Instructions For Form 706

ADVERTISEMENT

INSTRUCTIONS

GENERAL

A tax is imposed upon any transfer of property to any distributee

INTEREST

in either of the following cases: (1) when the transfer is from a

If the estate tax as finally determined is not paid within 9 months

person who dies while a resident of Wisconsin, and (2) when the

of the decedent’s death, interest is due. Interest is calculated

transfer is of property within the jurisdiction of Wisconsin and

from the date of death to the date the tax is paid at the rate of

the decedent was not a resident of Wisconsin at death. The

12% per year. Interest is assessed regardless of any extension

Wisconsin estate tax is a tax based on the Federal State Death

to file the return.

Tax Credit. This tax is imposed upon both resident and nonresi-

dent decedents dying on or after January 1, 1992. An estate is

PENALTY

not taxable and no estate tax return is required if a Federal

Any person who fails to file a return by the due date is subject

Estate Tax Return (Form 706) is not required.

to a penalty of 5% of the tax due but not less than $25 nor more

than $500. The penalty is imposed even if there is no tax due.

WHO SHOULD FILE

The Wisconsin Form W706 should be filed by the person

CHANGES TO FEDERAL ESTATE RETURN

responsible for filing the Federal Estate Tax Return (i.e., per-

(FORM 706) OR FEDERAL ESTATE TAX

sonal representative, special administrator, trustee, distributee

If the Federal Form 706 or the federal estate tax is amended or

or other person signing the Federal Form 706).

adjusted by any means, including a federal estate tax audit, a

refund claim or an amendment to the Federal Estate Tax

TIME TO FILE

Return, the Wisconsin Department of Revenue must be notified

The Form W706 is due 9 months after the date of death or when

within 30 days.

the Federal Estate Tax Return (Form 706) is required to be filed;

as extended, whichever is later. However, regardless of when

CERTIFICATE DETERMINING ESTATE TAX

the return is filed, the tax is due 9 months after date of death.

Upon receipt of the return and payment of the liability and after

audit, the Department of Revenue will issue a dated certificate

WHERE TO FILE

showing the amount of tax, interest and penalty.

Mail the completed Form W706 to the following address:

Wisconsin Department of Revenue

P.O. Box 8904

INSTALLMENT PAYMENTS

Madison, WI 53708-8904

Effective for deaths on or after July 29, 1995, some estates may

qualify to pay the Wisconsin estate tax in installments. If a

ATTACHMENTS REQUIRED

percentage of the federal tax on an estate may be paid in

A complete copy of the Federal Estate Return Form 706 and

installments under section 6166 of the Internal Revenue Code

copies of ALL DOCUMENTS submitted with the Form 706 must

(IRC), the same percentage of Wisconsin estate tax may be

be filed with the Wisconsin Form W706.

paid under the same installment schedule. An election to pay in

installments for federal estate tax purposes does not constitute

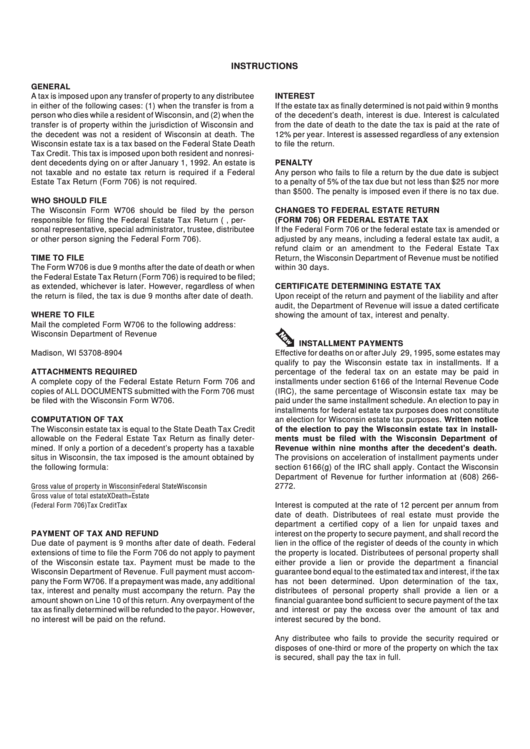

COMPUTATION OF TAX

an election for Wisconsin estate tax purposes. Written notice

The Wisconsin estate tax is equal to the State Death Tax Credit

of the election to pay the Wisconsin estate tax in install-

allowable on the Federal Estate Tax Return as finally deter-

ments must be filed with the Wisconsin Department of

mined. If only a portion of a decedent’s property has a taxable

Revenue within nine months after the decedent's death.

situs in Wisconsin, the tax imposed is the amount obtained by

The provisions on acceleration of installment payments under

the following formula:

section 6166(g) of the IRC shall apply. Contact the Wisconsin

Department of Revenue for further information at (608) 266-

Gross value of property in Wisconsin

Federal State

Wisconsin

2772.

Gross value of total estate

X

Death

=

Estate

(Federal Form 706)

Tax Credit

Tax

Interest is computed at the rate of 12 percent per annum from

date of death. Distributees of real estate must provide the

department a certified copy of a lien for unpaid taxes and

PAYMENT OF TAX AND REFUND

interest on the property to secure payment, and shall record the

Due date of payment is 9 months after date of death. Federal

lien in the office of the register of deeds of the county in which

extensions of time to file the Form 706 do not apply to payment

the property is located. Distributees of personal property shall

of the Wisconsin estate tax. Payment must be made to the

either provide a lien or provide the department a financial

Wisconsin Department of Revenue. Full payment must accom-

guarantee bond equal to the estimated tax and interest, if the tax

pany the Form W706. If a prepayment was made, any additional

has not been determined. Upon determination of the tax,

tax, interest and penalty must accompany the return. Pay the

distributees of personal property shall provide a lien or a

amount shown on Line 10 of this return. Any overpayment of the

financial guarantee bond sufficient to secure payment of the tax

tax as finally determined will be refunded to the payor. However,

and interest or pay the excess over the amount of tax and

no interest will be paid on the refund.

interest secured by the bond.

Any distributee who fails to provide the security required or

disposes of one-third or more of the property on which the tax

is secured, shall pay the tax in full.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1