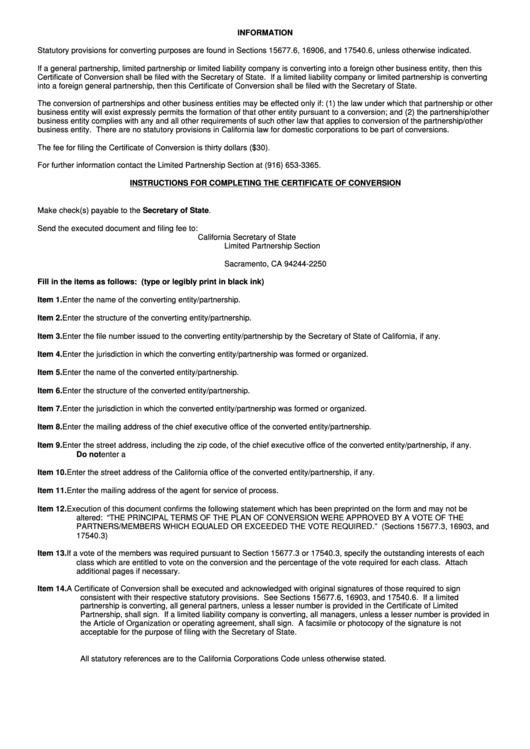

Instructions For Completing The Certificate Of Conversion

ADVERTISEMENT

INFORMATION

Statutory provisions for converting purposes are found in Sections 15677.6, 16906, and 17540.6, unless otherwise indicated.

If a general partnership, limited partnership or limited liability company is converting into a foreign other business entity, then this

Certificate of Conversion shall be filed with the Secretary of State. If a limited liability company or limited partnership is converting

into a foreign general partnership, then this Certificate of Conversion shall be filed with the Secretary of State.

The conversion of partnerships and other business entities may be effected only if: (1) the law under which that partnership or other

business entity will exist expressly permits the formation of that other entity pursuant to a conversion; and (2) the partnership/other

business entity complies with any and all other requirements of such other law that applies to conversion of the partnership/other

business entity. There are no statutory provisions in California law for domestic corporations to be part of conversions.

The fee for filing the Certificate of Conversion is thirty dollars ($30).

For further information contact the Limited Partnership Section at (916) 653-3365.

INSTRUCTIONS FOR COMPLETING THE CERTIFICATE OF CONVERSION

Make check(s) payable to the Secretary of State.

Send the executed document and filing fee to:

California Secretary of State

Limited Partnership Section

P.O. Box 944225

Sacramento, CA 94244-2250

Fill in the items as follows: (type or legibly print in black ink)

Item 1.

Enter the name of the converting entity/partnership.

Item 2.

Enter the structure of the converting entity/partnership.

Item 3.

Enter the file number issued to the converting entity/partnership by the Secretary of State of California, if any.

Item 4.

Enter the jurisdiction in which the converting entity/partnership was formed or organized.

Item 5.

Enter the name of the converted entity/partnership.

Item 6.

Enter the structure of the converted entity/partnership.

Item 7.

Enter the jurisdiction in which the converted entity/partnership was formed or organized.

Item 8.

Enter the mailing address of the chief executive office of the converted entity/partnership.

Item 9.

Enter the street address, including the zip code, of the chief executive office of the converted entity/partnership, if any.

Do not enter a P.O. Box number or abbreviate the name of the city.

Item 10.

Enter the street address of the California office of the converted entity/partnership, if any.

Item 11.

Enter the mailing address of the agent for service of process.

Item 12.

Execution of this document confirms the following statement which has been preprinted on the form and may not be

altered: “THE PRINCIPAL TERMS OF THE PLAN OF CONVERSION WERE APPROVED BY A VOTE OF THE

PARTNERS/MEMBERS WHICH EQUALED OR EXCEEDED THE VOTE REQUIRED.” (Sections 15677.3, 16903, and

17540.3)

Item 13.

If a vote of the members was required pursuant to Section 15677.3 or 17540.3, specify the outstanding interests of each

class which are entitled to vote on the conversion and the percentage of the vote required for each class. Attach

additional pages if necessary.

Item 14.

A Certificate of Conversion shall be executed and acknowledged with original signatures of those required to sign

consistent with their respective statutory provisions. See Sections 15677.6, 16903, and 17540.6. If a limited

partnership is converting, all general partners, unless a lesser number is provided in the Certificate of Limited

Partnership, shall sign. If a limited liability company is converting, all managers, unless a lesser number is provided in

the Article of Organization or operating agreement, shall sign. A facsimile or photocopy of the signature is not

acceptable for the purpose of filing with the Secretary of State.

All statutory references are to the California Corporations Code unless otherwise stated.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1