Oregon Depreciation Schedule - 2000 Page 3

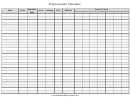

ADVERTISEMENT

Assets placed in service on or after

these assets. You generally will use the same method and

recovery period for Oregon that you use for federal

January 1, 1987

purposes.

MACRS is effective for assets placed in service on or after

If you did not elect the one-time depreciation adjustment

January 1, 1987. The method and life will be the same

on your 1996 Oregon return, you may use any method

as you used on the federal return. If you elect to expense

allowed under 1980 federal tax law. The most common

the cost of qualifying assets under IRC Section 179, the

depreciation methods are explained below.

election and amount is also effective for Oregon purposes.

Straight-line. You may use the straight-line method for

Section 179 expense deductions for federal and state

any depreciable property. Do not depreciate beyond the

are:

asset’s useful life. Do not depreciate below the asset’s

Maximum Section 179

salvage value.

Tax Year

Expense Deduction

Declining balance. You may use the declining balance

1987 – 1992

$10,000

method only for the types of property shown below.

1993 – 1996

$17,500

Qualifying Property

Qualifying Percentage

1997

$18,000

Real property

1998

$18,500

• New residential rental

200%

1999

$19,000

property

2000

$20,000

• Other new real property

150%

The regular federal investment credit was repealed for

• Used residential property,

125%

property placed in service after 1985. The credit is still

20 or more years of useful

available for limited types of property and expenditures.

life

If you have taken this credit, you will have a higher ba-

Personal property

sis for Oregon because your Oregon basis isn’t reduced

(with three or more years of useful life)

by the federal credit. The difference in depreciation for

• New tangible personal property

200%

Oregon will be shown as an “Other subtraction.”

• Used tangible personal property

150%

Assets placed in service on or after

Don’t subtract salvage value from your cost or other

January 1, 1985, and before January 1, 1987

basis. The total depreciation taken in earlier years plus

the current year’s depreciation can’t exceed a reasonable

Did you place assets in service in tax years beginning on

salvage value.

or between January 1, 1985, and December 31, 1986? Use

the ACRS in effect on December 31, 1984. Your Oregon

Did you sell or trade the property during the tax year?

depreciation for Section 179 election to expense the cost

Then you may take only a portion of a partial year’s de-

of assets will generally be the same as the federal amount.

preciation. Figure your depreciation based on the num-

Assets used for the production of income but not used

ber of months you had the property.

in a trade or business don’t qualify for the Section 179

expense. The maximum Section 179 expense is $5,000

Passive activity losses

for all property.

You may have had a depreciation difference for assets

ACRS can be used for recovery property placed in ser-

used in a passive activity that were not affected by the

vice in tax years beginning on or between January 1, 1985,

1996 one-time adjustment. For example, assets transferred

and December 31, 1986. Recovery property is tangible

into Oregon or assets for which you claimed a federal

property that can be depreciated. This property must be

tax credit may continue to have a difference in

used in a trade or business or be held for the production

depreciation. Report your passive activity loss for Oregon

of income. Recovery property doesn’t include any mo-

using an “Other addition” or “Other subtraction” on your

tion picture film or videotape.

Oregon return. Label it “Passive activity loss,” or “PAL.”

(Refer to federal Form 8582 and instructions for the

Assets placed in service on or after

definition of passive activity.)

January 1, 1981, and before January 1, 1985

Suspended losses

If you claimed the one-time depreciation adjustment on

your 1996 Oregon return, you will no longer have

If you elected to align your Oregon basis with your federal

Oregon modifications for depreciation differences for

basis, your 1996 one-time adjustment increased (or

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4