Print

Clear

Print Blank Form

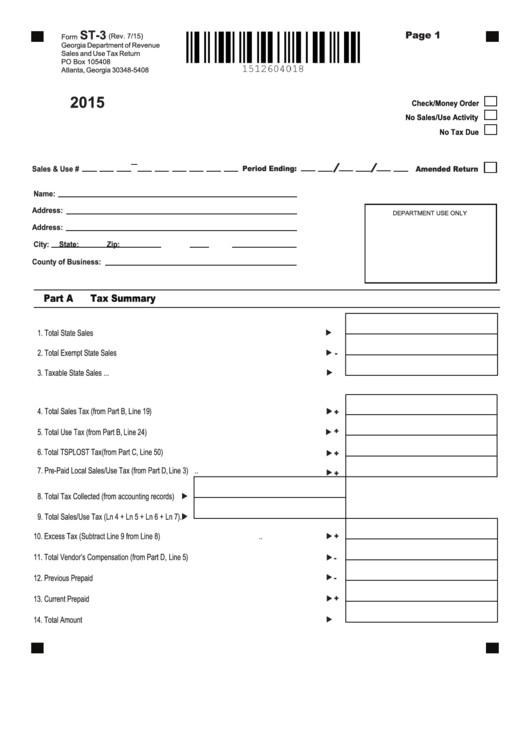

ST-3

Page 1

(Rev. 7/15)

Form

Georgia Department of Revenue

Sales and Use Tax Return

PO Box 105408

Atlanta, Georgia 30348-5408

2015

Check/Money Order

No Sales/Use Activity

No Tax Due

-

/

/

Period Ending:

Sales & Use #

Amended Return

Name:

Address:

DEPARTMENT USE ONLY

Address:

City:

State:

Zip:

County of Business:

Part A Tax Summary

1. Total State Sales ..................................................................................................................................

2. Total Exempt State Sales ............................................................................................

..................................

-

3. Taxable State Sales .. . ......................................................................................... . .................................

4. Total Sales Tax (from Part B, Line 19)..................................................................................................

+

+

5. Total Use Tax (from Part B, Line 24)

...................................... ..............................................................

6. Total TSPLOST Tax (from Part C, Line 50)..........................................................................................

+

7. Pre-Paid Local Sales/Use Tax (from Part D,Line 3).............................................................................

+

8. Total Tax Collected (from accounting records).....

9. Total Sales / Use Tax ( Ln 4 + Ln 5 + Ln 6 + Ln 7).

10. Excess Tax ( Subtract Line 9 from Line 8) ............................................................................................

. .

+

11. Total Vendor’s Compensation (from Part D, Line 5).............................................................................

-

12. Previous Prepaid Amount......................................................................................................................

-

13. Current Prepaid Amount........................................................................................................................

+

14. Total Amount Due..................................................................................................................................

1

1 2

2 3

3 4

4 5

5