Form St-3 - Sales And Use Tax Return (St-3) Instructions - 2013

ADVERTISEMENT

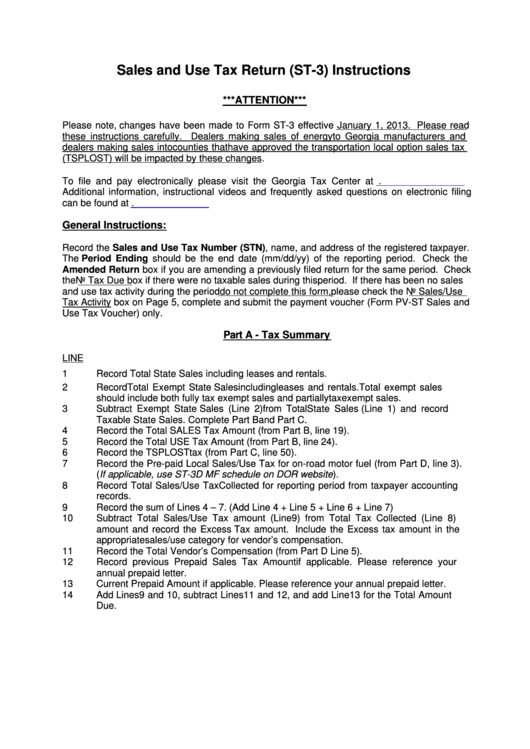

Sales and Use Tax Return (ST-3) Instructions

***ATTENTION***

Please note, changes have been made to Form ST-3 effective January 1, 2013. Please read

these instructions carefully. Dealers making sales of energy to Georgia manufacturers and

dealers making sales into counties that have approved the transportation local option sales tax

(TSPLOST) will be impacted by these changes.

To file and pay electronically please visit the Georgia Tax Center at https://gtc.dor.ga.gov.

Additional information, instructional videos and frequently asked questions on electronic filing

can be found at

General Instructions:

Record the Sales and Use Tax Number (STN), name, and address of the registered taxpayer.

The Period Ending should be the end date (mm/dd/yy) of the reporting period. Check the

Amended Return box if you are amending a previously filed return for the same period. Check

the No Tax Due box if there were no taxable sales during this period. If there has been no sales

and use tax activity during the period do not complete this form, please check the No Sales/Use

Tax Activity box on Page 5, complete and submit the payment voucher (Form PV-ST Sales and

Use Tax Voucher) only.

Part A - Tax Summary

LINE

1

Record Total State Sales including leases and rentals.

2

Record Total Exempt State Sales including leases and rentals. Total exempt sales

should include both fully tax exempt sales and partially tax exempt sales.

3

Subtract Exempt State Sales (Line 2) from Total State Sales (Line 1) and record

Taxable State Sales. Complete Part B and Part C.

4

Record the Total SALES Tax Amount (from Part B, line 19).

5

Record the Total USE Tax Amount (from Part B, line 24).

6

Record the TSPLOST tax (from Part C, line 50).

7

Record the Pre-paid Local Sales/Use Tax for on-road motor fuel (from Part D, line 3).

(If applicable, use ST-3D MF schedule on DOR website).

8

Record Total Sales/Use Tax Collected for reporting period from taxpayer accounting

records.

9

Record the sum of Lines 4 – 7. (Add Line 4 + Line 5 + Line 6 + Line 7)

10

Subtract Total Sales/Use Tax amount (Line 9) from Total Tax Collected (Line 8)

amount and record the Excess Tax amount. Include the Excess tax amount in the

appropriate sales/use category for vendor’s compensation.

11

Record the Total Vendor’s Compensation (from Part D Line 5).

12

Record previous Prepaid Sales Tax Amount if applicable. Please reference your

annual prepaid letter.

13

Current Prepaid Amount if applicable. Please reference your annual prepaid letter.

14

Add Lines 9 and 10, subtract Lines 11 and 12, and add Line 13 for the Total Amount

Due.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11