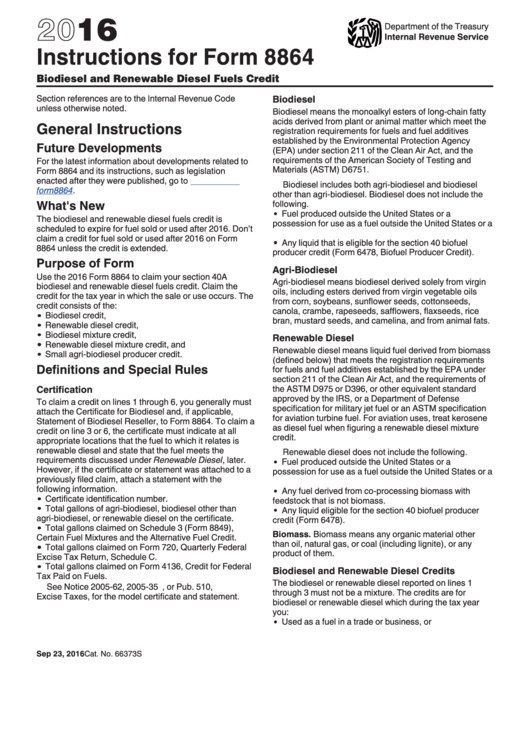

Instructions For Form 8864 - Biodiesel And Renewable Diesel Fuels Credit - 2016

ADVERTISEMENT

2016

Department of the Treasury

Internal Revenue Service

Instructions for Form 8864

Biodiesel and Renewable Diesel Fuels Credit

Section references are to the Internal Revenue Code

Biodiesel

unless otherwise noted.

Biodiesel means the monoalkyl esters of long-chain fatty

acids derived from plant or animal matter which meet the

General Instructions

registration requirements for fuels and fuel additives

established by the Environmental Protection Agency

Future Developments

(EPA) under section 211 of the Clean Air Act, and the

requirements of the American Society of Testing and

For the latest information about developments related to

Materials (ASTM) D6751.

Form 8864 and its instructions, such as legislation

enacted after they were published, go to

Biodiesel includes both agri-biodiesel and biodiesel

form8864.

other than agri-biodiesel. Biodiesel does not include the

What's New

following.

Fuel produced outside the United States or a U.S.

The biodiesel and renewable diesel fuels credit is

possession for use as a fuel outside the United States or a

scheduled to expire for fuel sold or used after 2016. Don’t

U.S. possession.

claim a credit for fuel sold or used after 2016 on Form

Any liquid that is eligible for the section 40 biofuel

8864 unless the credit is extended.

producer credit (Form 6478, Biofuel Producer Credit).

Purpose of Form

Agri-Biodiesel

Use the 2016 Form 8864 to claim your section 40A

Agri-biodiesel means biodiesel derived solely from virgin

biodiesel and renewable diesel fuels credit. Claim the

oils, including esters derived from virgin vegetable oils

credit for the tax year in which the sale or use occurs. The

from corn, soybeans, sunflower seeds, cottonseeds,

credit consists of the:

canola, crambe, rapeseeds, safflowers, flaxseeds, rice

Biodiesel credit,

bran, mustard seeds, and camelina, and from animal fats.

Renewable diesel credit,

Biodiesel mixture credit,

Renewable Diesel

Renewable diesel mixture credit, and

Renewable diesel means liquid fuel derived from biomass

Small agri-biodiesel producer credit.

(defined below) that meets the registration requirements

Definitions and Special Rules

for fuels and fuel additives established by the EPA under

section 211 of the Clean Air Act, and the requirements of

Certification

the ASTM D975 or D396, or other equivalent standard

approved by the IRS, or a Department of Defense

To claim a credit on lines 1 through 6, you generally must

specification for military jet fuel or an ASTM specification

attach the Certificate for Biodiesel and, if applicable,

for aviation turbine fuel. For aviation uses, treat kerosene

Statement of Biodiesel Reseller, to Form 8864. To claim a

as diesel fuel when figuring a renewable diesel mixture

credit on line 3 or 6, the certificate must indicate at all

credit.

appropriate locations that the fuel to which it relates is

renewable diesel and state that the fuel meets the

Renewable diesel does not include the following.

requirements discussed under Renewable Diesel, later.

Fuel produced outside the United States or a U.S.

However, if the certificate or statement was attached to a

possession for use as a fuel outside the United States or a

previously filed claim, attach a statement with the

U.S. possession.

following information.

Any fuel derived from co-processing biomass with

Certificate identification number.

feedstock that is not biomass.

Total gallons of agri-biodiesel, biodiesel other than

Any liquid eligible for the section 40 biofuel producer

agri-biodiesel, or renewable diesel on the certificate.

credit (Form 6478).

Total gallons claimed on Schedule 3 (Form 8849),

Biomass. Biomass means any organic material other

Certain Fuel Mixtures and the Alternative Fuel Credit.

than oil, natural gas, or coal (including lignite), or any

Total gallons claimed on Form 720, Quarterly Federal

product of them.

Excise Tax Return, Schedule C.

Total gallons claimed on Form 4136, Credit for Federal

Biodiesel and Renewable Diesel Credits

Tax Paid on Fuels.

The biodiesel or renewable diesel reported on lines 1

See Notice 2005-62, 2005-35 I.R.B. 443, or Pub. 510,

through 3 must not be a mixture. The credits are for

Excise Taxes, for the model certificate and statement.

biodiesel or renewable diesel which during the tax year

you:

Used as a fuel in a trade or business, or

Sep 23, 2016

Cat. No. 66373S

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4