Instructions For Mf-6431

ADVERTISEMENT

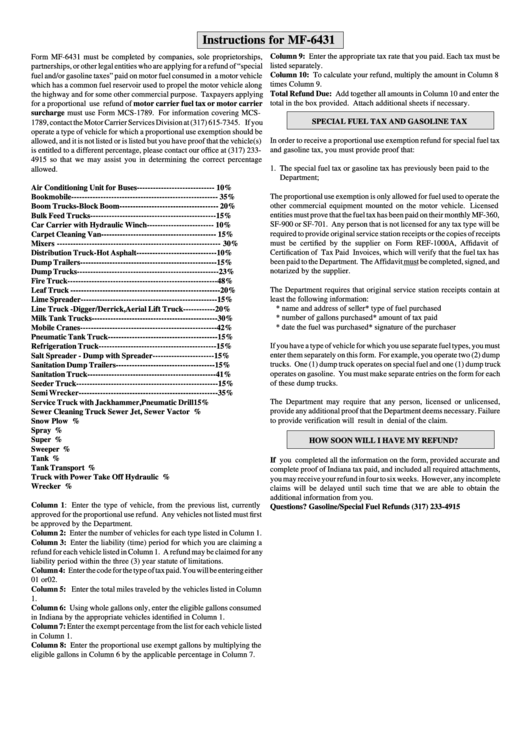

Instructions for MF-6431

Column 9: Enter the appropriate tax rate that you paid. Each tax must be

Form MF-6431 must be completed by companies, sole proprietorships,

listed separately.

partnerships, or other legal entities who are applying for a refund of “special

Column 10: To calculate your refund, multiply the amount in Column 8

fuel and/or gasoline taxes” paid on motor fuel consumed in a motor vehicle

times Column 9.

which has a common fuel reservoir used to propel the motor vehicle along

Total Refund Due: Add together all amounts in Column 10 and enter the

the highway and for some other commercial purpose. Taxpayers applying

total in the box provided. Attach additional sheets if necessary.

for a proportional use refund of motor carrier fuel tax or motor carrier

surcharge must use Form MCS-1789. For information covering MCS-

SPECIAL FUEL TAX AND GASOLINE TAX

1789, contact the Motor Carrier Services Division at (317) 615-7345. If you

operate a type of vehicle for which a proportional use exemption should be

In order to receive a proportional use exemption refund for special fuel tax

allowed, and it is not listed or is listed but you have proof that the vehicle(s)

and gasoline tax, you must provide proof that:

is entitled to a different percentage, please contact our office at (317) 233-

4915 so that we may assist you in determining the correct percentage

1. The special fuel tax or gasoline tax has previously been paid to the

allowed.

Department;

Air Conditioning Unit for Buses ----------------------------- 10%

The proportional use exemption is only allowed for fuel used to operate the

Bookmobile ------------------------------------------------------- 35%

other commercial equipment mounted on the motor vehicle. Licensed

Boom Trucks-Block Boom ------------------------------------- 20%

entities must prove that the fuel tax has been paid on their monthly MF-360,

Bulk Feed Trucks ----------------------------------------------- 15%

SF-900 or SF-701. Any person that is not licensed for any tax type will be

Car Carrier with Hydraulic Winch ------------------------- 10%

required to provide original service station receipts or the copies of receipts

Carpet Cleaning Van ------------------------------------------- 15%

must be certified by the supplier on Form REF-1000A, Affidavit of

Mixers ------------------------------------------------------------- 30%

Certification of Tax Paid Invoices, which will verify that the fuel tax has

Distribution Truck-Hot Asphalt ------------------------------ 10%

been paid to the Department. The Affidavit must be completed, signed, and

Dump Trailers --------------------------------------------------- 15%

notarized by the supplier.

Dump Trucks ----------------------------------------------------- 23%

Fire Truck -------------------------------------------------------- 48%

The Department requires that original service station receipts contain at

Leaf Truck -------------------------------------------------------- 20%

least the following information:

Lime Spreader --------------------------------------------------- 15%

* name and address of seller

* type of fuel purchased

Line Truck -Digger/Derrick,Aerial Lift Truck ------------ 20%

* number of gallons purchased

* amount of tax paid

Milk Tank Trucks ----------------------------------------------- 30%

* date the fuel was purchased

* signature of the purchaser

Mobile Cranes --------------------------------------------------- 42%

Pneumatic Tank Truck ----------------------------------------- 15%

If you have a type of vehicle for which you use separate fuel types, you must

Refrigeration Truck -------------------------------------------- 15%

enter them separately on this form. For example, you operate two (2) dump

Salt Spreader - Dump with Spreader ----------------------- 15%

trucks. One (1) dump truck operates on special fuel and one (1) dump truck

Sanitation Dump Trailers ------------------------------------- 15%

operates on gasoline. You must make separate entries on the form for each

Sanitation Truck ------------------------------------------------ 41%

of these dump trucks.

Seeder Truck ----------------------------------------------------- 15%

Semi Wrecker ---------------------------------------------------- 35%

The Department may require that any person, licensed or unlicensed,

Service Truck with Jackhammer,Pneumatic Drill

15%

provide any additional proof that the Department deems necessary. Failure

Sewer Cleaning Truck Sewer Jet, Sewer Vactor ............. 35%

to provide verification will result in denial of the claim.

Snow Plow ........................................................................... 10%

Spray Tuck .......................................................................... 15%

Super Sucker ....................................................................... 90%

HOW SOON WILL I HAVE MY REFUND?

Sweeper Truck .................................................................... 20%

Tank Trucks ........................................................................ 24%

If you completed all the information on the form, provided accurate and

Tank Transport ................................................................... 15%

complete proof of Indiana tax paid, and included all required attachments,

Truck with Power Take Off Hydraulic Winch ................ 20%

you may receive your refund in four to six weeks. However, any incomplete

Wrecker ............................................................................... 10%

claims will be delayed until such time that we are able to obtain the

additional information from you.

Column 1: Enter the type of vehicle, from the previous list, currently

Questions? Gasoline/Special Fuel Refunds (317) 233-4915

approved for the proportional use refund. Any vehicles not listed must first

be approved by the Department.

Column 2: Enter the number of vehicles for each type listed in Column 1.

Column 3: Enter the liability (time) period for which you are claiming a

refund for each vehicle listed in Column 1. A refund may be claimed for any

liability period within the three (3) year statute of limitations.

Column 4: Enter the code for the type of tax paid. You will be entering either

01 or 02.

Column 5: Enter the total miles traveled by the vehicles listed in Column

1.

Column 6: Using whole gallons only, enter the eligible gallons consumed

in Indiana by the appropriate vehicles identified in Column 1.

Column 7: Enter the exempt percentage from the list for each vehicle listed

in Column 1.

Column 8: Enter the proportional use exempt gallons by multiplying the

eligible gallons in Column 6 by the applicable percentage in Column 7.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1