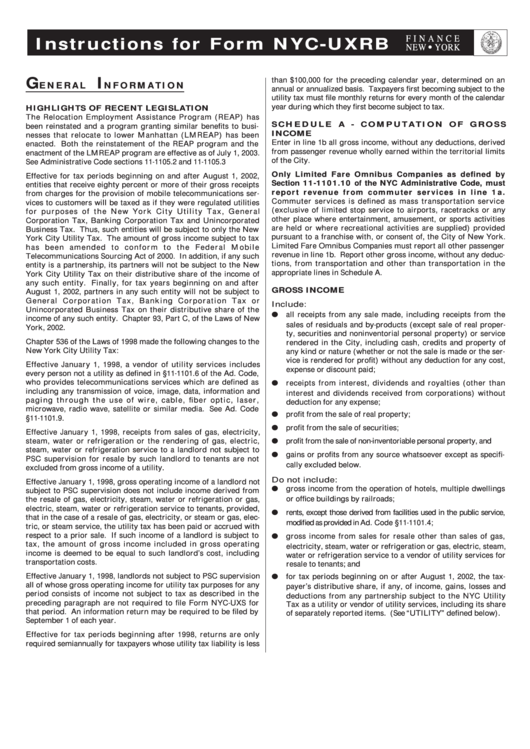

Instructions For Form Nyc-Uxrb 2006

ADVERTISEMENT

F I N A N C E

Instr uctions for For m NYC-UXRB

NEW YORK

G

I

than $100,000 for the preceding calendar year, determined on an

E N E R A L

N F O R M A T I O N

annual or annualized basis. Taxpayers first becoming subject to the

utility tax must file monthly returns for every month of the calendar

year during which they first become subject to tax.

HIGHLIGHTS OF RECENT LEGISLATION

The Relocation Employment Assistance Program (REAP) has

S C H E D U L E A - C O M P U T A T I O N O F G R O S S

been reinstated and a program granting similar benefits to busi-

INCOME

nesses that relocate to lower Manhattan (LMREAP) has been

Enter in line 1b all gross income, without any deductions, derived

enacted. Both the reinstatement of the REAP program and the

from passenger revenue wholly earned within the territorial limits

enactment of the LMREAP program are effective as of July 1, 2003.

of the City.

See Administrative Code sections 11-1105.2 and 11-1105.3

Only Limited Fare Omnibus Companies as defined by

Effective for tax periods beginning on and after August 1, 2002,

Section 11-1101.10 of the NYC Administrative Code, must

entities that receive eighty percent or more of their gross receipts

report revenue from commuter services in line 1a.

from charges for the provision of mobile telecommunications ser-

Commuter services is defined as mass transportation service

vices to customers will be taxed as if they were regulated utilities

(exclusive of limited stop service to airports, racetracks or any

for purposes of the New York City Utility Tax, General

other place where entertainment, amusement, or sports activities

Corporation Tax, Banking Corporation Tax and Unincorporated

are held or where recreational activities are supplied) provided

Business Tax. Thus, such entities will be subject to only the New

pursuant to a franchise with, or consent of, the City of New York.

York City Utility Tax. The amount of gross income subject to tax

Limited Fare Omnibus Companies must report all other passenger

has been amended to conform to the Federal Mobile

revenue in line 1b. Report other gross income, without any deduc-

Telecommunications Sourcing Act of 2000. In addition, if any such

tions, from transportation and other than transportation in the

entity is a partnership, its partners will not be subject to the New

appropriate lines in Schedule A.

York City Utility Tax on their distributive share of the income of

any such entity. Finally, for tax years beginning on and after

GROSS INCOME

August 1, 2002, partners in any such entity will not be subject to

General Corporation Tax, Banking Corporation Tax or

Include:

Unincorporated Business Tax on their distributive share of the

all receipts from any sale made, including receipts from the

income of any such entity. Chapter 93, Part C, of the Laws of New

sales of residuals and by-products (except sale of real proper-

York, 2002.

ty, securities and noninventorial personal property) or service

Chapter 536 of the Laws of 1998 made the following changes to the

rendered in the City, including cash, credits and property of

New York City Utility Tax:

any kind or nature (whether or not the sale is made or the ser-

vice is rendered for profit) without any deduction for any cost,

Effective January 1, 1998, a vendor of utility services includes

expense or discount paid;

every person not a utility as defined in §11-1101.6 of the Ad. Code,

who provides telecommunications services which are defined as

receipts from interest, dividends and royalties (other than

including any transmission of voice, image, data, information and

interest and dividends received from corporations) without

paging through the use of wire, cable, fiber optic, laser,

deduction for any expense;

microwave, radio wave, satellite or similar media. See Ad. Code

profit from the sale of real property;

§11-1101.9.

profit from the sale of securities;

Effective January 1, 1998, receipts from sales of gas, electricity,

steam, water or refrigeration or the rendering of gas, electric,

profit from the sale of non-inventoriable personal property, and

steam, water or refrigeration service to a landlord not subject to

gains or profits from any source whatsoever except as specifi-

PSC supervision for resale by such landlord to tenants are not

cally excluded below.

excluded from gross income of a utility.

Do not include:

Effective January 1, 1998, gross operating income of a landlord not

gross income from the operation of hotels, multiple dwellings

subject to PSC supervision does not include income derived from

or office buildings by railroads;

the resale of gas, electricity, steam, water or refrigeration or gas,

electric, steam, water or refrigeration service to tenants, provided,

rents, except those derived from facilities used in the public service,

that in the case of a resale of gas, electricity, or steam or gas, elec-

modified as provided in Ad. Code §11-1101.4;

tric, or steam service, the utility tax has been paid or accrued with

respect to a prior sale. If such income of a landlord is subject to

gross income from sales for resale other than sales of gas,

tax, the amount of gross income included in gross operating

electricity, steam, water or refrigeration or gas, electric, steam,

income is deemed to be equal to such landlord’s cost, including

water or refrigeration service to a vendor of utility services for

transportation costs.

resale to tenants; and

Effective January 1, 1998, landlords not subject to PSC supervision

for tax periods beginning on or after August 1, 2002, the tax-

all of whose gross operating income for utility tax purposes for any

payer’s distributive share, if any, of income, gains, losses and

period consists of income not subject to tax as described in the

deductions from any partnership subject to the NYC Utility

preceding paragraph are not required to file Form NYC-UXS for

Tax as a utility or vendor of utility services, including its share

that period. An information return may be required to be filed by

of separately reported items. (See “UTILITY” defined below).

September 1 of each year.

Effective for tax periods beginning after 1998, returns are only

required semiannually for taxpayers whose utility tax liability is less

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2