Print

Clear

Print Blank Form

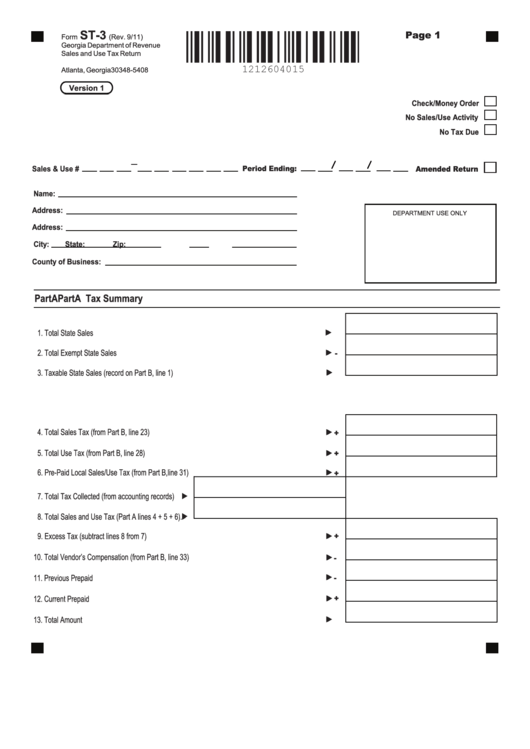

ST-3

Page 1

Form

(Rev. 9/11)

Georgia Department of Revenue

Sales and Use Tax Return

P.O. Box 105408

Atlanta, Georgia 30348-5408

Version 1

Check/Money Order

No Sales/Use Activity

No Tax Due

-

/

/

Period Ending:

Sales & Use #

Amended Return

Name:

Address:

DEPARTMENT USE ONLY

Address:

City:

State:

Zip:

County of Business:

Part A

Part A Tax Summary

1. Total State Sales ..................................................................................................................................

2. Total Exempt State Sales ............................................................................................

..................................

-

3. Taxable State Sales (record on Part B, line 1) .....................................................................................

.

4. Total Sales Tax (from Part B, line 23)....................................................................................................

+

5. Total Use Tax (from Part B, line 28)......................................................................................................

+

6. Pre-Paid Local Sales/Use Tax (from Part B,line 31)..............................................................................

+

7. Total Tax Collected (from accounting records).....

8. Total Sales and Use Tax (Part A lines 4 + 5 + 6).

9. Excess Tax (subtract lines 8 from 7).....................................................................................................

+

10. Total Vendor’s Compensation (from Part B, line 33)..............................................................................

-

11. Previous Prepaid Amount......................................................................................................................

-

12. Current Prepaid Amount........................................................................................................................

+

13. Total Amount Due..................................................................................................................................

1

1 2

2 3

3 4

4