Instruction For Form 120x - Amended Corporation Income Tax Return - 2006

ADVERTISEMENT

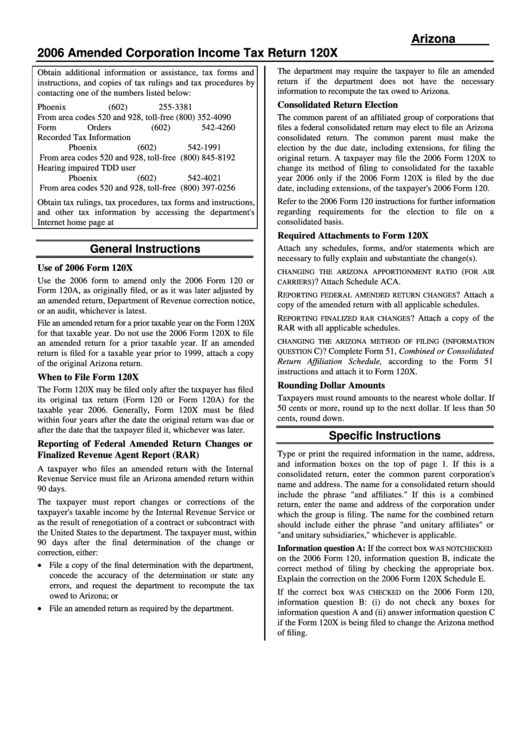

Arizona Form

2006 Amended Corporation Income Tax Return

120X

The department may require the taxpayer to file an amended

Obtain additional information or assistance, tax forms and

return if the department does not have the necessary

instructions, and copies of tax rulings and tax procedures by

information to recompute the tax owed to Arizona.

contacting one of the numbers listed below:

Consolidated Return Election

Phoenix

(602) 255-3381

From area codes 520 and 928, toll-free

(800) 352-4090

The common parent of an affiliated group of corporations that

Form Orders

(602) 542-4260

files a federal consolidated return may elect to file an Arizona

Recorded Tax Information

consolidated return. The common parent must make the

Phoenix

(602) 542-1991

election by the due date, including extensions, for filing the

From area codes 520 and 928, toll-free

(800) 845-8192

original return. A taxpayer may file the 2006 Form 120X to

Hearing impaired TDD user

change its method of filing to consolidated for the taxable

Phoenix

(602) 542-4021

year 2006 only if the 2006 Form 120X is filed by the due

From area codes 520 and 928, toll-free

(800) 397-0256

date, including extensions, of the taxpayer's 2006 Form 120.

Refer to the 2006 Form 120 instructions for further information

Obtain tax rulings, tax procedures, tax forms and instructions,

regarding requirements for the election to file on a

and other tax information by accessing the department's

consolidated basis.

Internet home page at

Required Attachments to Form 120X

General Instructions

Attach any schedules, forms, and/or statements which are

necessary to fully explain and substantiate the change(s).

Use of 2006 Form 120X

(

CHANGING THE ARIZONA APPORTIONMENT RATIO

FOR AIR

Use the 2006 form to amend only the 2006 Form 120 or

)? Attach Schedule ACA.

CARRIERS

Form 120A, as originally filed, or as it was later adjusted by

R

? Attach a

EPORTING FEDERAL AMENDED RETURN CHANGES

an amended return, Department of Revenue correction notice,

copy of the amended return with all applicable schedules.

or an audit, whichever is latest.

R

? Attach a copy of the

EPORTING FINALIZED RAR CHANGES

File an amended return for a prior taxable year on the Form 120X

RAR with all applicable schedules.

for that taxable year. Do not use the 2006 Form 120X to file

(

CHANGING THE ARIZONA METHOD OF FILING

INFORMATION

an amended return for a prior taxable year. If an amended

C)? Complete Form 51, Combined or Consolidated

QUESTION

return is filed for a taxable year prior to 1999, attach a copy

Return Affiliation Schedule, according to the Form 51

of the original Arizona return.

instructions and attach it to Form 120X.

When to File Form 120X

Rounding Dollar Amounts

The Form 120X may be filed only after the taxpayer has filed

Taxpayers must round amounts to the nearest whole dollar. If

its original tax return (Form 120 or Form 120A) for the

50 cents or more, round up to the next dollar. If less than 50

taxable year 2006. Generally, Form 120X must be filed

cents, round down.

within four years after the date the original return was due or

after the date that the taxpayer filed it, whichever was later.

Specific Instructions

Reporting of Federal Amended Return Changes or

Type or print the required information in the name, address,

Finalized Revenue Agent Report (RAR)

and information boxes on the top of page 1. If this is a

A taxpayer who files an amended return with the Internal

consolidated return, enter the common parent corporation's

Revenue Service must file an Arizona amended return within

name and address. The name for a consolidated return should

90 days.

include the phrase "and affiliates." If this is a combined

The taxpayer must report changes or corrections of the

return, enter the name and address of the corporation under

taxpayer's taxable income by the Internal Revenue Service or

which the group is filing. The name for the combined return

as the result of renegotiation of a contract or subcontract with

should include either the phrase "and unitary affiliates" or

the United States to the department. The taxpayer must, within

"and unitary subsidiaries," whichever is applicable.

90 days after the final determination of the change or

Information question A: If the correct box

WAS NOT CHECKED

correction, either:

on the 2006 Form 120, information question B, indicate the

• File a copy of the final determination with the department,

correct method of filing by checking the appropriate box.

concede the accuracy of the determination or state any

Explain the correction on the 2006 Form 120X Schedule E.

errors, and request the department to recompute the tax

If the correct box

on the 2006 Form 120,

WAS CHECKED

owed to Arizona; or

information question B: (i) do not check any boxes for

• File an amended return as required by the department.

information question A and (ii) answer information question C

if the Form 120X is being filed to change the Arizona method

of filing.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5