Instructions For Form Ft-945/1045 - Report Of Sales Tax Prepayment On Motor Fuel/diesel Motor Fuel

ADVERTISEMENT

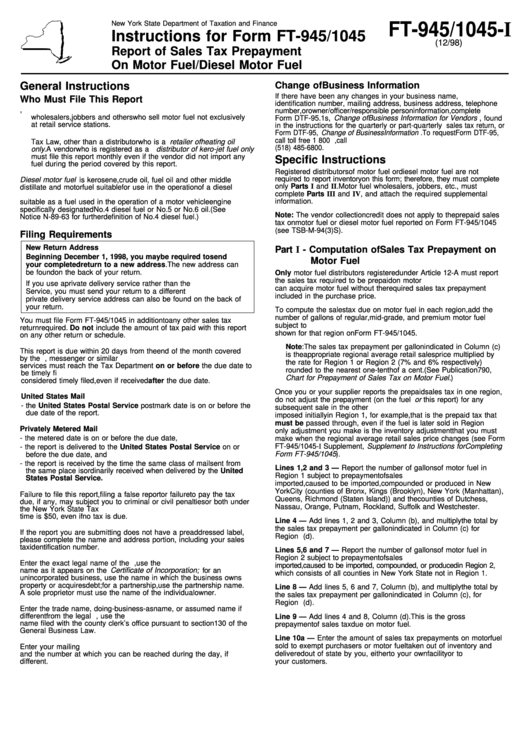

New York State Department of Taxation and Finance

FT-945/1045-I

Instructions for Form FT-945/1045

(12/98)

Report of Sales Tax Prepayment

On Motor Fuel/Diesel Motor Fuel

General Instructions

Change of Business Information

If there have been any changes in your business name,

Who Must File This Report

identification number, mailing address, business address, telephone

1. Motor fuel distributors registered under Article 12-A of the Tax Law,

number, or owner/officer/responsible person information, complete

wholesalers, jobbers and others who sell motor fuel not exclusively

Form DTF-95.1s, Change of Business Information for Vendors , found

at retail service stations.

in the instructions for the quarterly or part-quarterly sales tax return, or

Form DTF-95, Change of Business Information . To request Form DTF-95,

2. Diesel motor fuel distributors registered under Article 12-A of the

call toll free 1 800 462-8100. From areas outside the U.S. and Canada, call

Tax Law, other than a distributor who is a retailer of heating oil

(518) 485-6800.

only . A vendor who is registered as a distributor of kero-jet fuel only

must file this report monthly even if the vendor did not import any

Specific Instructions

fuel during the period covered by this report.

Registered distributors of motor fuel or diesel motor fuel are not

required to report inventory on this form; therefore, they must complete

Diesel motor fuel is kerosene, crude oil, fuel oil and other middle

only Parts I and II. Motor fuel wholesalers, jobbers, etc., must

distillate and motor fuel suitable for use in the operation of a diesel

complete Parts III and IV, and attach the required supplemental

engine. It does not include that special grade of diesel product not

information.

suitable as a fuel used in the operation of a motor vehicle engine

specifically designated No. 4 diesel fuel or No. 5 or No. 6 oil. (See

Note: The vendor collection credit does not apply to the prepaid sales

Notice N-89-63 for further definition of No. 4 diesel fuel.)

tax on motor fuel or diesel motor fuel reported on Form FT-945/1045

(see TSB-M-94(3)S).

Filing Requirements

New Return Address

Part I - Computation of Sales Tax Prepayment on

Beginning December 1, 1998, you may be required to send

Motor Fuel

your completed return to a new address. The new address can

be found on the back of your return.

Only motor fuel distributors registered under Article 12-A must report

the sales tax required to be prepaid on motor fuel. No other person

If you use a private delivery service rather than the U.S. Postal

can acquire motor fuel without the required sales tax prepayment

Service, you must send your return to a different address. The

included in the purchase price.

private delivery service address can also be found on the back of

your return.

