Instructions For Form N-323 - Department Of Taxation State Of Hawaii

ADVERTISEMENT

Clear Form

INSTRUCTIONS

STATE OF HAWAII

__

DEPARTMENT OF TAXATION

FORM N-323

INSTRUCTIONS FOR FORM N-323

(REV. 2012)

CARRYOVER OF TAX CREDITS

GENERAL INSTRUCTIONS

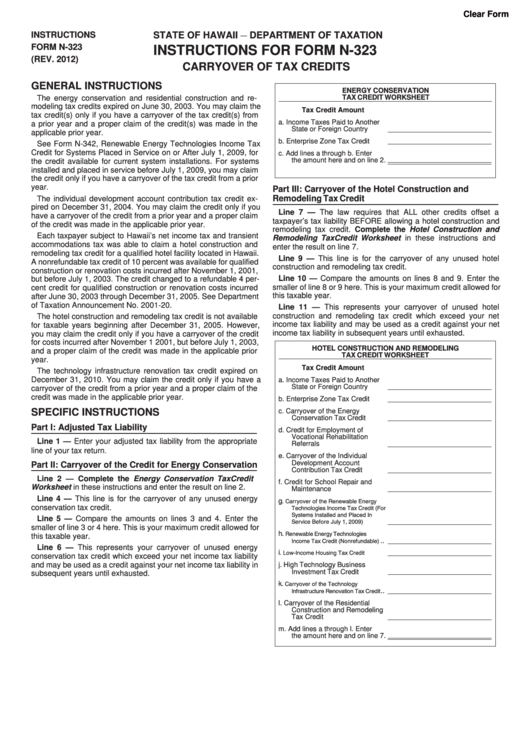

ENERGY CONSERVATION

The energy conservation and residential construction and re-

TAX CREDIT WORKSHEET

modeling tax credits expired on June 30, 2003. You may claim the

Tax Credit

Amount

tax credit(s) only if you have a carryover of the tax credit(s) from

a. Income Taxes Paid to Another

a prior year and a proper claim of the credit(s) was made in the

State or Foreign Country .......

applicable prior year.

b.

Enterprise Zone Tax Credit ....

See Form N-342, Renewable Energy Technologies Income Tax

Credit for Systems Placed in Service on or After July 1, 2009, for

c.

Add lines a through b. Enter

the amount here and on line 2.

the credit available for current system installations. For systems

installed and placed in service before July 1, 2009, you may claim

the credit only if you have a carryover of the tax credit from a prior

year.

Part III: Carryover of the Hotel Construction and

Remodeling Tax Credit

The individual development account contribution tax credit ex-

pired on December 31, 2004. You may claim the credit only if you

Line 7 — The law requires that ALL other credits offset a

have a carryover of the credit from a prior year and a proper claim

taxpayer’s tax liability BEFORE allowing a hotel construction and

of the credit was made in the applicable prior year.

remodeling tax credit. Complete the Hotel Construction and

Each taxpayer subject to Hawaii’s net income tax and transient

Remodeling Tax Credit Worksheet in these instructions and

accommodations tax was able to claim a hotel construction and

enter the result on line 7.

remodeling tax credit for a qualified hotel facility located in Hawaii.

Line 9 — This line is for the carryover of any unused hotel

A nonrefundable tax credit of 10 percent was available for qualified

construction and remodeling tax credit.

construction or renovation costs incurred after November 1, 2001,

Line 10 — Compare the amounts on lines 8 and 9. Enter the

but before July 1, 2003. The credit changed to a refundable 4 per-

smaller of line 8 or 9 here. This is your maximum credit allowed for

cent credit for qualified construction or renovation costs incurred

this taxable year.

after June 30, 2003 through December 31, 2005. See Department

of Taxation Announcement No. 2001-20.

Line 11 — This represents your carryover of unused hotel

construction and remodeling tax credit which exceed your net

The hotel construction and remodeling tax credit is not available

income tax liability and may be used as a credit against your net

for taxable years beginning after December 31, 2005. However,

income tax liability in subsequent years until exhausted.

you may claim the credit only if you have a carryover of the credit

for costs incurred after November 1 2001, but before July 1, 2003,

HOTEL CONSTRUCTION AND REMODELING

and a proper claim of the credit was made in the applicable prior

TAX CREDIT WORKSHEET

year.

Tax Credit

Amount

The technology infrastructure renovation tax credit expired on

December 31, 2010. You may claim the credit only if you have a

a. Income Taxes Paid to Another

State or Foreign Country .......

carryover of the credit from a prior year and a proper claim of the

credit was made in the applicable prior year.

b.

Enterprise Zone Tax Credit ....

SPECIFIC INSTRUCTIONS

c.

Carryover of the Energy

Conservation Tax Credit .........

Part I: Adjusted Tax Liability

d. Credit for Employment of

Vocational Rehabilitation

Line 1 — Enter your adjusted tax liability from the appropriate

Referrals ................................

line of your tax return.

e.

Carryover of the Individual

Development Account

Part II: Carryover of the Credit for Energy Conservation

Contribution Tax Credit ..........

Line 2 — Complete the Energy Conservation Tax Credit

f.

Credit for School Repair and

Worksheet in these instructions and enter the result on line 2.

Maintenance ..........................

Line 4 — This line is for the carryover of any unused energy

g. Carryover of the Renewable Energy

Technologies Income Tax Credit (For

conservation tax credit.

Systems Installed and Placed In

Line 5 — Compare the amounts on lines 3 and 4. Enter the

Service Before July 1, 2009) ..........

smaller of line 3 or 4 here. This is your maximum credit allowed for

h. Renewable Energy Technologies

this taxable year.

Income Tax Credit (Nonrefundable) ..

Line 6 — This represents your carryover of unused energy

Low-Income Housing Tax Credit .....

i.

conservation tax credit which exceed your net income tax liability

and may be used as a credit against your net income tax liability in

j.

High Technology Business

Investment Tax Credit ............

subsequent years until exhausted.

Carryover of the Technology

k.

Infrastructure Renovation Tax Credit ..

l.

Carryover of the Residential

Construction and Remodeling

Tax Credit ...............................

m. Add lines a through l. Enter

the amount here and on line 7.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3