Reset Form

Print Form

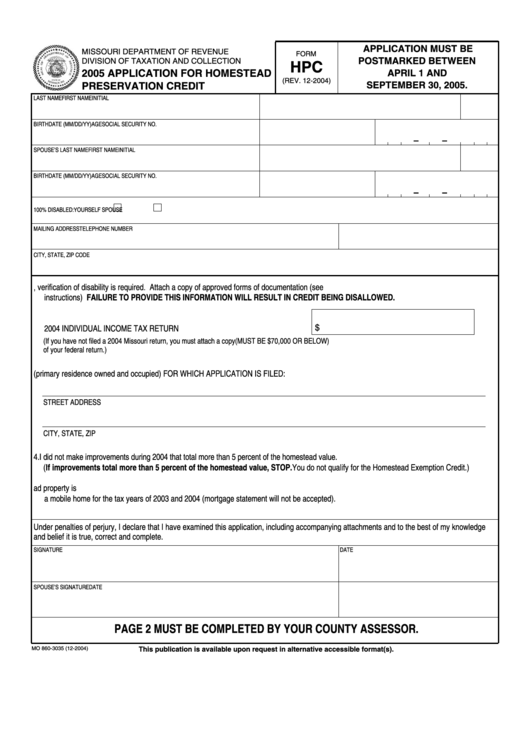

APPLICATION MUST BE

MISSOURI DEPARTMENT OF REVENUE

FORM

POSTMARKED BETWEEN

DIVISION OF TAXATION AND COLLECTION

HPC

2005 APPLICATION FOR HOMESTEAD

APRIL 1 AND

(REV. 12-2004)

SEPTEMBER 30, 2005.

PRESERVATION CREDIT

LAST NAME

FIRST NAME

INITIAL

BIRTHDATE (MM/DD/YY)

AGE

SOCIAL SECURITY NO.

–

–

SPOUSE’S LAST NAME

FIRST NAME

INITIAL

BIRTHDATE (MM/DD/YY)

AGE

SOCIAL SECURITY NO.

–

–

100% DISABLED:

YOURSELF

SPOUSE

MAILING ADDRESS

TELEPHONE NUMBER

CITY, STATE, ZIP CODE

1. If claiming credit eligibility due to being disabled, verification of disability is required. Attach a copy of approved forms of documentation (see

instructions) FAILURE TO PROVIDE THIS INFORMATION WILL RESULT IN CREDIT BEING DISALLOWED.

2. FEDERAL ADJUSTED GROSS INCOME AS SHOWN ON YOUR

$

2004 INDIVIDUAL INCOME TAX RETURN

(If you have not filed a 2004 Missouri return, you must attach a copy

(MUST BE $70,000 OR BELOW)

of your federal return.)

3. ADDRESS OF HOMESTEAD PROPERTY (primary residence owned and occupied) FOR WHICH APPLICATION IS FILED:

STREET ADDRESS

CITY, STATE, ZIP

4. I did not make improvements during 2004 that total more than 5 percent of the homestead value.

(If improvements total more than 5 percent of the homestead value, STOP. You do not qualify for the Homestead Exemption Credit.)

5. Attach copies of PAID real estate property tax receipts for 2003 and 2004 and/or PAID personal property tax receipts if homestead property is

a mobile home for the tax years of 2003 and 2004 (mortgage statement will not be accepted).

Under penalties of perjury, I declare that I have examined this application, including accompanying attachments and to the best of my knowledge

and belief it is true, correct and complete.

SIGNATURE

DATE

SPOUSE’S SIGNATURE

DATE

PAGE 2 MUST BE COMPLETED BY YOUR COUNTY ASSESSOR.

MO 860-3035 (12-2004)

This publication is available upon request in alternative accessible format(s).

1

1 2

2