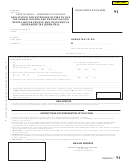

Form Cab-7 - Application For Property Tax Reduction For Commercial Or Industrial Real Property Improvements And Personal Property Page 2

ADVERTISEMENT

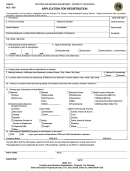

Property Tax Reduction for Commercial or Industrial

Real Property Improvements and Personal Property

Application

Acknowledgement of Application Procedures and Criteria

In applying for this tax reduction, you acknowledge the following:

Application process

● The property owner of record (or his/her agent) is required to complete the applicant section of the form and

submit it to the governing bodies by April 15 in order to receive the tax benefit for that tax year. The application

needs to include a legal description of the property and verification that the property (1) has not been operating

for at least 6 months prior to submitting the application and (2) will not be used for at least 6 months following the

granting of the reduction in taxable value.

Decision on tax benefits by governing bodies

● The computation of tax benefits will depend on the passing of the joint resolution by the governing bodies.

● The governing bodies may end the tax benefits by majority vote at any time.

● The governing bodies may refuse to reduce the taxable value of the property if they determine that the business is

restructuring the ownership of the property for the primary purpose of escaping payment of property taxes or if the

governing bodies determine that the reduction in taxable value is not in the best interest of the local governments.

Tax reduction

● The reduction in taxable value may be granted for a maximum of 3 years. To continue the tax benefit, the property

owner needs to submit a new application, along with a new joint resolution by the governing bodies.

● The tax benefits cannot be granted if the business owes delinquent property taxes for prior tax years.

● Property taxes abated from the reduction in taxable value allowed by Montana law (15-24-2102, MCA) are subject

to recapture by each local governing body if the ownership or use of the property does not meet the statutory

requirements or the joint resolution. The recapture is equal to the amount of taxes avoided, plus interest and

penalties for nonpayment of property taxes, during any period in which the abatement was in effect. The recapture

of abated taxes may be canceled, in whole or in part, if a local governing body determined that the taxpayer’s

failure to meet the requirements of this section is a result of circumstances beyond the control of the taxpayer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2