of attorney to be valid. Also, if the type

lieu of Form N-848

of attorney and do not want to name a new

of tax is general excise/use, withholding, transient

representative, or if a representative wants

accommodations, or rental motor vehicle and tour

to withdraw from representation, send a copy

vehicle surcharge, you must enter the Hawaii Tax

Federal Form 2848, Power of Attorney and

of the previously executed power of attorney

Declaration of Representative, may be used in lieu

I.D. Number. For example, you may list “income

to the office where the power of attorney was

tax”, “Form N-11”, for “calendar year 2010”; or

of Form N-848. You must print “HAWAII” at the top

filed. The copy of the power of attorney must

of the form, and specifically list the Hawaii taxes,

you may list “W-12345678-01”, “general excise/

have a current signature of the taxpayer if the

use taxes”, “Form G-45 and Form G-49”, for the

forms, and periods to which the power of attorney

taxpayer is revoking, or the representative if the

will apply. If the type of tax is general excise/

“first and second semiannual periods of 2010

representative is withdrawing, under the original

and calendar year 2010”. A general reference to

use, withholding, transient accommodations, or

signature on Part I, line 6, or Part II. Write

rental motor vehicle and tour vehicle surcharge,

“All taxes”, “All forms”, or “All periods or years” is

“REVOKE” across the top of the form.

NOT acceptable.

you must list the Hawaii Tax I.D. Number. Also,

in Part II, the representative must print the last

Tax

clearances.—If

If you do not have a copy of the power of

authorizing

your

4 numbers of the representative’s social security

attorney you want to revoke or withdraw, send

representative to receive confidential information

number.

a statement to the office where the power of

regarding any tax deficiencies which arise in the

attorney was filed. The statement of revocation or

The designation of representatives for federal

course of processing a Form A-6, Application

withdrawal must indicate that the authority of the

for Tax Clearance, all taxes to which you were

and Hawaii tax matters may NOT be combined

power of attorney is revoked, list the tax matters,

onto a single Form 2848.

subject, the tax forms you were required to

and must be signed and dated by the taxpayer

file, the periods and years you were subject to

Line-By-Line Instructions

or representative. If the taxpayer is revoking,

those taxes, and the Hawaii Tax I.D. Number, if

list the name and address of each recognized

Part I—Power of Attorney

applicable, must be listed as indicated above.

representative whose authority is revoked. If the

To avoid any unnecessary delays, you may wish

representative is withdrawing, list the name and

to list all tax years not previously checked and

Line 1—Taxpayer Information

address of the taxpayer.

cleared by the Department, or years beginning

Individuals.—Enter your name, address,

with the date your business began in Hawaii

Line 6—Signature of Taxpayer(s)

to the present. For example, if your business

Social Security Number (SSN), Federal Employer

Individuals.—You must sign and date the

started in 2000, you may want to include on line

Identification Number (FEIN), if applicable,

power of attorney. If a joint return has been filed

3, “W-12345678-01”, “general excise/use taxes”,

daytime telephone number, fax number, and

and both husband and wife will be represented

“Form G-45 and Form G-49”, for the “monthly,

e-mail address in the spaces provided. If a joint

by the same individual(s), both must sign the

quarterly, semiannual and annual periods, 2000-

return is involved and you and your spouse are

power of attorney unless one spouse authorizes

designating the same representative(s), also

present”.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2