Reconciliation Of Employee Earnings And Loveland Tax Withheld Form

ADVERTISEMENT

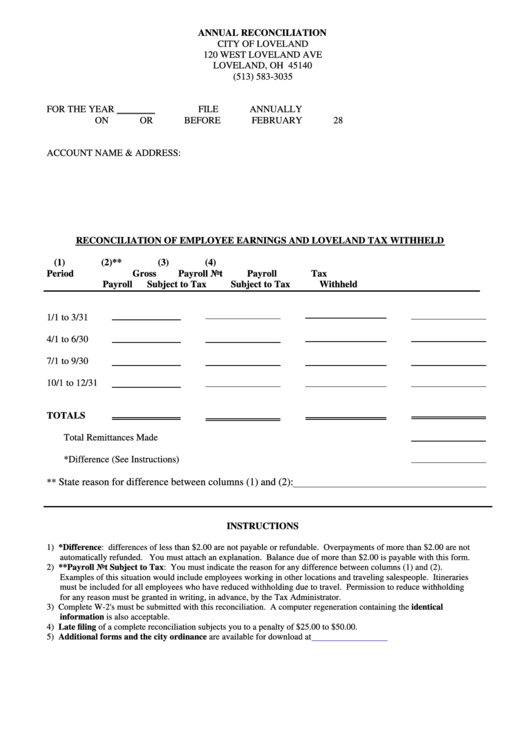

ANNUAL RECONCILIATION

CITY OF LOVELAND

120 WEST LOVELAND AVE

LOVELAND, OH 45140

(513) 583-3035

FOR THE YEAR ________

FILE ANNUALLY

ON OR BEFORE FEBRUARY 28

ACCOUNT NAME & ADDRESS:

RECONCILIATION OF EMPLOYEE EARNINGS AND LOVELAND TAX WITHHELD

(1)

(2)**

(3)

(4)

Period

Gross

Payroll Not

Payroll

Tax

Payroll

Subject to Tax

Subject to Tax

Withheld

1/1 to 3/31

4/1 to 6/30

7/1 to 9/30

10/1 to 12/31

TOTALS

Total Remittances Made

*Difference (See Instructions)

State reason for difference between columns (1) and (2):

**

INSTRUCTIONS

1) *Difference: differences of less than $2.00 are not payable or refundable. Overpayments of more than $2.00 are not

automatically refunded. You must attach an explanation. Balance due of more than $2.00 is payable with this form.

2) **Payroll Not Subject to Tax: You must indicate the reason for any difference between columns (1) and (2).

Examples of this situation would include employees working in other locations and traveling salespeople. Itineraries

must be included for all employees who have reduced withholding due to travel. Permission to reduce withholding

for any reason must be granted in writing, in advance, by the Tax Administrator.

3) Complete W-2's must be submitted with this reconciliation. A computer regeneration containing the identical

information is also acceptable.

4) Late filing of a complete reconciliation subjects you to a penalty of $25.00 to $50.00.

5) Additional forms and the city ordinance are available for download at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1