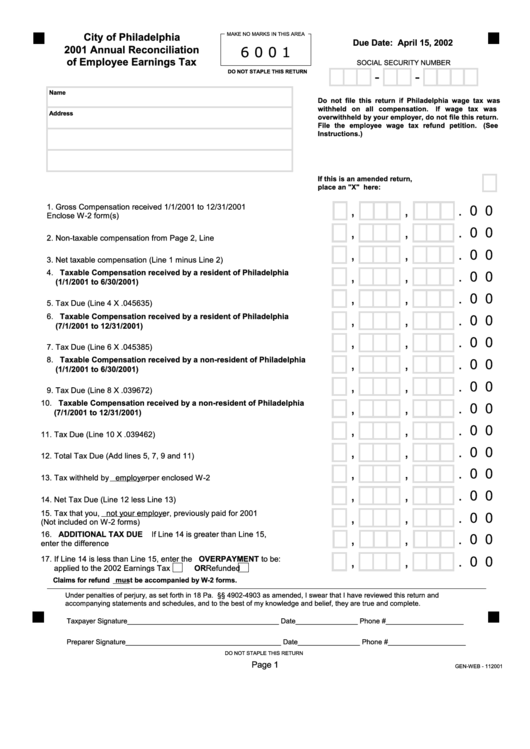

2001 Annual Reconciliation Of Employee Earnings Tax - City Of Philadelphia

ADVERTISEMENT

MAKE NO MARKS IN THIS AREA

City of Philadelphia

Due Date: April 15, 2002

6 0 0 1

2001 Annual Reconciliation

of Employee Earnings Tax

SOCIAL SECURITY NUMBER

DO NOT STAPLE THIS RETURN

-

-

Name

Do not file this return if Philadelphia wage tax was

withheld on all compensation.

If wage tax was

Address

overwithheld by your employer, do not file this return.

File the employee wage tax refund petition.

(See

Instructions.)

If this is an amended return,

place an "X" here:.................................................

1. Gross Compensation received 1/1/2001 to 12/31/2001

,

,

. 0 0

Enclose W-2 form(s).........................................................................................1.

,

,

. 0 0

2. Non-taxable compensation from Page 2, Line 3................................................2.

,

,

. 0 0

3. Net taxable compensation (Line 1 minus Line 2)...............................................3.

4. Taxable Compensation received by a resident of Philadelphia

,

,

. 0 0

(1/1/2001 to 6/30/2001).....................................................................................4.

,

,

. 0 0

5. Tax Due (Line 4 X .045635)...............................................................................5.

6. Taxable Compensation received by a resident of Philadelphia

,

,

. 0 0

(7/1/2001 to 12/31/2001)...................................................................................6.

,

,

. 0 0

7. Tax Due (Line 6 X .045385)...............................................................................7.

8. Taxable Compensation received by a non-resident of Philadelphia

,

,

. 0 0

(1/1/2001 to 6/30/2001).....................................................................................8.

,

,

. 0 0

9. Tax Due (Line 8 X .039672)...............................................................................9.

10. Taxable Compensation received by a non-resident of Philadelphia

,

,

. 0 0

(7/1/2001 to 12/31/2001)..................................................................................10.

,

,

. 0 0

11. Tax Due (Line 10 X .039462)............................................................................11.

,

,

. 0 0

12. Total Tax Due (Add lines 5, 7, 9 and 11)..........................................................12.

,

,

. 0 0

13. Tax withheld by employer per enclosed W-2 forms..........................................13.

,

,

. 0 0

14. Net Tax Due (Line 12 less Line 13)..................................................................14.

15. Tax that you, not your employer, previously paid for 2001

,

,

. 0 0

(Not included on W-2 forms).............................................................................15.

16. ADDITIONAL TAX DUE If Line 14 is greater than Line 15,

,

,

. 0 0

enter the difference here...................................................................................16.

,

,

. 0 0

17. If Line 14 is less than Line 15, enter the OVERPAYMENT to be:

applied to the 2002 Earnings Tax

OR Refunded

..............................17.

Claims for refund must be accompanied by W-2 forms.

Under penalties of perjury, as set forth in 18 Pa. C.S. §§ 4902-4903 as amended, I swear that I have reviewed this return and

accompanying statements and schedules, and to the best of my knowledge and belief, they are true and complete.

Taxpayer Signature_______________________________________ Date________________ Phone #____________________

Preparer Signature________________________________________ Date________________ Phone #____________________

DO NOT STAPLE THIS RETURN

Page 1

GEN-WEB - 112001

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1