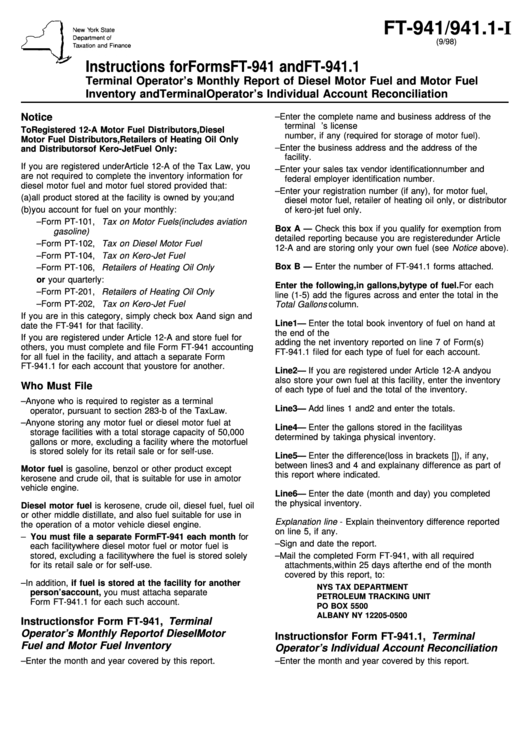

Instructions For Forms Ft-941 And Ft-941.1 - Terminal Operator'S Monthly Report Of Diesel Motor Fuel And Motor Fuel Inventory And Terminal Operator'S Individual Account Reconciliation

ADVERTISEMENT

FT-941/941.1-I

(9/98)

Instructions for Forms FT-941 and FT-941.1

Terminal Operator’s Monthly Report of Diesel Motor Fuel and Motor Fuel

Inventory and Terminal Operator’s Individual Account Reconciliation

Notice

– Enter the complete name and business address of the

terminal operator. Enter terminal operator’s license

To Registered 12-A Motor Fuel Distributors, Diesel

number, if any (required for storage of motor fuel).

Motor Fuel Distributors, Retailers of Heating Oil Only

– Enter the business address and the address of the

and Distributors of Kero-Jet Fuel Only:

facility.

If you are registered under Article 12-A of the Tax Law, you

– Enter your sales tax vendor identification number and

are not required to complete the inventory information for

federal employer identification number.

diesel motor fuel and motor fuel stored provided that:

– Enter your registration number (if any), for motor fuel,

(a) all product stored at the facility is owned by you; and

diesel motor fuel, retailer of heating oil only, or distributor

(b) you account for fuel on your monthly:

of kero-jet fuel only.

– Form PT-101, Tax on Motor Fuels (includes aviation

Box A — Check this box if you qualify for exemption from

gasoline)

detailed reporting because you are registered under Article

– Form PT-102, Tax on Diesel Motor Fuel

12-A and are storing only your own fuel (see Notice above).

– Form PT-104, Tax on Kero-Jet Fuel

Box B — Enter the number of FT-941.1 forms attached.

– Form PT-106, Retailers of Heating Oil Only

or your quarterly:

Enter the following, in gallons, by type of fuel. For each

– Form PT-201, Retailers of Heating Oil Only

line (1-5) add the figures across and enter the total in the

– Form PT-202, Tax on Kero-Jet Fuel

Total Gallons column.

If you are in this category, simply check box A and sign and

Line 1 — Enter the total book inventory of fuel on hand at

date the FT-941 for that facility.

the end of the month. These amounts are determined by

If you are registered under Article 12-A and store fuel for

adding the net inventory reported on line 7 of Form(s)

others, you must complete and file Form FT-941 accounting

FT-941.1 filed for each type of fuel for each account.

for all fuel in the facility, and attach a separate Form

FT-941.1 for each account that you store for another.

Line 2 — If you are registered under Article 12-A and you

also store your own fuel at this facility, enter the inventory

Who Must File

of each type of fuel and the total of the inventory.

– Anyone who is required to register as a terminal

Line 3 — Add lines 1 and 2 and enter the totals.

operator, pursuant to section 283-b of the Tax Law.

– Anyone storing any motor fuel or diesel motor fuel at

Line 4 — Enter the gallons stored in the facility as

storage facilities with a total storage capacity of 50,000

determined by taking a physical inventory.

gallons or more, excluding a facility where the motor fuel

is stored solely for its retail sale or for self-use.

Line 5 — Enter the difference (loss in brackets [ ]), if any,

between lines 3 and 4 and explain any difference as part of

Motor fuel is gasoline, benzol or other product except

this report where indicated.

kerosene and crude oil, that is suitable for use in a motor

vehicle engine.

Line 6 — Enter the date (month and day) you completed

the physical inventory.

Diesel motor fuel is kerosene, crude oil, diesel fuel, fuel oil

or other middle distillate, and also fuel suitable for use in

Explanation line - Explain the inventory difference reported

the operation of a motor vehicle diesel engine.

on line 5, if any.

– You must file a separate Form FT-941 each month for

– Sign and date the report.

each facility where diesel motor fuel or motor fuel is

stored, excluding a facility where the fuel is stored solely

– Mail the completed Form FT-941, with all required

for its retail sale or for self-use.

attachments, within 25 days after the end of the month

covered by this report, to:

– In addition, if fuel is stored at the facility for another

NYS TAX DEPARTMENT

person’s account, you must attach a separate

PETROLEUM TRACKING UNIT

Form FT-941.1 for each such account.

PO BOX 5500

ALBANY NY 12205-0500

Instructions for Form FT-941, Terminal

Operator’s Monthly Report of Diesel Motor

Instructions for Form FT-941.1, Terminal

Fuel and Motor Fuel Inventory

Operator’s Individual Account Reconciliation

– Enter the month and year covered by this report.

– Enter the month and year covered by this report.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2