Instructions For Form Lgl-001 - Status Letter Request For Business Taxes

ADVERTISEMENT

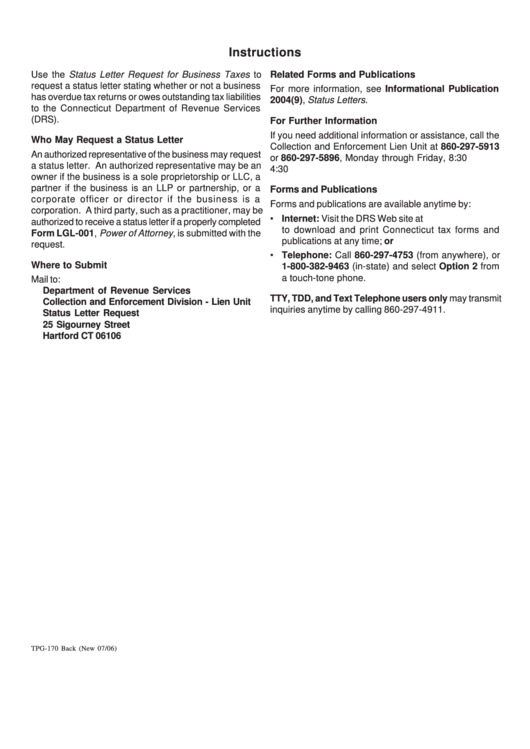

Instructions

Use the Status Letter Request for Business Taxes to

Related Forms and Publications

request a status letter stating whether or not a business

For more information, see Informational Publication

has overdue tax returns or owes outstanding tax liabilities

2004(9), Status Letters.

to the Connecticut Department of Revenue Services

(DRS).

For Further Information

If you need additional information or assistance, call the

Who May Request a Status Letter

Collection and Enforcement Lien Unit at 860-297-5913

An authorized representative of the business may request

or 860-297-5896, Monday through Friday, 8:30 a.m. to

a status letter. An authorized representative may be an

4:30 p.m.

owner if the business is a sole proprietorship or LLC, a

partner if the business is an LLP or partnership, or a

Forms and Publications

corporate officer or director if the business is a

Forms and publications are available anytime by:

corporation. A third party, such as a practitioner, may be

• Internet: Visit the DRS Web site at

authorized to receive a status letter if a properly completed

to download and print Connecticut tax forms and

Form LGL-001, Power of Attorney, is submitted with the

publications at any time; or

request.

• Telephone: Call 860-297-4753 (from anywhere), or

Where to Submit

1-800-382-9463 (in-state) and select Option 2 from

a touch-tone phone.

Mail to:

Department of Revenue Services

TTY, TDD, and Text Telephone users only may transmit

Collection and Enforcement Division - Lien Unit

inquiries anytime by calling 860-297-4911.

Status Letter Request

25 Sigourney Street

Hartford CT 06106

TPG-170 Back (New 07/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1