To compute the sales tax due on motor fuel in each region, add the

number of gallons of regular, mid-grade, and premium motor fuel

You must file Form FT-945/1045 in addition to any other sales tax

subject to tax. Multiply the total by the sales tax prepayment per gallon

return required. Do not include the amount of tax paid with this report

shown for that region on Form FT-945/1045.

on any other return or schedule.

Note: The sales tax prepayment per gallon indicated in Column (c)

This report is due within 20 days from the end of the month covered

is the appropriate regional average retail sales price multiplied by

by the report. Reports delivered by courier, messenger or similar

the rate for Region 1 or Region 2 (7% and 6% respectively)

services must reach the Tax Department on or before the due date to

rounded to the nearest one-tenth of a cent. (See Publication 790,

be timely filed. Reports that meet the following conditions will be

Chart for Prepayment of Sales Tax on Motor Fuel. )

considered timely filed, even if received after the due date.

Once you or your supplier reports the prepaid sales tax in one region,

United States Mail

do not adjust the prepayment (on the fuel or this report) for any

- the United States Postal Service postmark date is on or before the

subsequent sale in the other region. If prepaid sales tax has been

due date of the report.

imposed initially in Region 1, for example, that is the prepaid tax that

must be passed through, even if the fuel is later sold in Region 2. The

Privately Metered Mail

only adjustment you make is the inventory adjustment that you must

- the metered date is on or before the due date,

make when the regional average retail sales price changes (see Form

FT-945/1045-I Supplement, Supplement to Instructions for Completing

- the report is delivered to the United States Postal Service on or

Form FT-945/1045 ).

before the due date, and

- the report is received by the time the same class of mail sent from

Lines 1, 2 and 3 — Report the number of gallons of motor fuel in

the same place is ordinarily received when delivered by the United

Region 1 subject to prepayment of sales tax. This includes all fuel

States Postal Service.

imported, caused to be imported, compounded or produced in New

York City (counties of Bronx, Kings (Brooklyn), New York (Manhattan),

Failure to file this report, filing a false report or failure to pay the tax

Queens, Richmond (Staten Island)) and the counties of Dutchess,

due, if any, may subject you to criminal or civil penalties or both under

Nassau, Orange, Putnam, Rockland, Suffolk and Westchester.

the New York State Tax Law. The minimum penalty for failure to file on

time is $50, even if no tax is due.

Line 4 — Add lines 1, 2 and 3, Column (b), and multiply the total by

the sales tax prepayment per gallon indicated in Column (c) for

If the report you are submitting does not have a preaddressed label,

Region 1. Enter the result in Column (d).

please complete the name and address portion, including your sales

tax identification number.

Lines 5, 6 and 7 — Report the number of gallons of motor fuel in

Region 2 subject to prepayment of sales tax. This includes all fuel

Enter the exact legal name of the business. For a corporation, use the

imported, caused to be imported, compounded, or produced in Region 2,

name as it appears on the Certificate of Incorporation; for an

which consists of all counties in New York State not in Region 1.

unincorporated business, use the name in which the business owns

property or acquires debt; for a partnership, use the partnership name.

Line 8 — Add lines 5, 6 and 7, Column (b), and multiply the total by

A sole proprietor must use the name of the individual owner.

the sales tax prepayment per gallon indicated in Column (c), for

Region 2. Enter the result in Column (d).

Enter the trade name, doing-business-as name, or assumed name if

different from the legal name. For an unincorporated business, use the

Line 9 — Add lines 4 and 8, Column (d). This is the gross

name filed with the county clerk’s office pursuant to section 130 of the

prepayment of sales tax due on motor fuel.

General Business Law.

Line 10a — Enter the amount of sales tax prepayments on motor fuel

sold to exempt purchasers or motor fuel taken out of inventory and

Enter your mailing address. Include your business telephone number

delivered out of state by you, either to your own facility or to

and the number at which you can be reached during the day, if

different.

your customers.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3