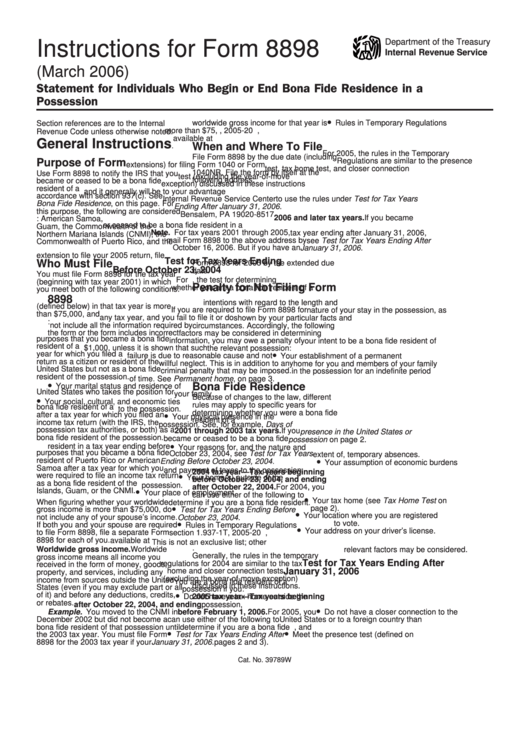

Instructions For Form 8898 (March 2006)

ADVERTISEMENT

Department of the Treasury

Instructions for Form 8898

Internal Revenue Service

(March 2006)

Statement for Individuals Who Begin or End Bona Fide Residence in a U.S.

Possession

•

Section references are to the Internal

worldwide gross income for that year is

Rules in Temporary Regulations

more than $75,000.

section 1.937-1T, 2005-20 I.R.B. 1039,

Revenue Code unless otherwise noted.

available at

General Instructions

When and Where To File

irb05-20.pdf.

For 2005, the rules in the Temporary

File Form 8898 by the due date (including

Regulations are similar to the presence

Purpose of Form

extensions) for filing Form 1040 or Form

test, tax home test, and closer connection

1040NR. File the form by itself at the

Use Form 8898 to notify the IRS that you

test (excluding the year-of-move

following address:

became or ceased to be a bona fide

exception) discussed in these instructions

resident of a U.S. possession in

and it generally will be to your advantage

accordance with section 937(c). See

Internal Revenue Service Center

to use the rules under Test for Tax Years

Bona Fide Residence, on this page. For

P.O. Box 331

Ending After January 31, 2006.

this purpose, the following are considered

Bensalem, PA 19020-8517

2006 and later tax years. If you became

U.S. possessions: American Samoa,

or ceased to be a bona fide resident in a

Guam, the Commonwealth of the

Note. For tax years 2001 through 2005,

tax year ending after January 31, 2006,

Northern Mariana Islands (CNMI), the

mail Form 8898 to the above address by

see Test for Tax Years Ending After

Commonwealth of Puerto Rico, and the

October 16, 2006. But if you have an

January 31, 2006.

U.S. Virgin Islands.

extension to file your 2005 return, file

Test for Tax Years Ending

Who Must File

Form 8898 for 2005 by the extended due

Before October 23, 2004

date.

You must file Form 8898 for the tax year

For U.S. citizens, the test for determining

(beginning with tax year 2001) in which

Penalty for Not Filing Form

whether you are a bona fide resident of a

you meet both of the following conditions:

U.S. possession is based on your

8898

1. Your worldwide gross income

intentions with regard to the length and

(defined below) in that tax year is more

If you are required to file Form 8898 for

nature of your stay in the possession, as

than $75,000, and

any tax year, and you fail to file it or do

shown by your particular facts and

2. You meet one of the following:

not include all the information required by

circumstances. Accordingly, the following

a. You take a position for U.S. tax

the form or the form includes incorrect

factors may be considered in determining

purposes that you became a bona fide

information, you may owe a penalty of

your intent to be a bona fide resident of

resident of a U.S. possession after a tax

$1,000, unless it is shown that such

the relevant possession:

•

year for which you filed a U.S. income tax

failure is due to reasonable cause and not

Your establishment of a permanent

return as a citizen or resident of the

willful neglect. This is in addition to any

home for you and members of your family

United States but not as a bona fide

criminal penalty that may be imposed.

in the possession for an indefinite period

resident of the possession.

of time. See Permanent home, on page 3.

•

b. You are a citizen or resident of the

Bona Fide Residence

Your marital status and residence of

United States who takes the position for

your family.

Because of changes to the law, different

•

U.S. tax purposes that you ceased to be a

Your social, cultural, and economic ties

rules may apply to specific years for

bona fide resident of a U.S. possession

to the possession.

determining whether you were a bona fide

•

after a tax year for which you filed an

Your physical presence in the

resident of a U.S. possession.

income tax return (with the IRS, the

possession. See, for example, Days of

possession tax authorities, or both) as a

2001 through 2003 tax years. If you

presence in the United States or U.S.

bona fide resident of the possession.

became or ceased to be a bona fide

possession on page 2.

•

c. You take the position for U.S. tax

resident in a tax year ending before

Your reasons for, and the nature and

purposes that you became a bona fide

October 23, 2004, see Test for Tax Years

extent of, temporary absences.

•

resident of Puerto Rico or American

Ending Before October 23, 2004.

Your assumption of economic burdens

Samoa after a tax year for which you

and payment of taxes to the possession.

2004 tax year — Tax years beginning

•

were required to file an income tax return

Your home(s) outside of the

before October 23, 2004, and ending

as a bona fide resident of the U.S. Virgin

possession.

after October 22, 2004. For 2004, you

•

Islands, Guam, or the CNMI.

Your place of employment.

can use either of the following to

•

Your tax home (see Tax Home Test on

When figuring whether your worldwide

determine if you are a bona fide resident.

•

page 2).

gross income is more than $75,000, do

Test for Tax Years Ending Before

•

Your location where you are registered

not include any of your spouse’s income.

October 23, 2004.

•

to vote.

If both you and your spouse are required

Rules in Temporary Regulations

•

Your address on your driver’s license.

to file Form 8898, file a separate Form

section 1.937-1T, 2005-20 I.R.B. 1039,

8898 for each of you.

available at

This is not an exclusive list; other

irb05-20.pdf.

Worldwide gross income. Worldwide

relevant factors may be considered.

Generally, the rules in the temporary

gross income means all income you

Test for Tax Years Ending After

regulations for 2004 are similar to the tax

received in the form of money, goods,

home and closer connection tests

January 31, 2006

property, and services, including any

(excluding the year-of-move exception)

income from sources outside the United

You are a bona fide resident of a U.S.

discussed in these instructions.

States (even if you may exclude part or all

possession if you:

•

of it) and before any deductions, credits,

Do not have a tax home outside the

2005 tax year — Tax years beginning

or rebates.

after October 22, 2004, and ending

possession,

•

Example. You moved to the CNMI in

before February 1, 2006. For 2005, you

Do not have a closer connection to the

December 2002 but did not become a

can use either of the following to

United States or to a foreign country than

bona fide resident of that possession until

determine if you are a bona fide resident.

to the possession, and

•

•

the 2003 tax year. You must file Form

Test for Tax Years Ending After

Meet the presence test (defined on

8898 for the 2003 tax year if your

January 31, 2006.

pages 2 and 3).

Cat. No. 39789W

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4