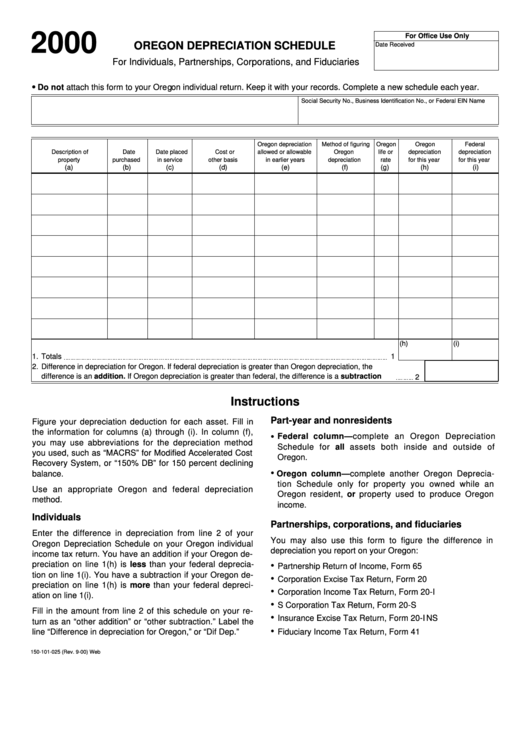

Oregon Depreciation Schedule - 2000

ADVERTISEMENT

2000

For Office Use Only

OREGON DEPRECIATION SCHEDULE

Date Received

For Individuals, Partnerships, Corporations, and Fiduciaries

Do not attach this form to your Oregon individual return. Keep it with your records. Complete a new schedule each year.

Name

Social Security No., Business Identification No., or Federal EIN

Oregon depreciation

Method of figuring

Oregon

Oregon

Federal

Description of

Date

Date placed

Cost or

allowed or allowable

Oregon

life or

depreciation

depreciation

property

purchased

in service

other basis

in earlier years

depreciation

rate

for this year

for this year

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

(h)

(i)

1.

Totals

1

2.

Difference in depreciation for Oregon. If federal depreciation is greater than Oregon depreciation, the

difference is an addition. If Oregon depreciation is greater than federal, the difference is a subtraction

2

Instructions

Part-year and nonresidents

Figure your depreciation deduction for each asset. Fill in

the information for columns (a) through (i). In column (f),

•

Federal column—complete an Oregon Depreciation

you may use abbreviations for the depreciation method

Schedule for all assets both inside and outside of

you used, such as “MACRS” for Modified Accelerated Cost

Oregon.

Recovery System, or “150% DB” for 150 percent declining

•

balance.

Oregon column—complete another Oregon Deprecia-

tion Schedule only for property you owned while an

Use an appropriate Oregon and federal depreciation

Oregon resident, or property used to produce Oregon

method.

income.

Individuals

Partnerships, corporations, and fiduciaries

Enter the difference in depreciation from line 2 of your

You may also use this form to figure the difference in

Oregon Depreciation Schedule on your Oregon individual

depreciation you report on your Oregon:

income tax return. You have an addition if your Oregon de-

preciation on line 1(h) is less than your federal deprecia-

•

Partnership Return of Income, Form 65

tion on line 1(i). You have a subtraction if your Oregon de-

•

Corporation Excise Tax Return, Form 20

preciation on line 1(h) is more than your federal depreci-

•

Corporation Income Tax Return, Form 20-I

ation on line 1(i).

•

S Corporation Tax Return, Form 20-S

Fill in the amount from line 2 of this schedule on your re-

•

Insurance Excise Tax Return, Form 20-INS

turn as an “other addition” or “other subtraction.” Label the

•

line “Difference in depreciation for Oregon,” or “Dif Dep.”

Fiduciary Income Tax Return, Form 41

150-101-025 (Rev. 9-00) Web

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4